here - Sullivan & Cromwell

here - Sullivan & Cromwell

here - Sullivan & Cromwell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EXCLUSIVE<br />

Wall Street’s fireman<br />

In the first part of an exclusive two part interview with Banker<br />

Middle East, Rodgin Cohen, the legendary lawyer who was a key<br />

figure during the events of 2008 that saw the collapse of Lehman<br />

Brothers and the near collapse of capitalism, looks back at the<br />

events that saw some of Wall Street’s biggest names nearly ‘go to<br />

the wall’ and gives Mike Gallagher his views on sovereign wealth<br />

funds and international regulation<br />

H<br />

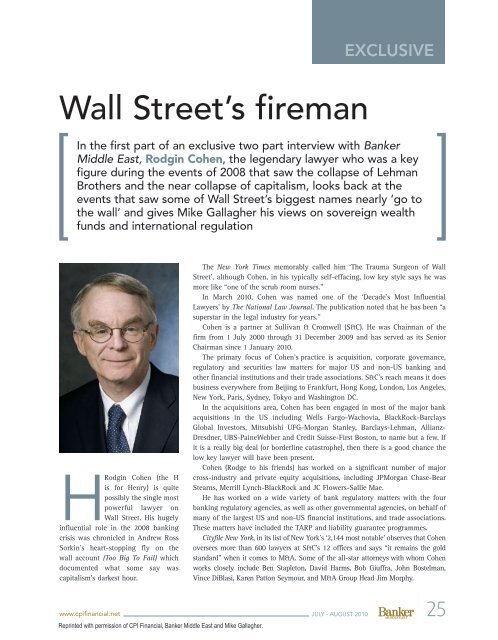

Rodgin Cohen (the H<br />

is for Henry) is quite<br />

possibly the single most<br />

powerful lawyer on<br />

Wall Street. His hugely<br />

influential role in the 2008 banking<br />

crisis was chronicled in Andrew Ross<br />

Sorkin’s heart-stopping fly on the<br />

wall account (Too Big To Fail) which<br />

documented what some say was<br />

capitalism’s darkest hour.<br />

The New York Times memorably called him ‘The Trauma Surgeon of Wall<br />

Street’, although Cohen, in his typically self-effacing, low key style says he was<br />

more like “one of the scrub room nurses.”<br />

In March 2010, Cohen was named one of the ‘Decade’s Most Influential<br />

Lawyers’ by The National Law Journal. The publication noted that he has been “a<br />

superstar in the legal industry for years.”<br />

Cohen is a partner at <strong>Sullivan</strong> & <strong>Cromwell</strong> (S&C). He was Chairman of the<br />

firm from 1 July 2000 through 31 December 2009 and has served as its Senior<br />

Chairman since 1 January 2010.<br />

The primary focus of Cohen’s practice is acquisition, corporate governance,<br />

regulatory and securities law matters for major US and non-US banking and<br />

other financial institutions and their trade associations. S&C’s reach means it does<br />

business everyw<strong>here</strong> from Beijing to Frankfurt, Hong Kong, London, Los Angeles,<br />

New York, Paris, Sydney, Tokyo and Washington DC.<br />

In the acquisitions area, Cohen has been engaged in most of the major bank<br />

acquisitions in the US including Wells Fargo-Wachovia, BlackRock-Barclays<br />

Global Investors, Mitsubishi UFG-Morgan Stanley, Barclays-Lehman, Allianz-<br />

Dresdner, UBS-PaineWebber and Credit Suisse-First Boston, to name but a few. If<br />

it is a really big deal (or borderline catastrophe), then t<strong>here</strong> is a good chance the<br />

low key lawyer will have been present.<br />

Cohen (Rodge to his friends) has worked on a significant number of major<br />

cross-industry and private equity acquisitions, including JPMorgan Chase-Bear<br />

Stearns, Merrill Lynch-BlackRock and JC Flowers-Sallie Mae.<br />

He has worked on a wide variety of bank regulatory matters with the four<br />

banking regulatory agencies, as well as other governmental agencies, on behalf of<br />

many of the largest US and non-US financial institutions, and trade associations.<br />

These matters have included the TARP and liability guarantee programmes.<br />

Cityfile New York, in its list of New York’s ‘2,144 most notable’ observes that Cohen<br />

oversees more than 600 lawyers at S&C’s 12 offices and says “it remains the gold<br />

standard” when it comes to M&A. Some of the all-star attorneys with whom Cohen<br />

works closely include Ben Stapleton, David Harms, Bob Giuffra, John Bostelman,<br />

Vince DiBlasi, Karen Patton Seymour, and M&A Group Head Jim Morphy.<br />

www.cpifinancial.net JULY - AUGUST 2010 25<br />

Reprinted with permission of CPI Financial, Banker Middle East and Mike Gallagher.

