reconvene regular meeting: 7:00 pm - Irvine Unified School District

reconvene regular meeting: 7:00 pm - Irvine Unified School District

reconvene regular meeting: 7:00 pm - Irvine Unified School District

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

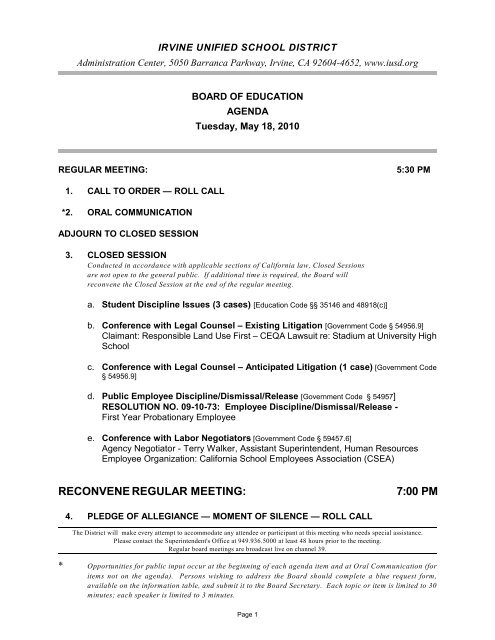

IRVINE UNIFIED SCHOOL DISTRICT<br />

Administration Center, 5050 Barranca Parkway, <strong>Irvine</strong>, CA 92604-4652, www.iusd.org<br />

BOARD OF EDUCATION<br />

AGENDA<br />

Tuesday, May 18, 2010<br />

REGULAR MEETING:<br />

5:30 PM<br />

1. CALL TO ORDER — ROLL CALL<br />

*2. ORAL COMMUNICATION<br />

ADJOURN TO CLOSED SESSION<br />

3. CLOSED SESSION<br />

Conducted in accordance with applicable sections of California law, Closed Sessions<br />

are not open to the general public. If additional time is required, the Board will<br />

<strong>reconvene</strong> the Closed Session at the end of the <strong>regular</strong> <strong>meeting</strong>.<br />

a. Student Discipline Issues (3 cases) [Education Code §§ 35146 and 48918(c)]<br />

b. Conference with Legal Counsel – Existing Litigation [Government Code § 54956.9]<br />

Claimant: Responsible Land Use First – CEQA Lawsuit re: Stadium at University High<br />

<strong>School</strong><br />

c. Conference with Legal Counsel – Anticipated Litigation (1 case) [Government Code<br />

§ 54956.9]<br />

d. Public Employee Discipline/Dismissal/Release [Government Code § 54957]<br />

RESOLUTION NO. 09-10-73: Employee Discipline/Dismissal/Release -<br />

First Year Probationary Employee<br />

e. Conference with Labor Negotiators [Government Code § 59457.6]<br />

Agency Negotiator - Terry Walker, Assistant Superintendent, Human Resources<br />

Employee Organization: California <strong>School</strong> Employees Association (CSEA)<br />

RECONVENE REGULAR MEETING:<br />

7:<strong>00</strong> PM<br />

4. PLEDGE OF ALLEGIANCE — MOMENT OF SILENCE — ROLL CALL<br />

The <strong>District</strong> will make every attempt to accommodate any attendee or participant at this <strong>meeting</strong> who needs special assistance.<br />

Please contact the Superintendent's Office at 949.936.5<strong>00</strong>0 at least 48 hours prior to the <strong>meeting</strong>.<br />

Regular board <strong>meeting</strong>s are broadcast live on channel 39.<br />

* Opportunities for public input occur at the beginning of each agenda item and at Oral Communication (for<br />

items not on the agenda). Persons wishing to address the Board should complete a blue request form,<br />

available on the information table, and submit it to the Board Secretary. Each topic or item is limited to 30<br />

minutes; each speaker is limited to 3 minutes.<br />

Page 1

5. REPORT OF CLOSED SESSION DISCUSSION / ACTION<br />

6. APPROVAL OF MINUTES OF PREVIOUS MEETING<br />

March 2, 2010 Regular Meeting<br />

March 9, 2010 Special Meeting<br />

7. ADOPTION OF THE AGENDA<br />

8. SPECIAL PRESENTATIONS/RECOGNITIONS<br />

a. IUSD Retirees<br />

Terry Walker, Assistant Superintendent, Human Resources<br />

b. IPSF<br />

Neda Zaengle, Chief Executive Officer<br />

c. PTA<br />

Steffanie Early, President<br />

*9. ORAL COMMUNICATION<br />

An opportunity to speak to a topic not on the agenda; limited to 3 minutes per person, 30 minutes per topic.<br />

10. STUDENT BOARD MEMBER REPORTS<br />

11. SUPERINTENDENT'S REPORT<br />

12. ANNOUNCEMENTS AND ACKNOWLEDGMENTS<br />

Board Report on <strong>School</strong> Visits, Conference Attendance, and Meeting Participation<br />

*13. CONSENT CALENDAR<br />

All matters of the Consent Calendar are considered to be routine and will be enacted by the Board in one<br />

motion, without prior discussion. At the time the Board adopts the agenda an item may be removed from the<br />

consent calendar by the Board, staff, or community for discussion.<br />

a. Payment for Nonpublic <strong>School</strong>/Agency Services for Special Education Students<br />

Recommendation: Approve the individual pupil service contract(s) for disabled<br />

student(s) negotiated between the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> and State Certified<br />

Nonpublic <strong>School</strong>s/Agencies.<br />

b. Contract for Special Education Related Services<br />

Recommendation: Authorize payment for special education related services in an<br />

amount not to exceed $2,5<strong>00</strong>.<strong>00</strong>.<br />

c. Payment in Accordance with the Terms of the Settlement Agreement(s)<br />

Recommendation: Authorize payment in an amount not to exceed $48,<strong>00</strong>0.<strong>00</strong> in<br />

accordance with the terms of the Settlement Agreement(s).<br />

* Opportunities for public input occur at the beginning of each agenda item and at Oral Communication (for<br />

items not on the agenda). Persons wishing to address the Board should complete a blue request form,<br />

available on the information table, and submit it to the Board Secretary. Each topic or item is limited to 30<br />

minutes; each speaker is limited to 3 minutes.<br />

Page 2

d. Purchase Order Detail Report<br />

Recommendation: Approve the Purchase Order Detail Report dated May 5, 2010.<br />

e. Check Register Report<br />

Recommendation: Ratify issuance of check numbers as listed, representing Board<br />

authorized purchase orders, invoices and contracts:<br />

<strong>District</strong> 75, <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> - Numbers <strong>00</strong>143410 through <strong>00</strong>144<strong>00</strong>1<br />

