Download the Full Report - Cerner Corporation

Download the Full Report - Cerner Corporation

Download the Full Report - Cerner Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

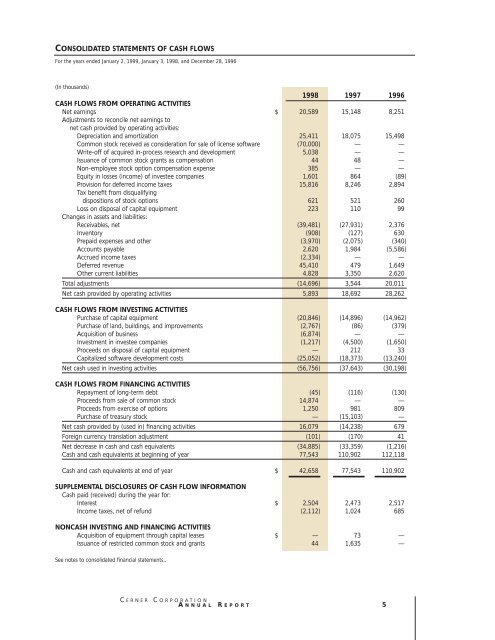

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

For <strong>the</strong> years ended January 2, 1999, January 3, 1998, and December 28, 1996<br />

(In thousands)<br />

1998 1997 1996<br />

CASH FLOWS FROM OPERATING ACTIVITIES<br />

Net earnings $ 20,589 15,148 8,251<br />

Adjustments to reconcile net earnings to<br />

net cash provided by operating activities:<br />

Depreciation and amortization 25,411 18,075 15,498<br />

Common stock received as consideration for sale of license software (70,000) — —<br />

Write-off of acquired in-process research and development 5,038 — —<br />

Issuance of common stock grants as compensation 44 48 —<br />

Non-employee stock option compensation expense 385 — —<br />

Equity in losses (income) of investee companies 1,601 864 (89)<br />

Provision for deferred income taxes 15,816 8,246 2,894<br />

Tax benefit from disqualifying<br />

dispositions of stock options 621 521 260<br />

Loss on disposal of capital equipment 223 110 99<br />

Changes in assets and liabilities:<br />

Receivables, net (39,481) (27,931) 2,376<br />

Inventory (908) (127) 630<br />

Prepaid expenses and o<strong>the</strong>r (3,970) (2,075) (340)<br />

Accounts payable 2,620 1,984 (5,586)<br />

Accrued income taxes (2,334) — —<br />

Deferred revenue 45,410 479 1,649<br />

O<strong>the</strong>r current liabilities 4,828 3,350 2,620<br />

Total adjustments (14,696) 3,544 20,011<br />

Net cash provided by operating activities 5,893 18,692 28,262<br />

CASH FLOWS FROM INVESTING ACTIVITIES<br />

Purchase of capital equipment (20,846) (14,896) (14,962)<br />

Purchase of land, buildings, and improvements (2,767) (86) (379)<br />

Acquisition of business (6,874) — —<br />

Investment in investee companies (1,217) (4,500) (1,650)<br />

Proceeds on disposal of capital equipment — 212 33<br />

Capitalized software development costs (25,052) (18,373) (13,240)<br />

Net cash used in investing activities (56,756) (37,643) (30,198)<br />

CASH FLOWS FROM FINANCING ACTIVITIES<br />

Repayment of long-term debt (45) (116) (130)<br />

Proceeds from sale of common stock 14,874 — —<br />

Proceeds from exercise of options 1,250 981 809<br />

Purchase of treasury stock — (15,103) —<br />

Net cash provided by (used in) financing activities 16,079 (14,238) 679<br />

Foreign currency translation adjustment (101) (170) 41<br />

Net decrease in cash and cash equivalents (34,885) (33,359) (1,216)<br />

Cash and cash equivalents at beginning of year 77,543 110,902 112,118<br />

Cash and cash equivalents at end of year $ 42,658 77,543 110,902<br />

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION<br />

Cash paid (received) during <strong>the</strong> year for:<br />

Interest $ 2,504 2,473 2,517<br />

Income taxes, net of refund (2,112) 1,024 685<br />

NONCASH INVESTING AND FINANCING ACTIVITIES<br />

Acquisition of equipment through capital leases $ — 73 —<br />

Issuance of restricted common stock and grants 44 1,635 —<br />

See notes to consolidated financial statements..<br />

C ERNER<br />

CORPORATION<br />

ANNUAL R EPORT 5