Federal Stafford Student Loan - Valencia College

Federal Stafford Student Loan - Valencia College

Federal Stafford Student Loan - Valencia College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

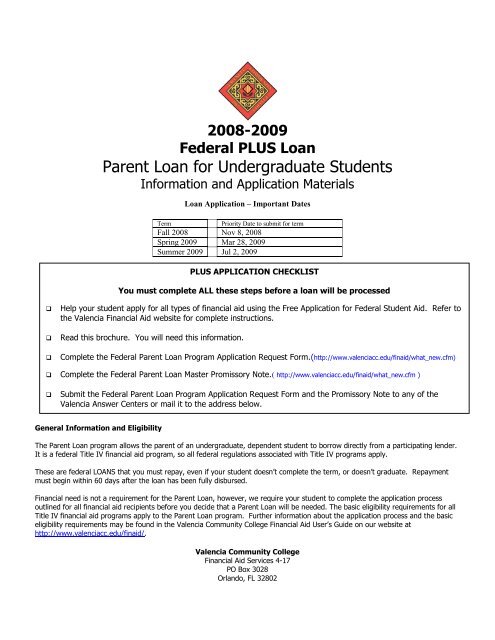

2008-2009<br />

<strong>Federal</strong> PLUS <strong>Loan</strong><br />

Parent <strong>Loan</strong> for Undergraduate <strong>Student</strong>s<br />

Information and Application Materials<br />

<strong>Loan</strong> Application – Important Dates<br />

Term<br />

Priority Date to submit for term<br />

Fall 2008 Nov 8, 2008<br />

Spring 2009 Mar 28, 2009<br />

Summer 2009 Jul 2, 2009<br />

PLUS APPLICATION CHECKLIST<br />

You must complete ALL these steps before a loan will be processed<br />

<br />

<br />

<br />

Help your student apply for all types of financial aid using the Free Application for <strong>Federal</strong> <strong>Student</strong> Aid. Refer to<br />

the <strong>Valencia</strong> Financial Aid website for complete instructions.<br />

Read this brochure. You will need this information.<br />

Complete the <strong>Federal</strong> Parent <strong>Loan</strong> Program Application Request Form.(http://www.valenciacc.edu/finaid/what_new.cfm)<br />

Complete the <strong>Federal</strong> Parent <strong>Loan</strong> Master Promissory Note.( http://www.valenciacc.edu/finaid/what_new.cfm )<br />

<br />

Submit the <strong>Federal</strong> Parent <strong>Loan</strong> Program Application Request Form and the Promissory Note to any of the<br />

<strong>Valencia</strong> Answer Centers or mail it to the address below.<br />

Visit the Answer Center if you have trouble completing these steps.<br />

General Information and Eligibility<br />

The Parent <strong>Loan</strong> program allows the parent of an undergraduate, dependent student to borrow directly from a participating lender.<br />

It is a federal Title IV financial aid program, so all federal regulations associated with Title IV programs apply.<br />

These are federal LOANS that you must repay, even if your student doesn’t complete the term, or doesn’t graduate. Repayment<br />

must begin within 60 days after the loan has been fully disbursed.<br />

Financial need is not a requirement for the Parent <strong>Loan</strong>, however, we require your student to complete the application process<br />

outlined for all financial aid recipients before you decide that a Parent <strong>Loan</strong> will be needed. The basic eligibility requirements for all<br />

Title IV financial aid programs apply to the Parent <strong>Loan</strong> program. Further information about the application process and the basic<br />

eligibility requirements may be found in the <strong>Valencia</strong> Community <strong>College</strong> Financial Aid User’s Guide on our website at<br />

http://www.valenciacc.edu/finaid/.<br />

<strong>Valencia</strong> Community <strong>College</strong><br />

Financial Aid Services 4-17<br />

PO Box 3028<br />

Orlando, FL 32802

How much can I borrow?<br />

<strong>Loan</strong> maximums depend upon four things:<br />

1. <strong>Valencia</strong>’s Estimated Cost of Attendance<br />

2. The amount of grant, scholarship or other assistance your student will receive, including resources such as the<br />

Florida Pre-paid program, VA benefits, or other third party billing arrangements<br />

3. The total amount you have borrowed previously from parent loan programs<br />

4. Whether your student enrolls as a part-time or a full-time student<br />

You will be notified if you do not qualify for the full amount you have requested.<br />