<strong>District</strong> 50, Community Facilities <strong>District</strong> No. 01-1 - Number <strong>00</strong><strong>00</strong>1452<br />

<strong>District</strong> 44, Community Facilities <strong>District</strong> No. 86-1 - Numbers <strong>00</strong><strong>00</strong>4133 through <strong>00</strong><strong>00</strong>4135<br />

<strong>District</strong> 41, <strong>Irvine</strong> Child Care Project - Number <strong>00</strong><strong>00</strong>2444<br />

Revolving Cash - Numbers 33019 through 33111<br />

f. Contract Services Action Report<br />

Recommendation: Approve and/or ratify the Contract Services Action Report 2<strong>00</strong>9-10/<br />

16, as submitted.<br />

g. Classified Personnel Action Report<br />

Recommendation: Approve and/or ratify the Classified Personnel Action Report 2<strong>00</strong>9-<br />

10/16, as submitted for Employment and Retirement.<br />

h. Certificated Personnel Action Report<br />

Recommendation: Approve and/or ratify the Certificated Personnel Action Report 2<strong>00</strong>9-<br />

10/16, as submitted for Employment and Retirement.<br />

i. Five Year Deferred Maintenance Plan<br />

Recommendation: Approve the Five Year Deferred Maintenance Plan.<br />

j. Gifts<br />

Recommendation: Accept gifts to the <strong>District</strong>, as listed.<br />

k. Conference Attendance<br />

Recommendation: Approve out-of-state conference attendance for staff, as follows –<br />

1) Melissa Figge and Elizabeth Taylor to Minneapolis, MN from July 29-31, 2010, for<br />

$1,5<strong>00</strong>.<strong>00</strong>.<br />

l. Field Trips and Excursions<br />

Recommendation: Approve the following field trips funded by donations —<br />

1) Bonita Canyon 4th grade students to Los Angeles, California, on June 1, 2010 for<br />

$1,8<strong>00</strong>.<strong>00</strong>;<br />

2) Stone Creek 4th grade students to Anaheim, California, on June 1, 2010 for<br />

$2,304.<strong>00</strong>;<br />

3) <strong>Irvine</strong> High <strong>School</strong> football team to Arroyo Grande, California, on July 15-17, 2010<br />

for $2,4<strong>00</strong>.<strong>00</strong>;<br />

4) <strong>Irvine</strong> High <strong>School</strong> yearbook staff to Indian Wells, California, on July 26-29, 2010<br />

for $3,045.<strong>00</strong>;<br />

5) <strong>Irvine</strong> High <strong>School</strong> leadership cabinet to <strong>Irvine</strong>, California, on August 11-12, 2010<br />

for $6,6<strong>00</strong>.<strong>00</strong>;<br />

6) University High <strong>School</strong> boys varsity water polo team to Poway, California, on<br />

The <strong>District</strong> will make every attempt to accommodate any attendee or participant at this <strong>meeting</strong> who needs special assistance.<br />

Please contact the Superintendent's Office at 949.936.5<strong>00</strong>0 at least 48 hours prior to the <strong>meeting</strong>.<br />

Regular board <strong>meeting</strong>s are broadcast live on channel 39.<br />

* Opportunities for public input occur at the beginning of each agenda item and at Oral Communication (for<br />

items not on the agenda). Persons wishing to address the Board should complete a blue request form,<br />

available on the information table, and submit it to the Board Secretary. Each topic or item is limited to 30<br />

minutes; each speaker is limited to 3 minutes.<br />

Page 3

September 10-11, 2010 for $6<strong>00</strong>.<strong>00</strong>.<br />

*14. FACILITIES CONSENT CALENDAR<br />

All matters of the Community Facilities <strong>District</strong> Consent Calendar are considered to be routine and will be<br />

enacted by the Board in one motion, without prior discussion. At the time the Board adopts the agenda an item<br />

may be removed from the consent calendar by the Board, staff, or community, for discussion.<br />

a. Authorization to Enter into a Takeover Agreement – Woodbridge High <strong>School</strong><br />

Modernization Project<br />

Recommendation: Authorize the Assistant Superintendent/CFO of Business Services<br />

to enter into a Takeover Agreement with Lincoln General Insurance Company, as surety<br />

of ATE Environmental, Inc. under Performance Bond No. 661122101 on the<br />

Woodbridge High <strong>School</strong> Modernization project. No change to the contract amount and<br />

no change to the completion date.<br />

b. Change Orders – Woodbridge High <strong>School</strong> Modernization Project<br />

Recommendation: Approve the listed change orders in the cumulative amount of<br />

$29,788.<strong>00</strong>, at the Woodbridge High <strong>School</strong> Modernization project. No change to the<br />

completion date.<br />

c. Architectural Services for Oak Creek Elementary <strong>School</strong> and Plaza Vista K-8<br />

Relocatable Classroom Additions<br />

Recommendation: Acting as the governing body of Community Facilities <strong>District</strong> No.<br />

86-1, authorize the Assistant Superintendent/CFO of Business Services to negotiate<br />

and enter into a contract with PJHM Architects to provide architectural services for the<br />

installation of three (3) relocatable classrooms at Oak Creek Elementary <strong>School</strong> and<br />

one (1) relocatable classroom at Plaza Vista K-8 <strong>School</strong>.<br />

d. Authorization to Renew Lease of One (1) 12’ x 30’ Department of Housing (DOH)<br />

Relocatable for Woodbridge High <strong>School</strong><br />

Recommendation: Acting as the governing body of Community Facilities <strong>District</strong> No.<br />

86-1, authorize the Assistant Superintendent/CFO of Business Services to renew the<br />

lease with Mobile Modular Management Corporation of one (1) 12’ x 30’ DOH<br />

Relocatable for Woodbridge High <strong>School</strong>.<br />

e. Authorization for the Placement of Three (3) Relocatable Classrooms at Oak<br />

