You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

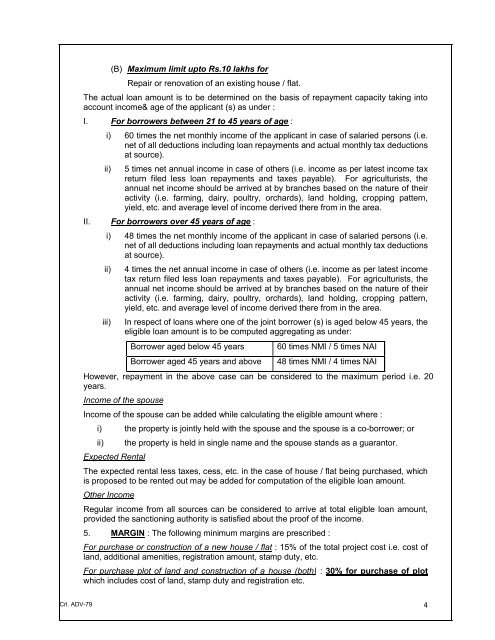

(B) Maximum limit upto Rs.10 lakhs for<br />

Repair or renovation of an existing house / flat.<br />

The actual loan amount is to be determined on the basis of repayment capacity taking into<br />

account income& age of the applicant (s) as under :<br />

I. For borrowers between 21 to 45 years of age :<br />

i) 60 times the net monthly income of the applicant in case of salaried persons (i.e.<br />

net of all deductions including loan repayments and actual monthly tax deductions<br />

at source).<br />

ii)<br />

5 times net annual income in case of others (i.e. income as per latest income tax<br />

return filed less loan repayments and taxes payable). For agriculturists, the<br />

annual net income should be arrived at by branches based on the nature of their<br />

activity (i.e. farming, dairy, poultry, orchards), land holding, cropping pattern,<br />

yield, etc. and average level of income derived there from in the area.<br />

II. For borrowers over 45 years of age :<br />

i) 48 times the net monthly income of the applicant in case of salaried persons (i.e.<br />

net of all deductions including loan repayments and actual monthly tax deductions<br />

at source).<br />

ii)<br />

iii)<br />

4 times the net annual income in case of others (i.e. income as per latest income<br />

tax return filed less loan repayments and taxes payable). For agriculturists, the<br />

annual net income should be arrived at by branches based on the nature of their<br />

activity (i.e. farming, dairy, poultry, orchards), land holding, cropping pattern,<br />

yield, etc. and average level of income derived there from in the area.<br />

In respect of loans where one of the joint borrower (s) is aged below 45 years, the<br />

eligible loan amount is to be computed aggregating as under:<br />

Borrower aged below 45 years<br />

Borrower aged 45 years and above<br />

60 times NMI / 5 times NAI<br />

48 times NMI / 4 times NAI<br />

However, repayment in the above case can be considered to the maximum period i.e. 20<br />

years.<br />

Income of the spouse<br />

Income of the spouse can be added while calculating the eligible amount where :<br />

i) the property is jointly held with the spouse and the spouse is a co-borrower; or<br />

ii)<br />

Expected Rental<br />

the property is held in single name and the spouse stands as a guarantor.<br />

The expected rental less taxes, cess, etc. in the case of house / flat being purchased, which<br />

is proposed to be rented out may be added for computation of the eligible loan amount.<br />

Other Income<br />

Regular income from all sources can be considered to arrive at total eligible loan amount,<br />

provided the sanctioning authority is satisfied about the proof of the income.<br />

5. MARGIN : The following minimum margins are prescribed :<br />

For purchase or construction of a new house / flat : 15% of the total project cost i.e. cost of<br />

land, additional amenities, registration amount, stamp duty, etc.<br />

For purchase plot of land and construction of a house (both) : 30% for purchase of plot<br />

which includes cost of land, stamp duty and registration etc.<br />

Crl. ADV-79 4