March 12 - Standard Chartered Bank

March 12 - Standard Chartered Bank

March 12 - Standard Chartered Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

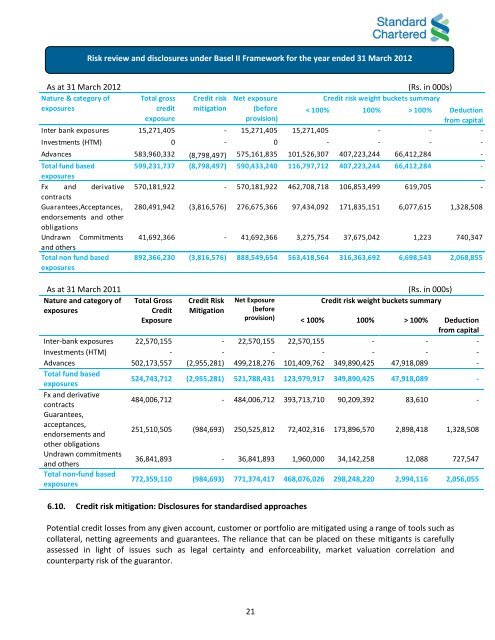

Risk review and disclosures under Basel II Framework for the year ended 31 <strong>March</strong> 20<strong>12</strong><br />

As at 31 <strong>March</strong> 20<strong>12</strong> (Rs. in 000s)<br />

Nature & category of<br />

Credit risk<br />

Credit risk weight buckets summary<br />

exposures<br />

mitigation<br />

< 100% 100% > 100% Deduction<br />

from capital<br />

Inter bank exposures 15,271,405 - 15,271,405 15,271,405 - - -<br />

Investments (HTM) 0 - 0 - - - -<br />

Advances 583,960,332 (8,798,497) 575,161,835 101,526,307 407,223,244 66,4<strong>12</strong>,284 -<br />

Total fund based<br />

exposures<br />

Fx and derivative<br />

contracts<br />

Guarantees,Acceptances,<br />

endorsements and other<br />

obligations<br />

Undrawn Commitments<br />

and others<br />

Total non fund based<br />

exposures<br />

Total gross<br />

credit<br />

exposure<br />

Net exposure<br />

(before<br />

provision)<br />

599,231,737 (8,798,497) 590,433,240 116,797,7<strong>12</strong> 407,223,244 66,4<strong>12</strong>,284 -<br />

570,181,922 - 570,181,922 462,708,718 106,853,499 619,705 -<br />

280,491,942 (3,816,576) 276,675,366 97,434,092 171,835,151 6,077,615 1,328,508<br />

41,692,366 - 41,692,366 3,275,754 37,675,042 1,223 740,347<br />

892,366,230 (3,816,576) 888,549,654 563,418,564 316,363,692 6,698,543 2,068,855<br />

As at 31 <strong>March</strong> 2011 (Rs. in 000s)<br />

Nature and category of<br />

Credit Risk<br />

Credit risk weight buckets summary<br />

exposures<br />

Mitigation<br />

Total Gross<br />

Credit<br />

Exposure<br />

Net Exposure<br />

(before<br />

provision)<br />

< 100% 100% > 100% Deduction<br />

from capital<br />

Inter-bank exposures 22,570,155 - 22,570,155 22,570,155 - - -<br />

Investments (HTM) - - - - - - -<br />

Advances 502,173,557 (2,955,281) 499,218,276 101,409,762 349,890,425 47,918,089 -<br />

Total fund based<br />

exposures<br />

524,743,7<strong>12</strong> (2,955,281) 521,788,431 <strong>12</strong>3,979,917 349,890,425 47,918,089 -<br />

Fx and derivative<br />

contracts<br />

484,006,7<strong>12</strong> - 484,006,7<strong>12</strong> 393,713,710 90,209,392 83,610 -<br />

Guarantees,<br />

acceptances,<br />

endorsements and<br />

251,510,505 (984,693) 250,525,8<strong>12</strong> 72,402,316 173,896,570 2,898,418 1,328,508<br />

other obligations<br />

Undrawn commitments<br />

and others<br />

36,841,893 - 36,841,893 1,960,000 34,142,258 <strong>12</strong>,088 727,547<br />

Total non-fund based<br />

exposures<br />

772,359,110 (984,693) 771,374,417 468,076,026 298,248,220 2,994,116 2,056,055<br />

6.10. Credit risk mitigation: Disclosures for standardised approaches<br />

Potential credit losses from any given account, customer or portfolio are mitigated using a range of tools such as<br />

collateral, netting agreements and guarantees. The reliance that can be placed on these mitigants is carefully<br />

assessed in light of issues such as legal certainty and enforceability, market valuation correlation and<br />

counterparty risk of the guarantor.<br />

21