Creek Elementary <strong>School</strong><br />

Recommendation: Acting as the governing body of Community Facilities <strong>District</strong> No.<br />

86-1, authorize the Assistant Superintendent/CFO of Business Services to place three<br />

(3) 24’ x 40’ relocatable classrooms at Oak Creek Elementary <strong>School</strong> this summer.<br />

f. Authorization for the Placement of One (1) Relocatable Classroom at Plaza Vista<br />

K-8 <strong>School</strong><br />

Recommendation: Acting as the governing body of Community Facilities <strong>District</strong> No.<br />

86-1, authorize the Assistant Superintendent/CFO of Business Services to place one<br />

(1) 24’ x 40’ relocatable classroom at Plaza Vista K-8 <strong>School</strong> this summer.<br />

ITEMS REMOVED FROM CONSENT CALENDARS<br />

* Opportunities for public input occur at the beginning of each agenda item and at Oral Communication (for<br />

items not on the agenda). Persons wishing to address the Board should complete a blue request form,<br />

available on the information table, and submit it to the Board Secretary. Each topic or item is limited to 30<br />

minutes; each speaker is limited to 3 minutes.<br />

Page 4

Items removed from Consent Calendars will be addressed at this time.<br />

*15. ITEMS OF BUSINESS<br />

a. Solar Project Update<br />

Recommendation: Review the proposed installation of solar photovoltaic systems at<br />

various sites. Provide input, feedback and direction to staff regarding the installation of<br />

rooftop, carports, and ground-mounted solar power systems.<br />

b. RESOLUTION NO. 09-10-72: Authorizing the Borrowing of Funds for Fiscal Year<br />

2010-11 and the Issuance and Sale of One or More Series of 2010-11 Tax and<br />

Revenue Anticipation Notes Therefor in an Amount Not to Exceed $25,<strong>00</strong>0,<strong>00</strong>0<br />

and Participation in the South Coast Local Education Agencies Pooled Tax and<br />

Revenue Anticipation Note Program and Requesting the Board of Supervisors of<br />

the County to Issue and Sell Said Notes - Roll Call<br />

Recommendation: Adopt Resolution No. 09-10-72 authorizing issuance, approving the<br />

Official Statement, and pledging revenues and entering into certain tax covenants in<br />

connection with the 2010-11 Tax and Revenue Anticipation Note (TRAN).<br />

c. Inter-district Transfers<br />

Recommendation: Approve the inter-district transfer approval practices, as presented.<br />

d. Appointment of California Interscholastic Federation Representatives – 2010-11<br />

Recommendation: Approve the following individuals to serve as the 2010-11 CIF league<br />

representatives for the schools indicated:<br />

Monica Colunga / <strong>Irvine</strong> High <strong>School</strong><br />

Leslie Roach / Northwood High <strong>School</strong><br />

John Pehrson / University High <strong>School</strong><br />

Jason Viloria / Woodbridge High <strong>School</strong><br />

e. Annual Review of <strong>District</strong>-wide Continuous Improvement Efforts for 2010-11<br />

Recommendation:<br />

1) Approve the Continuous Improvement Efforts for 2010-11, as presented.<br />

2) Express appreciation to the members of the 2010-11 Curriculum Council for their<br />

work.<br />

f. Nutrition Services Reorganization<br />

Recommendation: For the Board’s information.<br />

ITEMS REMOVED FROM CONSENT CALENDARS<br />

Items removed from Consent Calendars, requiring additional information from staff.<br />

*16. ORAL COMMUNICATION<br />

An opportunity to speak to a topic not on the agenda; limited to 3 minutes per person, 30 minutes per topic.<br />

17. CLOSED SESSION<br />

Conducted in accordance with applicable sections of California law, Closed Sessions are not open<br />

to the general public.<br />

* Opportunities for public input occur at the beginning of each agenda item and at Oral Communication (for<br />

items not on the agenda). Persons wishing to address the Board should complete a blue request form,<br />

available on the information table, and submit it to the Board Secretary. Each topic or item is limited to 30<br />

minutes; each speaker is limited to 3 minutes.<br />

Page 5

18. ADJOURNMENT<br />

PRESIDENT: Sharon Wallin<br />

SUPERINTENDENT: Gwen E. Gross<br />

FUTURE MEETINGS:<br />

June 1, 2010<br />

June 29, 2010<br />

A copy of the board <strong>meeting</strong> agenda and support materials is posted on the <strong>District</strong>’s web site<br />

(www.iusd.org/board/) prior to the close of business on the Friday preceding the <strong>meeting</strong>. Any written<br />

materials distributed to the Board after the 72 hour posting period will also be made available for public<br />

review at the time of distribution. Copies may also be obtained at the <strong>District</strong> Administration Center or at<br />

the <strong>meeting</strong>.<br />

The <strong>District</strong> will make every attempt to accommodate any attendee or participant at this <strong>meeting</strong> who needs special assistance.<br />

Please contact the Superintendent's Office at 949.936.5<strong>00</strong>0 at least 48 hours prior to the <strong>meeting</strong>.<br />

Regular board <strong>meeting</strong>s are broadcast live on channel 39.<br />

* Opportunities for public input occur at the beginning of each agenda item and at Oral Communication (for<br />

items not on the agenda). Persons wishing to address the Board should complete a blue request form,<br />

available on the information table, and submit it to the Board Secretary. Each topic or item is limited to 30<br />

minutes; each speaker is limited to 3 minutes.<br />

Page 6

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

<strong>Irvine</strong>, California<br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Call to Order<br />

The Regular Meeting of the Board of Education was called to order by President Wallin at 5:48<br />

p.m. , in the <strong>District</strong> Administration Center, 5050 Barranca Parkway, <strong>Irvine</strong>, California.<br />

Roll Call<br />

Members Present:<br />

Gavin Huntley-Fenner, Sue Kuwabara, Carolyn McInerney, Mike Parham, Sharon Wallin<br />

Members Absent:<br />

None<br />

Oral Communication<br />

The following addressed the Board regarding the Oak Creek Outdoor Education trip:<br />

Thomas Chung<br />

MinHee Chung<br />

So-Young Yu<br />

Closed Session<br />

The Board adjourned to Closed Session at 6:<strong>00</strong> p.m.<br />

Student Discipline Issue<br />

The Board discussed four student discipline issues.<br />

Public Employee Discipline/Dismissal/Release<br />

The Board discussed a public employee discipline issue.<br />

Conference with Labor Negotiators<br />

The Board discussed labor negotiations involving the <strong>Irvine</strong> Teachers Association and the<br />