EXCLUSIVE<br />

Wachtell, Lipton, Rosen & Katz Co-Chair Ed Herlihy, another key player in the<br />

events of September 2008, is widely seen as Cohen’s big Wall Street intellectual<br />

rival and a report in Fortune magazine pointed out that both men went “head-tohead<br />

in 18 of the 25 major bank mergers during the ‘90s.”<br />

Both men seemed to be everyw<strong>here</strong> at once during the dark days of September<br />

2008 and in the same month The Deal was quick to make a note of the comings<br />

and goings of the two firemen.<br />

“Every time I looked up, it seemed like Rodge was in the room,” said Henry<br />

(Hank) Paulson, the former Treasury secretary.<br />

“If you need any more proof that H. Rodgin Cohen and Edward Herlihy are<br />

the country’s leading banking M&A lawyers, look no further than this month’s<br />

financial services firestorm. The two attorneys have been almost as ubiquitous as<br />

Federal Reserve Chairman Ben Bernanke and Treasury Secretary Henry Paulson in<br />

the recent shotgun weddings, collapses and bailouts that are reshaping the sector,”<br />

The Deal said in September 2008.<br />

Herlihy and his team were flat out trying to save Fannie Mae, Freddie Mac<br />

and AIG, while simultaneously advising Bank of America on whether it was wise<br />

to spend $50 billion on a rapidly weakening Merrill Lynch (something its team<br />

managed to sort out in less than a day) and almost immediately after that helped<br />

Morgan Stanley in its negotiations with Mitsubishi UFJ Financial Group.<br />

At the same scary time, Cohen was leading a strike force around Wall Street<br />

in a race against the clock to shore<br />

up Fannie Mae, Lehman Brothers and<br />

advise Barclays in its dealings on a<br />

rapidly ailing Lehman. He also managed<br />

to find time to advise JPMorgan in its<br />

Government-brokered acquisition of<br />

Washington Mutual.<br />

Cohen was t<strong>here</strong> when Wachovia<br />

was sold to Wells Fargo, and he was also<br />

instrumental in helping to turn Goldman<br />

Sachs into a bank holding company.<br />

Tim Geithner and Hank Paulson “By our count--he has lost track-<br />

-he advised on at least 17 global<br />

credit crisis-related mergers, bailouts, and cash infusions in 2008. He was in the<br />

room when Bear Stearns was sold, when Fannie Mae was nationalised, and when<br />

Lehman Brothers died,” Ben Hallman, writing in The American Lawyer said.<br />

Cohen, who was one of a small group of people who somehow managed to<br />

save capitalism during its darkest days since October 1929, surprisingly comes<br />

across as being low key and is actually quite affable for someone who must have<br />

felt the weight of those momentous times. He admits that he felt the pressure of<br />

the hour during those frantic days as many of the biggest names in banking faced<br />

oblivion and the world looked on nervously.<br />

“Oh, absolutely,” he said. “One of the biggest dangers we will forget (memories<br />

will dim), is how close we were to the edge of the precipice. Had it gone over,<br />

had that happened, t<strong>here</strong> would have been a financial calamity and an economic<br />

calamity. If you look at the 1930s as a model/precedent, t<strong>here</strong> could have been<br />

major social and political dislocation.<br />

“It was, at the risk of exaggeration, the most serious situation I have seen, and<br />

