foundation annual report 2009â10 - National Gallery of Australia

foundation annual report 2009â10 - National Gallery of Australia

foundation annual report 2009â10 - National Gallery of Australia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NATIONAL GALLERY OF AUSTRALIA FOUNDATION<br />

FINANCIAL REPORT FOR THE YEAR ENDED 30 JUNE 2010<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

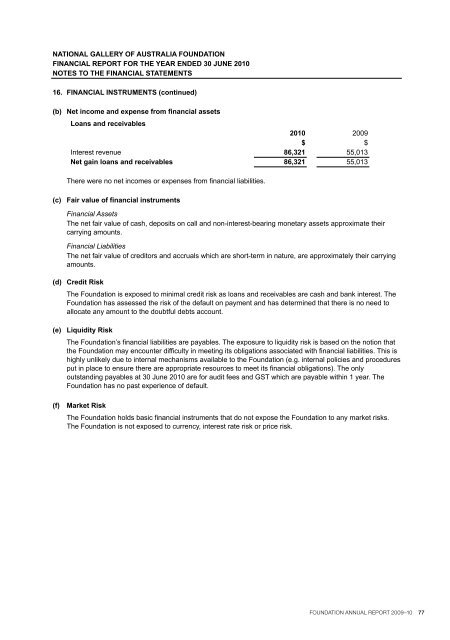

16. FINANCIAL INSTRUMENTS (continued)<br />

(b)<br />

Net income and expense from financial assets<br />

Loans and receivables<br />

2010 2009<br />

$ $<br />

Interest revenue 86,321 55,013<br />

Net gain loans and receivables 86,321 55,013<br />

(c) Fair value <strong>of</strong> financial instruments<br />

Financial Assets<br />

The net fair value <strong>of</strong> cash, deposits on call and non-interest-bearing monetary assets approximate their<br />

carrying amounts.<br />

(d)<br />

There were no net incomes or expenses from financial liabilities.<br />

Financial Liabilities<br />

The net fair value <strong>of</strong> creditors and accruals which are short-term in nature, are approximately their carrying<br />

amounts.<br />

Credit Risk<br />

The Foundation is exposed to minimal credit risk as loans and receivables are cash and bank interest. The<br />

Foundation has assessed the risk <strong>of</strong> the default on payment and has determined that there is no need to<br />

allocate any amount to the doubtful debts account.<br />

(e)<br />

(f)<br />

Liquidity Risk<br />

The Foundation’s financial liabilities are payables. The exposure to liquidity risk is based on the notion that<br />

the Foundation may encounter difficulty in meeting its obligations associated with financial liabilities. This is<br />

highly unlikely due to internal mechanisms available to the Foundation (e.g. internal policies and procedures<br />

put in place to ensure there are appropriate resources to meet its financial obligations). The only<br />

outstanding payables at 30 June 2010 are for audit fees and GST which are payable within 1 year. The<br />

Foundation has no past experience <strong>of</strong> default.<br />

Market Risk<br />

The Foundation holds basic financial instruments that do not expose the Foundation to any market risks.<br />

The Foundation is not exposed to currency, interest rate risk or price risk.<br />

FOUNDATION ANNUAL REPORT 2009–10 77