March 12 - Standard Chartered Bank

March 12 - Standard Chartered Bank

March 12 - Standard Chartered Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

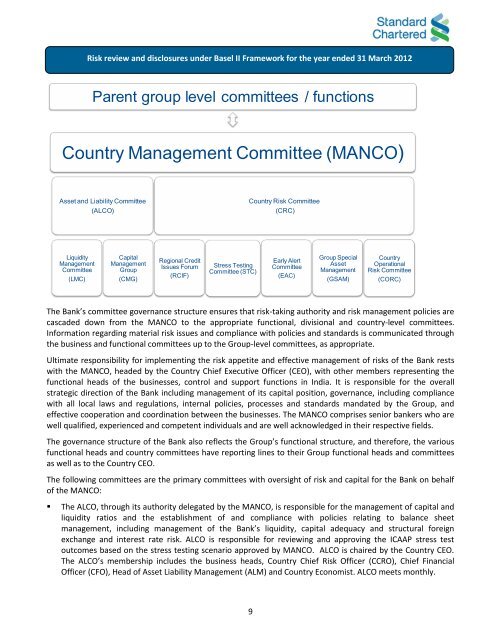

Risk review and disclosures under Basel II Framework for the year ended 31 <strong>March</strong> 20<strong>12</strong><br />

Parent group level committees / functions<br />

Country Management Committee (MANCO)<br />

Asset and Liability Committee<br />

(ALCO)<br />

Country Risk Committee<br />

(CRC)<br />

Liquidity<br />

Management<br />

Committee<br />

(LMC)<br />

Capital<br />

Management<br />

Group<br />

(CMG)<br />

Regional Credit<br />

Issues Forum<br />

(RCIF)<br />

Stress Testing<br />

Committee (STC)<br />

Early Alert<br />

Committee<br />

(EAC)<br />

Group Special<br />

Asset<br />

Management<br />

(GSAM)<br />

Country<br />

Operational<br />

Risk Committee<br />

(CORC)<br />

The <strong>Bank</strong>’s committee governance structure ensures that risk-taking authority and risk management policies are<br />

cascaded down from the MANCO to the appropriate functional, divisional and country-level committees.<br />

Information regarding material risk issues and compliance with policies and standards is communicated through<br />

the business and functional committees up to the Group-level committees, as appropriate.<br />

Ultimate responsibility for implementing the risk appetite and effective management of risks of the <strong>Bank</strong> rests<br />

with the MANCO, headed by the Country Chief Executive Officer (CEO), with other members representing the<br />

functional heads of the businesses, control and support functions in India. It is responsible for the overall<br />

strategic direction of the <strong>Bank</strong> including management of its capital position, governance, including compliance<br />

with all local laws and regulations, internal policies, processes and standards mandated by the Group, and<br />

effective cooperation and coordination between the businesses. The MANCO comprises senior bankers who are<br />

well qualified, experienced and competent individuals and are well acknowledged in their respective fields.<br />

The governance structure of the <strong>Bank</strong> also reflects the Group’s functional structure, and therefore, the various<br />

functional heads and country committees have reporting lines to their Group functional heads and committees<br />

as well as to the Country CEO.<br />

The following committees are the primary committees with oversight of risk and capital for the <strong>Bank</strong> on behalf<br />

of the MANCO:<br />

• The ALCO, through its authority delegated by the MANCO, is responsible for the management of capital and<br />

liquidity ratios and the establishment of and compliance with policies relating to balance sheet<br />

management, including management of the <strong>Bank</strong>’s liquidity, capital adequacy and structural foreign<br />

exchange and interest rate risk. ALCO is responsible for reviewing and approving the ICAAP stress test<br />

outcomes based on the stress testing scenario approved by MANCO. ALCO is chaired by the Country CEO.<br />

The ALCO’s membership includes the business heads, Country Chief Risk Officer (CCRO), Chief Financial<br />

Officer (CFO), Head of Asset Liability Management (ALM) and Country Economist. ALCO meets monthly.<br />

9