California <strong>School</strong> Employees Association and provided direction to staff.<br />

Public Employee Performance Evaluation<br />

Page 7

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 2<br />

This item was removed by staff.<br />

Reconvene Regular Meeting<br />

President Wallin <strong>reconvene</strong>d the <strong>meeting</strong> at 7:05 p.m.<br />

Pledge of Allegiance<br />

The Pledge of Allegiance to the Flag of the United States of America was led by Student<br />

Member Conroy and was followed by a moment of silence.<br />

Roll Call<br />

Members Present:<br />

Gavin Huntley-Fenner, Sue Kuwabara, Carolyn McInerney, Mike Parham, Sharon Wallin<br />

Members Absent:<br />

None<br />

Student Members Present:<br />

Laura Bran, Ryan Conroy, Gal Sadlik, Brianne Searl<br />

Student Members Absent:<br />

Lucas Salzman<br />

Staff:<br />

Gwen Gross, Superintendent of <strong>School</strong>s<br />

Lisa Howell, Assistant Superintendent, Business Services<br />

Cassie Parham, Assistant Superintendent, Education Services<br />

Terry Walker, Assistant Superintendent, Human Resources<br />

Lee Brooks, Executive Assistant to the Superintendent<br />

Other Staff:<br />

Julie Bautista, Kelli Cheshire, Shelley Edgar, Kathy Erickson, Kimberly Fenton, Helen Ford,<br />

Lisa Freedberg, Patricia Godwin, Ian Hanigan, Jennifer Herman, Catherine Holmes,<br />

Kathy Huntsberger, Chris Kroesen, Lloyd Linton, Heather Phillips, Leslie Roach,<br />

Rick Seibert, Lauren Sipelis, Mark Sontag, Brad Van Patten, Cindy Vandermoortel<br />

Page 8

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 3<br />

Video Production:<br />

James Adling<br />

Brian Des Palmes<br />

Closed Session Report<br />

President Wallin reported on the discussion in Closed Session and the second Closed Session of<br />

February 16, 2010.<br />

Student Discipline Issues<br />

On the motion of Member McInerney, seconded by Member Parham and carried 5-0, the<br />

Board approved the staff recommendation to expel Student No. 160990405 through June 23,<br />

2010.<br />

On the motion of Member Parham, seconded by Member McInerney and carried 5-0, the<br />

Board approved the staff recommendation to expel Student No. 112990491 through<br />

January 27, 2011, with suspension of the expulsion at the beginning of first semester of the<br />

2010-11 school year, allowing the student to return with probationary status.<br />

On the motion of Member McInerney, seconded by Member Kuwabara and carried 5-0, the<br />

Board approved the staff recommendation to expel Student No. 124990175 through January<br />

27, 2011, with suspension of the expulsion at the beginning of first semester of the 2010-11<br />

school year, allowing the student to return with probationary status.<br />

On the motion of Member Huntley-Fenner, seconded by Member McInerney and carried 5-<br />

0, the Board approved the staff recommendation to expel Student No. 1910309983 through<br />

January 27, 2011, with suspension of the expulsion at the beginning of first semester of the<br />

2010-11 school year, allowing the student to return with probationary status.<br />

Approval of Minutes<br />

On the motion of Member Kuwabara, seconded by Member Parham and carried 5-0, the Board<br />

approved the following Minutes, as presented.<br />

December 8, 2<strong>00</strong>9 Organizational/Regular Meeting<br />

January 7, 2010 Special Meeting<br />

Adoption of the Agenda<br />

On the motion of Member Huntley-Fenner, seconded by Member Parham and carried 5-0, the<br />

Page 9

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 4<br />

Board adopted the agenda, as amended:<br />

REVISE<br />

Item 16c - Resolution No. 09-10-54: Reduction or Elimination of Certain<br />

Certificated Services and Release of Temporary Certificated Employees<br />

(Education Code Sections 44949, 44954, 44955)<br />

Special Presentations/Recognitions<br />

Arts Advantage Program<br />

Elaine Keeley, Orange County Dept. of Education, and Dalynn Malek, California Arts Project,<br />

presented a report on the county's Arts Advantage Program, developed by a committee of<br />

educational, community and business leaders with the goal of restoring the arts to K-12<br />

education.<br />

Speaking to the topic:<br />

Don McCrea<br />

IPSF Update<br />

IPSF CEO Neda Zaengle reported on the foundation's fund raising efforts including the Five<br />

Week Campaign, which has raised more than $172,<strong>00</strong>0 to date, and has been extended until<br />

March 15. Also highlighted were the "Dine Out, Help Out" event and the "iRead" campaign,<br />

wherein local restaurants and Barnes & Noble bookstores have pledged a percentage of receipts<br />

on specified days.<br />

PTA Update<br />

PTA Council President Steffanie Early expressed appreciation to site-based PTAs, which have<br />

made direct contributions to IPSF in support of the Five Week Campaign. She reported on<br />

legislative advocacy efforts, including a petition drive being spearheaded by PTA to lower the<br />

parcel tax threshold to 55%. Lastly, she encouraged parents to join the education community in<br />

wearing blue on March 4, to send a message to the state that we are "blue about the budget" and<br />

deeply concerned about the negative impacts to education.<br />

Oral Communication<br />

Kathy Huntsberger addressed the Board regarding salary reductions.<br />

Allison Lewis spoke in support of the Science Specialist program.<br />

Student Board Member Reports<br />

Student Members Bran, Conroy, Sadlik and Searl reported on school activities.<br />

Page 10

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 5<br />

Superintendent’s Report<br />

Superintendent Gross reported on current district and county-wide activities including the<br />

Education Coalition Rally on March 4 to call attention to the impact of cuts to public schools,<br />

and PTA's annual high school student advocacy trip to Sacramento on April 14. Other upcoming<br />

events were announced including a Special Board Meeting on March 9 to ratify the tentative<br />

agreement with the <strong>Irvine</strong> Teachers Association; the <strong>District</strong> Science Fair on March 3 at<br />

Northwood H.S.; the Stonegate Elementary <strong>School</strong> Dedication on March 10; and IPSF's "1<strong>00</strong><br />

