March 12 - Standard Chartered Bank

March 12 - Standard Chartered Bank

March 12 - Standard Chartered Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

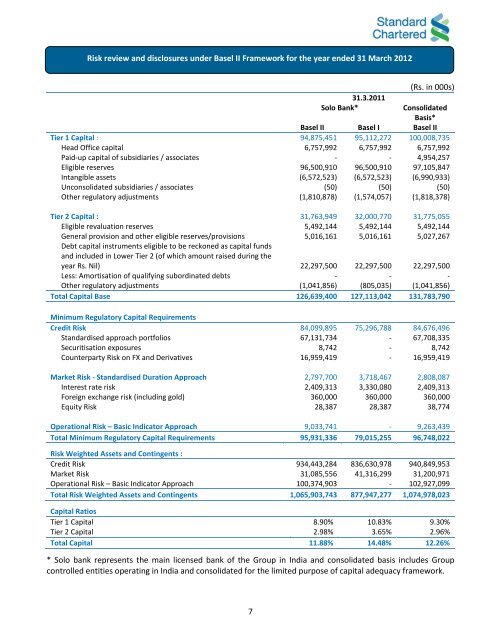

Risk review and disclosures under Basel II Framework for the year ended 31 <strong>March</strong> 20<strong>12</strong><br />

31.3.2011<br />

Solo <strong>Bank</strong>*<br />

(Rs. in 000s)<br />

Consolidated<br />

Basis*<br />

Basel II Basel I Basel II<br />

Tier 1 Capital : 94,875,451 95,1<strong>12</strong>,272 100,008,735<br />

Head Office capital 6,757,992 6,757,992 6,757,992<br />

Paid-up capital of subsidiaries / associates - - 4,954,257<br />

Eligible reserves 96,500,910 96,500,910 97,105,847<br />

Intangible assets (6,572,523) (6,572,523) (6,990,933)<br />

Unconsolidated subsidiaries / associates (50) (50) (50)<br />

Other regulatory adjustments (1,810,878) (1,574,057) (1,818,378)<br />

Tier 2 Capital : 31,763,949 32,000,770 31,775,055<br />

Eligible revaluation reserves 5,492,144 5,492,144 5,492,144<br />

General provision and other eligible reserves/provisions 5,016,161 5,016,161 5,027,267<br />

Debt capital instruments eligible to be reckoned as capital funds<br />

and included in Lower Tier 2 (of which amount raised during the<br />

year Rs. Nil) 22,297,500 22,297,500 22,297,500<br />

Less: Amortisation of qualifying subordinated debts - - -<br />

Other regulatory adjustments (1,041,856) (805,035) (1,041,856)<br />

Total Capital Base <strong>12</strong>6,639,400 <strong>12</strong>7,113,042 131,783,790<br />

Minimum Regulatory Capital Requirements<br />

Credit Risk 84,099,895 75,296,788 84,676,496<br />

<strong>Standard</strong>ised approach portfolios 67,131,734 - 67,708,335<br />

Securitisation exposures 8,742 - 8,742<br />

Counterparty Risk on FX and Derivatives 16,959,419 - 16,959,419<br />

Market Risk - <strong>Standard</strong>ised Duration Approach 2,797,700 3,718,467 2,808,087<br />

Interest rate risk 2,409,313 3,330,080 2,409,313<br />

Foreign exchange risk (including gold) 360,000 360,000 360,000<br />

Equity Risk 28,387 28,387 38,774<br />

Operational Risk – Basic Indicator Approach 9,033,741 - 9,263,439<br />

Total Minimum Regulatory Capital Requirements 95,931,336 79,015,255 96,748,022<br />

Risk Weighted Assets and Contingents :<br />

Credit Risk 934,443,284 836,630,978 940,849,953<br />

Market Risk 31,085,556 41,316,299 31,200,971<br />

Operational Risk – Basic Indicator Approach 100,374,903 - 102,927,099<br />

Total Risk Weighted Assets and Contingents 1,065,903,743 877,947,277 1,074,978,023<br />

Capital Ratios<br />

Tier 1 Capital 8.90% 10.83% 9.30%<br />

Tier 2 Capital 2.98% 3.65% 2.96%<br />

Total Capital 11.88% 14.48% <strong>12</strong>.26%<br />

* Solo bank represents the main licensed bank of the Group in India and consolidated basis includes Group<br />

controlled entities operating in India and consolidated for the limited purpose of capital adequacy framework.<br />

7