You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Under the check-off arrangement, an irrevocable letter of authority is required to be<br />

obtained from the borrower (employee) concerned and a letter of undertaking from the<br />

employer also is to be taken as per Annexure-D & E.<br />

In case of Govt., officers, who are themselves the drawing and disbursing authorities<br />

and avail housing loans, separate undertaking letters to be obtained, as per Annexure E1.<br />

Post dated cheques<br />

Post dated cheques should be obtained invariably in all cases even where check-off facility<br />

is available and follow the instructions as per Annexure-III.<br />

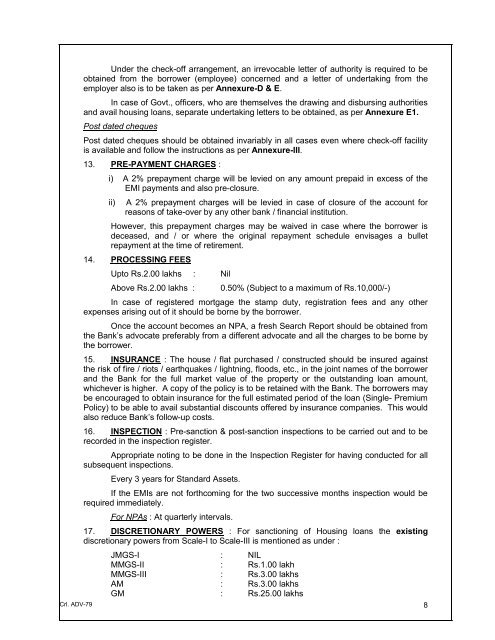

13. PRE-PAYMENT CHARGES :<br />

i) A 2% prepayment charge will be levied on any amount prepaid in excess of the<br />

EMI payments and also pre-closure.<br />

ii)<br />

A 2% prepayment charges will be levied in case of closure of the account for<br />

reasons of take-over by any other bank / financial institution.<br />

However, this prepayment charges may be waived in case where the borrower is<br />

deceased, and / or where the original repayment schedule envisages a bullet<br />

repayment at the time of retirement.<br />

14. PROCESSING FEES<br />

Upto Rs.2.00 lakhs : Nil<br />

Above Rs.2.00 lakhs :<br />

0.50% (Subject to a maximum of Rs.10,000/-)<br />

In case of registered mortgage the stamp duty, registration fees and any other<br />

expenses arising out of it should be borne by the borrower.<br />

Once the account becomes an NPA, a fresh Search Report should be obtained from<br />

the Bank’s advocate preferably from a different advocate and all the charges to be borne by<br />

the borrower.<br />

15. INSURANCE : The house / flat purchased / constructed should be insured against<br />

the risk of fire / riots / earthquakes / lightning, floods, etc., in the joint names of the borrower<br />

and the Bank for the full market value of the property or the outstanding loan amount,<br />

whichever is higher. A copy of the policy is to be retained with the Bank. The borrowers may<br />

be encouraged to obtain insurance for the full estimated period of the loan (Single- Premium<br />

Policy) to be able to avail substantial discounts offered by insurance companies. This would<br />

also reduce Bank’s follow-up costs.<br />

16. INSPECTION : Pre-sanction & post-sanction inspections to be carried out and to be<br />

recorded in the inspection register.<br />

Appropriate noting to be done in the Inspection Register for having conducted for all<br />

subsequent inspections.<br />

Every 3 years for Standard Assets.<br />

If the EMIs are not forthcoming for the two successive months inspection would be<br />

required immediately.<br />

For NPAs : At quarterly intervals.<br />

17. DISCRETIONARY POWERS : For sanctioning of Housing loans the existing<br />

discretionary powers from Scale-I to Scale-III is mentioned as under :<br />

JMGS-I : NIL<br />

MMGS-II : Rs.1.00 lakh<br />

MMGS-III : Rs.3.00 lakhs<br />

AM : Rs.3.00 lakhs<br />

GM : Rs.25.00 lakhs<br />

Crl. ADV-79 8