Legacy Partner Campaign Kick-Off" on March 10 at UCI's University Club.<br />

Announcements and Acknowledgments<br />

Members Huntley-Fenner, Kuwabara, McInerney, Parham and Wallin reported on school visits,<br />

conference attendance and <strong>meeting</strong> participation.<br />

Consent Calendar<br />

On the motion of Member McInerney, seconded by Member Parham and carried 5-0 (Student<br />

Members voting "Yes"), the Board took the following action on the Consent Calendar:<br />

1. Payment for Nonpublic <strong>School</strong>/Agency Services for Special Education Students<br />

Approved the individual pupil service contract(s) for disabled student(s) negotiated<br />

between the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> and State Certified Nonpublic<br />

<strong>School</strong>s/Agencies.<br />

2. Grant Proposal – Type 2 Diabetes Screening Program<br />

Approved the submission of the Health Services 2010-2011 proposal to Kaiser<br />

Permanente Community Grant Program, for the purpose of developing and implementing<br />

a type 2 diabetes screening program at all seven district middle schools.<br />

3. Purchase Order Detail Report<br />

(A written report is on file in the <strong>District</strong> Office.)<br />

Approved the Purchase Order Detail Report dated February18, 2010.<br />

4. Check Register Report<br />

Ratified issuance of check numbers as listed, representing Board authorized purchase<br />

orders, invoices and contracts:<br />

<strong>District</strong> 75, <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> - Numbers <strong>00</strong>140925 through <strong>00</strong>141413<br />

<strong>District</strong> 50, Community Facilities <strong>District</strong> No. 01-1 - Number <strong>00</strong><strong>00</strong>1439<br />

<strong>District</strong> 44, Community Facilities <strong>District</strong> No. 86-1 - Numbers <strong>00</strong>04082 through<br />

<strong>00</strong><strong>00</strong>4086<br />

Page 11

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 6<br />

<strong>District</strong> 41, <strong>Irvine</strong> Child Care Project - Numbers <strong>00</strong><strong>00</strong>2419 through <strong>00</strong><strong>00</strong>2425<br />

Revolving Cash - Numbers 32694 through 32806<br />

5. Contract Services Action Report<br />

(A written report was included with the agenda and is on file in the <strong>District</strong> Office.)<br />

Approved and/or ratified the Contract Services Action Report 2<strong>00</strong>9-10/12, as submitted.<br />

6. Additional Participation in the Orange County Department of Education Inside the<br />

Outdoors Field Program for the 2<strong>00</strong>9-2010 <strong>School</strong> Year<br />

Approved participation of Greentree Elementary <strong>School</strong> in the Inside the Outdoors Field<br />

Program with the Orange County Department of Education for the 2<strong>00</strong>9-2010 school<br />

year.<br />

7. Classified Personnel Action Report<br />

(A written report was included with the agenda and is on file in the <strong>District</strong> Office.)<br />

Approved and/or ratified the Classified Personnel Action Report 2<strong>00</strong>9-10/12, as<br />

submitted for Employment.<br />

8. Certificated Personnel Action Report<br />

(A written report was included with the agenda and is on file in the <strong>District</strong> Office.)<br />

Approved and/or ratified the Certificated Personnel Action Report 2<strong>00</strong>9-10/12, as<br />

submitted for Employment, Leaves of Absence, and Separations.<br />

9. Gifts<br />

(A written report was included with the agenda and is on file in the <strong>District</strong> Office.)<br />

Accepted gifts to the <strong>District</strong>, as listed.<br />

10. Conference Attendance<br />

Approved out-of-state conference attendance for staff, as follows –<br />

1) Nancy Colocino to Rockville, Maryland March 14-16, 2010, at no cost to the <strong>District</strong>.<br />

11. Field Trips and Excursions<br />

Approved the following field trips funded by donations —<br />

th<br />

1) College Park 6 grade science students to Anaheim, California, on February 20, 2010<br />

for $3,649.<strong>00</strong>;<br />

2) <strong>Irvine</strong> High <strong>School</strong> physics students to Buena Park, California, on March 4, 2010 for<br />

$2,730.<strong>00</strong>;<br />

3) Northwood High <strong>School</strong> ASB students to Fullerton, California, on March 12, 2010<br />

for $1,1<strong>00</strong>.<strong>00</strong>;<br />

4) Northwood High <strong>School</strong> Science Olympiad Team to Huntington Beach, California,<br />

on March 12, 2010 for $0;<br />

5) Northwood High <strong>School</strong> Competition Cheer students to Palm Springs, California, on<br />

March 26-28, 2010 for $4,2<strong>00</strong>.<strong>00</strong>;<br />

6) <strong>Irvine</strong> High <strong>School</strong>, Northwood High <strong>School</strong>, University High <strong>School</strong>, Woodbridge<br />

Page 12

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 7<br />

High <strong>School</strong>, Creekside High <strong>School</strong> students and PTSA members to Sacramento,<br />

California, on April 14, 2010 for $5,775.<strong>00</strong>;<br />

rd th<br />

7) College Park 3 and 4 grade students to Anaheim, California, on April 22, 2010 for<br />

$3,048.<strong>00</strong>;<br />

8) <strong>Irvine</strong> High <strong>School</strong> boys’ track and field to Fresno, California, on June 3-6, 2010 for<br />

$1,2<strong>00</strong>.<strong>00</strong>.<br />

Consent Calendar Resolutions<br />

On the motion of Member McInerney, seconded by Member Parham and carried 5-0 (Student<br />

Members voting "Yes"), the Board took the following action on the Consent Calendar<br />

Resolutions:<br />

1. RESOLUTION NO. 09-10-51: Signature Authorization and Submission of Grant<br />

Proposal – Cal STAT Leadership Site Award<br />

Adopted Resolution No. 09-10-51 for signature authorization and approved submission of<br />

the grant proposal for the implementation of the Cal STAT Leadership Site Award.<br />

2. RESOLUTION NO: 09-10-52: Signature Authorization and Submission of Grant<br />

Proposal – Cal STAT Regional Leadership Institute Site Award<br />

Adopted Resolution No: 09-10-52 for signature authorization and approved submission<br />

of the grant proposal for the implementation of the Cal STAT Regional Leadership<br />