What are the qualifications?<br />

1. You must be the parent of a dependent, undergraduate student.<br />

2. Your student must be enrolled in at least 6 credit hours, required for the degree in which he/she is enrolled,<br />

and be meeting Satisfactory Academic Progress requirements.<br />

3. Your student must meet the basic eligibility requirements for all Title IV financial aid programs.<br />

4. Your student must first apply for other Title IV financial aid programs by completing the Free Application for<br />

<strong>Federal</strong> <strong>Student</strong> Aid.<br />

5. You cannot have adverse credit on your credit report.<br />

6. You must apply while the student is still enrolled in classes at <strong>Valencia</strong>.<br />

When will I have to repay my loan?<br />

Repayment of principal and interest will begin within 60 days after your loan has been fully disbursed.<br />

It is very important that you understand how much you will be expected to pay each month. A repayment chart can<br />

be found in this document. We also encourage you to consider whether you will need to rely on future Parent <strong>Loan</strong>s,<br />

as your monthly payments will increase with each loan you borrow.<br />

Sample Repayment Chart - 10 Year Repayment @ 6%*<br />

Amount borrowed<br />

Monthly Repayment<br />

Up to $4,000 $ 50<br />

$10,000 $111<br />

$15,000 $167<br />

$20,000 $222<br />

$25,000 $278<br />

$30,000 $333<br />

*Interest rates may be variable when your loan enters repayment. This chart represents typical examples of<br />

repayments. Your actual repayment amount will be computed by your lender and may vary.<br />

Your Master Promissory Note<br />

Your Master Promissory Note (MPN) is a legal document on which you agree to repay your loan according to its terms.<br />

You may have already completed your MPN online at your lender’s website. Or, you may choose one of the lenders<br />

on our suggested Lender List and submit your completed MPN to <strong>Valencia</strong>. We will forward our certification of your<br />

eligibility electronically and mail your MPN to your lender. Be sure you complete your Master Promissory Note in its<br />

entirety. Print clearly using blue or black ink. Sign it carefully. Do not use correction fluid.<br />

If there are any problems with your loan or your Master Promissory Note, you will be contacted by your lender. Make<br />

sure you have used your correct mailing address and telephone number.

What Happens Next?<br />

1. Your loan eligibility will be determined. If you chose one of our preferred lenders, your information will be<br />

transmitted electronically by <strong>Valencia</strong> to the Florida Guarantee Agency and your lender. Your Promissory Note will<br />

be forwarded to your lender for their approval, if necessary.<br />

2. The amount of your loan will be based on the enrollment plans you listed on your PLUS <strong>Loan</strong> Request form. If<br />

your student enrolls for fewer hours than planned, your loan amount could be reduced or cancelled. Your student<br />

must enroll for a minimum of 6 credit hours (required for the program in which he/she is enrolled) each term<br />

for you to receive a loan.<br />

3. Your lender will check your credit and will issue the final approval of your loan once they receive both the<br />

guarantee commitment and the Promissory Note. If your loan is denied for adverse credit history, the lender will<br />

contact you.<br />

4. You will receive a Notice of <strong>Loan</strong> Disclosure statement from your lender once the loan is approved. Please check it<br />

for your approximate disbursement dates.<br />

5. Your student must maintain half-time enrollment (at least 6 credit hours) and be meeting Satisfactory Academic<br />

Progress requirements for the duration of your PLUS loan period. No loan proceeds will be sent if your student is<br />

not enrolled at least half-time or fails to meet the Satisfactory Academic Progress requirements found in <strong>Valencia</strong>’s<br />

Catalog or on our website at http://www.valenciacc.edu/finaid/programs/satisfactory_progress.cfm.<br />

6. Your lender will forward the funds either by check or electronic funds transfer (EFT) to <strong>Valencia</strong>’s Financial<br />

Services office, made payable to you. <strong>Valencia</strong> will confirm that your student still meets eligibility requirements<br />

and forward the check to you at the address you have provided us.<br />

Important<br />

Your student will not be able to charge tuition or<br />

books against your PLUS loan. However, <strong>Valencia</strong><br />

does offer a Tuition Installment Plan you may access<br />

while you are waiting for your PLUS loan check.<br />

To apply, have your student go to:<br />

http://www.valenciacc.edu/finanserv/TIP-<br />

TuitionInstallmentPlans.cfm