t<strong>here</strong> have been a number of them<br />

over the past four years, but they were<br />

nothing like this.”<br />

But for all the pressure and<br />

stress of those grim days, Cohen<br />

does not believe it was quite as<br />

apocalyptic as it seemed to many<br />

others. He dismisses the ‘darkest<br />

hour’ suggestions and is, if anything,<br />

given to playing down his role in the<br />

tumultuous events.<br />

“I’m not sure it was capitalism’s<br />

darkest hour. It was the financial<br />

system’s darkest hour, at least since the<br />

1930s and t<strong>here</strong> clearly was trauma.”<br />

Cohen and his team, which must<br />

have been working around the<br />

clock, frenetically racing from the<br />

headquarters of one bank to another,<br />

with visits to the offices of the New<br />

York Fed in between (w<strong>here</strong> Tim<br />

Geithner and Hank Paulson were<br />

hammering out rescue plans) were<br />

probably putting in the same painful<br />

hours as junior doctors. However<br />

Cohen in his unassuming way instead<br />

cracks jokes about his New York Times<br />

nickname-‘The Trauma Surgeon of<br />

Wall Street.’<br />

“At the risk of being inappropriately<br />

modest, but I think more accurate,<br />

I think I was more like one of the<br />

scrub room nurses, w<strong>here</strong>as the real<br />

surgeons were Paulson and Geithner<br />

and Bernanke.”<br />

26<br />

JULY - AUGUST 2010<br />

www.cpifinancial.net

What was the toughest part?<br />

“I think the most critical aspect was<br />

that so much was coming at the policy<br />

makers and regulators at once,” he said<br />

from his office in New York, which<br />

rather handily sits nearby that of one<br />

of his clients, Goldman Sachs, on 125<br />

Broad Street.<br />

“T<strong>here</strong> was no game book. No one<br />

had a plan ahead of time for any of these<br />

institutions, much less full financial<br />

contagion. It was the cumulative impact.<br />

I think you could have handled any one<br />

of these, but what you couldn’t handle<br />

was the whole facade cracking and<br />

everybody being at risk.”<br />

Cohen is well used to being thrown<br />

in at the deep end of unprecedented<br />

situations (he was instrumental during<br />

the Iran hostage crisis in 1980 in helping<br />

to free US captives) and if lawyers of<br />

his ilk are anything to go by, probably<br />

enjoys tackling the kinds of emergencies<br />

that would give most politicians and<br />

central bankers a heart attack.<br />

He even advises sovereign wealth<br />

funds (SWFs) in their delicate and<br />

extremely low key business dealings.<br />

Cohen praises the funds for their<br />

sophistication and once again, as is<br />

part of this character, plays down his<br />

role in his dealings with them.<br />

He is quick to acknowledge the<br />

SWF’s canny, long-term investor<br />

attitude. Some Western bankers have<br />

come to the SWF table with promises<br />

of all kinds of advice and suggestions of which kinds of products make the best<br />

investment, but Cohen cautions otherwise.<br />

“The sovereign wealth funds generally have people who are very sophisticated<br />

in financial terms. They do not need advice at all, certainly not on how to handle<br />

financial transactions. They come to us for what I call ‘deal technology.’ How do<br />

you structure a deal to make the most sense and they come to us in particular<br />

because the US regulatory system is very complex, difficult to navigate.<br />

“T<strong>here</strong> is often as much lore as t<strong>here</strong> is law and they want to know how to deal<br />

with the US regulatory system; how you structure a transaction and so on. If you need<br />

approval, how do you go about getting it?”<br />

He is also quick to praise the move towards greater transparency that people<br />

like Hank Paulson, during a trip to Abu Dhabi in 2008 pondered on. “As economies<br />

change, uncertainty can create resistance to openness. It is critical to understand,<br />

however that in the long run openness to trade and investment will not only bring<br />

prosperity, but will also improve stability by better enabling economies to manage<br />

external shocks and smooth out business cycles,” Paulson said at the time.<br />

At the same time, while recognising that some funds may have been stung by<br />

investments that are now worth less than when they acquired the stakes, Cohen, who<br />

has probably seen (and dealt with) more crises than most politicians have had hot<br />

dinners, in his nearly 40 years in the business, takes the historic view in such matters.<br />

I think I was more like one of the scrub<br />

room nurses, w<strong>here</strong>as the real surgeons<br />

were Paulson and Geithner and Bernanke.<br />

“I think t<strong>here</strong> has been a push, which to a significant extent has been successful,<br />

in more transparency coming from the sovereign wealth funds,” Cohen opined.<br />

“They certainly had losses, but some of these sovereign wealth funds, at least<br />

the ones that I am closest to, exemplified that famous story when Henry Kissinger<br />

met Zhou Enlai and asked him what he thought had been the impact of the French<br />

Revolution and Zhou Enlai said it was “too early to tell.”<br />

“These sovereign wealth funds are very long term investors. The answer to<br />

their success can’t be measured now - 2014/2015 is the time to look. Nobody can<br />

time the bottom precisely.”<br />

But a lot of people think that Warren Buffet tends to time the bottom<br />

better than many other people.<br />

“Yeah, but even Buffet makes mistakes from time to time. Of course, t<strong>here</strong> is a<br />

question as to whether Buffet is human anyway,” Cohen says, laughing.<br />

When asked if any many Middle Eastern banks come to him for advice, Cohen<br />

admits that they haven’t, “and I am not surprised at that because at the end I think<br />

that regulatory systems differ, cultures differ and what makes sense for the United<br />

States may, or may not make sense for anyone anyw<strong>here</strong> else in the world.”<br />

In the next edition of Banker Middle East, two years on from the grim days of<br />

September 2008, Rodgin Cohen talks about whether Lehman should have been allowed<br />

to fall, his views on M&A and MAC clauses and offers the readers of Banker Middle East<br />

a few suggestions on what can be done to create a stronger global banking system. •<br />

www.cpifinancial.net JULY - AUGUST 2010 27