Institute Award.<br />

AYES: Members Huntley-Fenner, Kuwabara, McInerney, Parham, Wallin<br />

NOES: None<br />

ABSENT: None<br />

Facilities Consent Calendar<br />

On the motion of Member Parham, seconded by Member McInerney and carried 5-0, the Board<br />

took the following action on the Facilities Consent Calendar:<br />

1. Change Order – Santiago Hills Elementary <strong>School</strong> Modernization Project<br />

Approved the listed change order in the cumulative amount of , at the Santiago<br />

Hills Elementary <strong>School</strong> Modernization project. No change to the completion date.<br />

2. Notice of Completion – Relocatable Classroom Vista Verde K-8 <strong>School</strong><br />

Accepted the contract of the listed contractor for the Relocatable Classroom project at Vista<br />

Verde K-8 <strong>School</strong>, as complete and authorized staff to file a Notice of Completion with the<br />

County of Orange Recorder's Office.<br />

Page 13

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 8<br />

3. Change Orders – Woodbridge High <strong>School</strong> Modernization Project<br />

Approved the listed change orders in the cumulative amount of $22,117.<strong>00</strong>, at the<br />

Woodbridge High <strong>School</strong> Modernization project. No change to the completion date.<br />

4. Receive Bids/Award Contracts – Woodbridge High <strong>School</strong> Modernization<br />

Authorized the Assistant Superintendent/CFO of Business Services to award the contracts for<br />

the Woodbridge High <strong>School</strong> Modernization project, for each bid category as listed in the<br />

board report.<br />

5. Payment in Accordance with the Terms of the Settlement Agreement<br />

Authorized payment in an amount not to exceed $49,694.<strong>00</strong> to HCH Constructors-<br />

Managers, Inc., in accordance with the terms of the Settlement Agreement at the Lakeside<br />

Middle <strong>School</strong> Modernization project and delegated authority to the Superintendent or CFO<br />

to sign the agreement on behalf of the Board and <strong>District</strong>.<br />

6. Payment in Accordance with the Terms of the Settlement Agreement<br />

Authorized payment in an amount not to exceed $59,689.<strong>00</strong> to Rocky Coast Framers, Inc., in<br />

accordance with the terms of the Settlement Agreement at the Lakeside Middle <strong>School</strong><br />

Modernization project and delegated authority to the Superintendent or CFO to sign the<br />

agreement on behalf of the Board and <strong>District</strong>.<br />

7. State Building Program – Authorized Signatories<br />

Authorized the filing of applications with the State Allocation Board and designated the<br />

<strong>District</strong> representatives submitted as authorized signatories for contracts, agreements, and<br />

change orders.<br />

Items of Business<br />

(Written reports were included with the agenda and are on file in the <strong>District</strong> Office.)<br />

Budget Update – Staff Recommendations<br />

Assistant Superintendent Lisa Howell reviewed the updated budget reduction/adjustment<br />

recommendations totaling more than $20 million, including 12 furlough days over the 2<strong>00</strong>9-10<br />

and 2010-11 school years. Three options relative to art, music and science instruction were<br />

presented for the Board's consideration. Howell advised that reductions to music and the science<br />

specialist program were removed due to identification of alternative funding sources including<br />

the <strong>Irvine</strong> Company's Educational Enrichment Agreement for music and the IRWD easement for<br />

science.<br />

Speaking to the topic:<br />

Julie Bautista<br />

Jeff Lalloway<br />

Lisa Freedberg<br />

Dan Grubb<br />

Page 14

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 9<br />

Following continued discussion, the Board reached consensus on the following:<br />

• Option C – Art, Music and Science (preserves the art specialist program at a reduced<br />

level and pilots the Arts Advantage Program)<br />

• Include $251/ADA revenue reduction in the budget ($201/ADA central administration<br />

cut, and additional $50/ADA still in question)<br />

• Contributions from Tier III to reduce the deficit<br />

Textbooks - $4<strong>00</strong>K<br />

Information Technology - $250K (ongoing)<br />

• Reduce site unrestricted allocations by 10%<br />

Curriculum Coordinator Mark Sontag responded to questions regarding the <strong>Irvine</strong> Online<br />

Assessment (IOLA) system and reported on staff efforts to identify a more effective Integrated<br />

Learning Management system.<br />

RESOLUTION NO. 09-10-53: Adopting an Initial Study and Mitigated Negative Declaration<br />

and Approving a Preliminary Environmental Assessment for the Proposed Woodbridge<br />

High <strong>School</strong> Expansion and Pool Projects and Authorization to File a Notice of<br />

Determination<br />

On the motion of Member Parham, seconded by Member Kuwabara and carried 5-0, the Board,<br />

after receiving no public comments or responses:<br />

1) Adopted Resolution No. 09-10-53, approving all environmental documents and adopting<br />

a Mitigated Negative Declaration for design and construction of the Woodbridge High<br />

<strong>School</strong> Expansion and Pool Projects;<br />

2) Authorized staff to file the Notice of Determination with the required agencies.<br />

AYES: Members Huntley-Fenner, Kuwabara, McInerney, Parham, Wallin<br />

NOES: None<br />

ABSENT: None<br />

RESOLUTION NO 09-10-54: Reduction or Elimination of Certain Certificated Services and<br />

Release of Temporary Certificated Employees (Education Code Sections 44949, 44954<br />

and 44955)<br />

On the motion of Member Kuwabara, seconded by Member McInerney and carried 5-0, the<br />

Board released temporary certificated employees, as identified in the revised report, in order to<br />

effectuate the reduction in particular kinds of services.<br />

AYES: Members Huntley-Fenner, Kuwabara, McInerney, Parham, Wallin<br />

NOES: None<br />

ABSENT: None<br />

FIRST READING: Proposed Board Policy 5141: Automated External Defibrillators<br />

Page 15

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Minutes of Regular Meeting<br />

March 2, 2010<br />

Page 10<br />

Assistant Superintendent Parham reviewed the proposed policy outlining the use and<br />

implementation plan for Automated External Defibrillators.<br />

On the motion of Member Kuwabara, seconded by Member Parham and carried 5-0, the Board<br />

approved for first reading proposed Board Policy 5141: Automated External Defibrillators.<br />

