You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

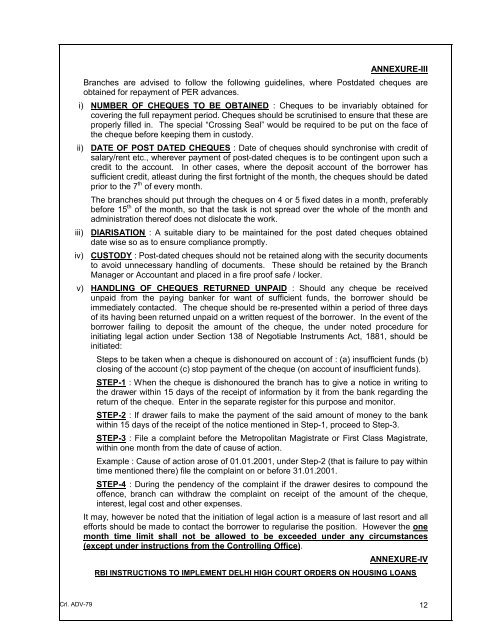

ANNEXURE-III<br />

Branches are advised to follow the following guidelines, where Postdated cheques are<br />

obtained for repayment of PER advances.<br />

i) NUMBER OF CHEQUES TO BE OBTAINED : Cheques to be invariably obtained for<br />

covering the full repayment period. Cheques should be scrutinised to ensure that these are<br />

properly filled in. The special “Crossing Seal” would be required to be put on the face of<br />

the cheque before keeping them in custody.<br />

ii)<br />

iii)<br />

iv)<br />

DATE OF POST DATED CHEQUES : Date of cheques should synchronise with credit of<br />

salary/rent etc., wherever payment of post-dated cheques is to be contingent upon such a<br />

credit to the account. In other cases, where the deposit account of the borrower has<br />

sufficient credit, atleast during the first fortnight of the month, the cheques should be dated<br />

prior to the 7 th of every month.<br />

The branches should put through the cheques on 4 or 5 fixed dates in a month, preferably<br />

before 15 th of the month, so that the task is not spread over the whole of the month and<br />

administration thereof does not dislocate the work.<br />

DIARISATION : A suitable diary to be maintained for the post dated cheques obtained<br />

date wise so as to ensure compliance promptly.<br />

CUSTODY : Post-dated cheques should not be retained along with the security documents<br />

to avoid unnecessary handling of documents. These should be retained by the Branch<br />

Manager or Accountant and placed in a fire proof safe / locker.<br />

v) HANDLING OF CHEQUES RETURNED UNPAID : Should any cheque be received<br />

unpaid from the paying banker for want of sufficient funds, the borrower should be<br />

immediately contacted. The cheque should be re-presented within a period of three days<br />

of its having been returned unpaid on a written request of the borrower. In the event of the<br />

borrower failing to deposit the amount of the cheque, the under noted procedure for<br />

initiating legal action under Section 138 of Negotiable Instruments Act, 1881, should be<br />

initiated:<br />

Steps to be taken when a cheque is dishonoured on account of : (a) insufficient funds (b)<br />

closing of the account (c) stop payment of the cheque (on account of insufficient funds).<br />

STEP-1 : When the cheque is dishonoured the branch has to give a notice in writing to<br />

the drawer within 15 days of the receipt of information by it from the bank regarding the<br />

return of the cheque. Enter in the separate register for this purpose and monitor.<br />

STEP-2 : If drawer fails to make the payment of the said amount of money to the bank<br />

within 15 days of the receipt of the notice mentioned in Step-1, proceed to Step-3.<br />

STEP-3 : File a complaint before the Metropolitan Magistrate or First Class Magistrate,<br />

within one month from the date of cause of action.<br />

Example : Cause of action arose of 01.01.2001, under Step-2 (that is failure to pay within<br />

time mentioned there) file the complaint on or before 31.01.2001.<br />

STEP-4 : During the pendency of the complaint if the drawer desires to compound the<br />

offence, branch can withdraw the complaint on receipt of the amount of the cheque,<br />

interest, legal cost and other expenses.<br />

It may, however be noted that the initiation of legal action is a measure of last resort and all<br />

efforts should be made to contact the borrower to regularise the position. However the one<br />

month time limit shall not be allowed to be exceeded under any circumstances<br />

(except under instructions from the Controlling Office).<br />

ANNEXURE-IV<br />

RBI INSTRUCTIONS TO IMPLEMENT DELHI HIGH COURT ORDERS ON HOUSING LOANS<br />

Crl. ADV-79 12