Undergraduate Prospectus 2011 - University of Southampton

Undergraduate Prospectus 2011 - University of Southampton

Undergraduate Prospectus 2011 - University of Southampton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Living costs<br />

When planning your finances, you will need to take into<br />

account the costs <strong>of</strong> living. These will vary, depending on<br />

a range <strong>of</strong> factors, such as whether you live in catered<br />

or self-catered halls <strong>of</strong> residence, private rented<br />

accommodation or with your parents/carers.<br />

Typical costs include:<br />

−−accommodation<br />

−−phone calls<br />

−−utility bills<br />

−−transport<br />

−−laundry<br />

−−socialising<br />

−−personal expenditure<br />

In addition to tuition fees, you will need to consider course<br />

costs such as books, field trips, studying abroad and any<br />

extra materials and equipment you may need for your<br />

studies. For more information about living and course<br />

costs, go to www.southampton.ac.uk/livingcosts<br />

Entering higher education for the first time<br />

Financial support:<br />

If you are a full-time UK student starting a higher education<br />

course in 2010/11, you can apply for loans to help pay for<br />

both fees and maintenance:<br />

−−Student Loan for Fees<br />

−−Student Loan for Maintenance<br />

Student loans are issued by Student Finance England on<br />

behalf <strong>of</strong> the government – they are not commercial loans.<br />

Interest is charged on a student loan from the date you<br />

receive it to the date you pay it <strong>of</strong>f. The interest charged<br />

is linked to the rate <strong>of</strong> inflation, so the amount you repay<br />

is the same in real terms as the amount you borrow.<br />

Student Loan for Fees:<br />

If you are a full-time UK/EU student, you will not have to<br />

pay any tuition fees before or during your studies. Instead,<br />

you can take out a Student Loan for Fees. You can borrow<br />

up to £3,290 for the academic year 2010/11 to cover the<br />

full cost <strong>of</strong> tuition fees. The amount you receive does not<br />

depend on your financial circumstances.<br />

Student Loan for Maintenance:<br />

If you are a full-time UK student you can take out a Student<br />

Loan for Maintenance to help with living costs. The amount<br />

you can borrow depends on:<br />

−−your level <strong>of</strong> income and household income<br />

−−where you study<br />

−−whether you live with your parents during your course<br />

You are entitled to about 72 per cent <strong>of</strong> the loan regardless<br />

<strong>of</strong> your household income and can apply for some or all<br />

<strong>of</strong> the remainder depending on your income. Higher<br />

loan rates are available if you live away from home.<br />

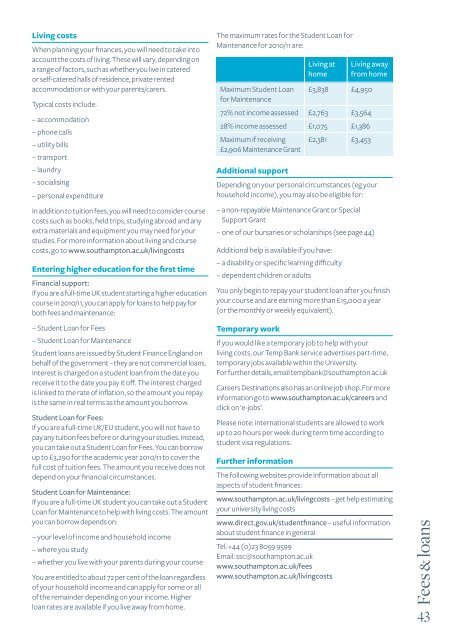

The maximum rates for the Student Loan for<br />

Maintenance for 2010/11 are:<br />

Living at<br />

home<br />

Living away<br />

from home<br />

Maximum Student Loan £3,838 £4,950<br />

for Maintenance<br />

72% not income assessed £2,763 £3,564<br />

28% income assessed £1,075 £1,386<br />

Maximum if receiving<br />

£2,906 Maintenance Grant<br />

£2,381 £3,453<br />

Additional support<br />

Depending on your personal circumstances (eg your<br />

household income), you may also be eligible for:<br />

−−a non-repayable Maintenance Grant or Special<br />

Support Grant<br />

−−one <strong>of</strong> our bursaries or scholarships (see page 44)<br />

Additional help is available if you have:<br />

−−a disability or specific learning difficulty<br />

−−dependent children or adults<br />

You only begin to repay your student loan after you finish<br />

your course and are earning more than £15,000 a year<br />

(or the monthly or weekly equivalent).<br />

Temporary work<br />

If you would like a temporary job to help with your<br />

living costs, our Temp Bank service advertises part-time,<br />

temporary jobs available within the <strong>University</strong>.<br />

For further details, email tempbank@southampton.ac.uk<br />

Careers Destinations also has an online job shop. For more<br />

information go to www.southampton.ac.uk/careers and<br />

click on ‘e-jobs’.<br />

Please note: international students are allowed to work<br />

up to 20 hours per week during term time according to<br />

student visa regulations.<br />

Further information<br />

The following websites provide information about all<br />

aspects <strong>of</strong> student finances:<br />

www.southampton.ac.uk/livingcosts – get help estimating<br />

your university living costs<br />

www.direct.gov.uk/studentfinance – useful information<br />

about student finance in general<br />

Tel: +44 (0)23 8059 9599<br />

Email: ssc@southampton.ac.uk<br />

www.southampton.ac.uk/fees<br />

www.southampton.ac.uk/livingcosts<br />

Fees & loans<br />

43