Oral Communication<br />

None<br />

Adjournment<br />

On the motion of Member Kuwabara, seconded by Member Parham and carried 5-0, there being<br />

no further Board of Education business, the <strong>meeting</strong> was adjourned at 10:07 p.m.<br />

Sharon Wallin<br />

Board President<br />

Gwen E. Gross, Ph.D.<br />

Superintendent of <strong>School</strong>s<br />

Page 16

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

<strong>Irvine</strong>, California<br />

Board of Education<br />

Minutes of Special Meeting<br />

March 9, 2010<br />

Call to Order<br />

The Special Meeting of the Board of Education was called to order by President Wallin at 8:07<br />

a.m., in the <strong>District</strong> Administration Center, 5050 Barranca Parkway, <strong>Irvine</strong>, California.<br />

Pledge of Allegiance<br />

The Pledge of Allegiance to the United States of America was led by President Wallin and was<br />

followed by a moment of silence.<br />

Roll Call<br />

Members Present:<br />

Sue Kuwabara, Carolyn McInerney, Sharon Wallin<br />

Members Absent:<br />

Gavin Huntley-Fenner (excused)<br />

Mike Parham (excused)<br />

Staff:<br />

Gwen Gross, Superintendent of <strong>School</strong>s<br />

Lisa Howell, Assistant Superintendent, Business Services<br />

Terry Walker, Assistant Superintendent, Human Resources<br />

Lee Brooks, Executive Assistant to the Superintendent<br />

Other Staff:<br />

Ian Hanigan<br />

Adoption of the Agenda<br />

On the motion of Member Kuwabara, seconded by Member McInerney and carried 3-0, the<br />

Board adopted the agenda as presented.<br />

Items of Business<br />

Page 17

<strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong><br />

Board of Education<br />

Special Meeting<br />

March 9, 2010<br />

Page 2<br />

RESOLUTION NO. 09-10-59: Release/Reassignment of an Administrator<br />

On the motion of Member McInerney, seconded by Member Kuwabara and carried 3-0, the<br />

Board released and/or reassigned administrators in accordance with the provisions of Education<br />

Code Section 44951.<br />

AYES:<br />

NOES:<br />

ABSENT:<br />

Members Kuwabara, McInerney, Wallin<br />

None<br />

Members Huntley-Fenner, Parham<br />

Salary and Benefits Settlement with the <strong>Irvine</strong> Administrative Assistants to the Principals<br />

and the <strong>Irvine</strong> Administrators Association for 2<strong>00</strong>9-2010 and 2010-2011<br />

On the motion of Member Kuwabara, seconded by Member McInerney and carried 3-0, the<br />

Board approved the settlement with the <strong>Irvine</strong> Administrative Assistants to the Principals and the<br />

<strong>Irvine</strong> Administrators Association for the 2<strong>00</strong>9-2010 and 2010-2011 school years.<br />

Ratification of Agreement Between the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> and the <strong>Irvine</strong><br />

Teachers Association for 2<strong>00</strong>9-2010 and 2010-2011<br />

On the motion of Member McInerney, seconded by Member Kuwabara and carried 3-0, the<br />

Board ratified the Tentative Agreement between the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> and the <strong>Irvine</strong><br />

Teachers Association for 2<strong>00</strong>9-2010 and 2010-2011.<br />

Adjournment<br />

On the motion of Member Kuwabara, seconded by Member McInerney and carried 3-0, there<br />

being no further Board of Education business, the <strong>meeting</strong> was adjourned at 8:17 a.m.<br />

Sharon Wallin<br />

Board President<br />

Gwen E. Gross, Ph.D.<br />

Superintendent of <strong>School</strong>s<br />

Page 18

Item No. 13 a.<br />

TOPIC<br />

BACKGROUND<br />

DESCRIPTION<br />

LEGAL IMPACT<br />

FISCAL IMPACT<br />

RECOMMENDATION<br />

PAYMENT FOR NONPUBLIC SCHOOL / AGENCY SERVICES<br />

FOR SPECIAL EDUCATION STUDENTS<br />

The district continues to experience need for non-public school and<br />

agency (NPS/NPA) services. Provision of service is mandated by law<br />

under the Individuals with Disabilities Education Act (IDEA) for one<br />

or more of the following reasons:<br />

Student has been placed in one of the district’s less restrictive<br />

programs and has been found to need a more restrictive setting. The<br />

change of placement occurs through the IEP process.<br />

Student was placed in a NPS or NPA program by another school<br />

district prior to the student’s <strong>Irvine</strong> residency. The placement will<br />

continue until reviewed by the IEP team.<br />

<strong>District</strong> is unable to provide the type or amount of service required<br />

in the student’s IEP due to lack of staff with appropriate<br />

qualifications or level of expertise.<br />

Students, with extreme mental health needs, who are in danger of<br />

harming themselves or others and have not been successful in less<br />

restrictive placements, may be placed in residential NPS schools in<br />

California or out-of-state placements. By law, such a placement is<br />

determined in partnership with Orange County Mental Health.<br />

Each year the district prepares a master agreement for special education<br />

services with nonpublic schools and nonpublic agencies. In addition to<br />

the general agreement, individual service agreements for each<br />

identified special education student are negotiated at each IEP <strong>meeting</strong>.<br />

NPS/NPA providers work cooperatively with the district to provide<br />

services unattainable within the district or other local public schools.<br />

The services and programs for which the district is contracting have<br />

been determined by the student’s IEP Team, which includes teachers,<br />

administrators, and parents. A student’s IEP is a legally binding<br />

document. While the district offers a range of options for all students,<br />

it is sometimes necessary to supplement with services from an NPS or<br />

NPA in order to meet a student’s needs.<br />

$18,832.<strong>00</strong> for the 2<strong>00</strong>9-10 school year in special education related<br />

services.<br />

Approve the individual pupil service contract(s) for disabled student(s)<br />

negotiated between the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> and State<br />

Certified Nonpublic <strong>School</strong>s/Agencies.<br />

IUSD/Parham/Bevernick<br />

Board Agenda<br />

May 18, 2010<br />

Page 19

Item No. 13 b.<br />

TOPIC<br />

DESCRIPTION<br />

CONTRACT FOR SPECIAL EDUCATION RELATED<br />

SERVICES<br />

On occasion, it is appropriate for the <strong>District</strong> to enter into a<br />

contract arrangement with parents of students with special<br />

education needs.<br />

A small percentage of more severely involved special education<br />

students have very unique needs that cannot be met entirely by<br />

special education employees of IUSD who normally support our<br />

school-based programs. It is frequently financially advantageous to<br />

the district to have the flexibility to provide these specialized<br />

services without the usual employment restrictions associated with<br />

education code procedures.<br />

All services are provided as required by federal and state mandates<br />

or the IEP.<br />

FISCAL IMPACT<br />

RECOMMENDATION<br />

$2,5<strong>00</strong>.<strong>00</strong> special education related services<br />

Authorize payment for special education related services in an<br />

amount not to exceed $2,5<strong>00</strong>.<strong>00</strong><br />

IUSD/Parham/Bevernick<br />

Board Agenda<br />

May 18, 2010<br />

Page 20

Item No. 13 c.<br />

TOPIC<br />

DESCRIPTION<br />

FISCAL IMPACT<br />

RECOMMENDATION<br />

PAYMENT IN ACCORDANCE WITH THE TERMS OF THE<br />

SETTLEMENT AGREEMENT(S)<br />

Pursuant to the Settlement Agreement(s), the negotiated<br />

agreement(s) has/have been reached.<br />

$48,<strong>00</strong>0.<strong>00</strong> special education related services<br />

Authorize payment in an amount not to exceed $48,<strong>00</strong>0.<strong>00</strong> in<br />

accordance with the terms of the Settlement Agreement(s).<br />

IUSD/Parham/Bevernick<br />

Board Agenda<br />

May 18, 2010<br />

Page 21

Item No. 13 d.<br />

TOPIC<br />

DESCRIPTION<br />

FISCAL IMPACT<br />

PURCHASE ORDER DETAIL REPORT<br />

The purchase orders listed on the Purchase Order Detail Report are<br />

processed in compliance with the applicable purchasing procedures<br />

and administrative regulations of the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong><br />

<strong>District</strong>. Copies of full reports are on file in the Business Office<br />

and available upon request. A purchase order cannot be initiated<br />

unless the funds necessary have been previously approved in the<br />

school or program budget by the Board of Education. Each<br />

purchase order has been approved in the form of a requisition by<br />

the school administrator or manager responsible for the respective<br />

site or program. After initial approval at the local level, each<br />

requisition is reviewed and, if appropriate, authorized for<br />

processing in the form of a purchase order by staff of the Business<br />

Department.<br />

All expenditures have been made within the authorized budget.<br />

RECOMMENDATION Approve the Purchase Order Detail Report dated May 5, 2010.<br />

IUSD/Howell<br />

Board Agenda<br />

May 18, 2010<br />

Page 22

Item No. 13 e.<br />

TOPIC<br />

DESCRIPTION<br />

CHECK REGISTER REPORT<br />

Commercial Check Registers have been presented to the Board of<br />

Education listing checks which have been issued in accordance<br />

with the established purchasing procedure and administrative<br />

regulations of the <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong>.<br />

These checks represent previously approved purchase orders and<br />

contracts and are presented to the Board of Education for<br />

ratification in accordance with the applicable provisions of the<br />

Education and Government Code Statutes of the State of<br />

California. Copies of full reports are available for review in the<br />

Office of the Superintendent upon request.<br />

RECOMMENDATION<br />

Ratify issuance of check numbers as listed, representing Board<br />

authorized purchase orders, invoices and contracts:<br />

<strong>District</strong> 75, <strong>Irvine</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> —<br />

Numbers <strong>00</strong>143410 through <strong>00</strong>144<strong>00</strong>1<br />

<strong>District</strong> 50, CFD No. 01-1 –<br />

Number <strong>00</strong><strong>00</strong>1452<br />

<strong>District</strong> 44, CFD No. 86-1 —<br />

Numbers <strong>00</strong><strong>00</strong>4133 through <strong>00</strong><strong>00</strong>4135<br />

<strong>District</strong> 41, <strong>Irvine</strong> Child Care Project —<br />

Number <strong>00</strong><strong>00</strong>2444<br />

Revolving Cash —<br />

Numbers 33019 through 33111<br />

IUSD/Howell<br />

Board Agenda<br />

May 18, 2010<br />

Page 23

Item No. 13 f.<br />

TOPIC CONTRACT SERVICES ACTION REPORT 2<strong>00</strong>9-10/16<br />

DESCRIPTION<br />

ADVOCATES FOR LABOR COMPLIANCE, LLC<br />

Consultant to provide all required Labor Compliance monitoring<br />

per the <strong>School</strong> Facility Program regulations for the Small<br />

Classroom Expansion Project at Oak Creek Elementary <strong>School</strong>.<br />

May 19, 2010 – December 31, 2010<br />

01<strong>00</strong>564485-6229<br />

Linton/ Construction & Facilities<br />

Fee ....................................................... not to exceed $7,020.<strong>00</strong><br />

Community Facilities <strong>District</strong><br />

ADVOCATES FOR LABOR COMPLIANCE, LLC<br />

Consultant to provide all required Labor Compliance monitoring<br />

per the <strong>School</strong> Facility Program regulations for the Small<br />

Classroom Expansion Project at Canyon View Elementary <strong>School</strong>.<br />

May 19, 2010 – December 31, 2010<br />

01<strong>00</strong>564485-6229<br />

Linton/ Construction & Facilities<br />

Fee ....................................................... not to exceed $4,520.<strong>00</strong><br />

Community Facilities <strong>District</strong><br />

ADVOCATES FOR LABOR COMPLIANCE, LLC<br />

Consultant to provide all required Labor Compliance monitoring<br />

per the <strong>School</strong> Facility Program regulations for the Small<br />

Classroom Expansion Project at Plaza Vista K-8 <strong>School</strong>..<br />

May 19, 2010 – December 31, 2010<br />

01<strong>00</strong>564485-6229<br />

Linton/ Construction & Facilities<br />

Fee ....................................................... not to exceed $9,<strong>00</strong>0.<strong>00</strong><br />

Community Facilities <strong>District</strong><br />

ADVOCATES FOR LABOR COMPLIANCE, LLC<br />

Consultant to provide all required Labor Compliance monitoring<br />

per the <strong>School</strong> Facility Program regulations and the Federally<br />

funded Community Develo<strong>pm</strong>ent Block Grant for the PA40 Middle<br />

<strong>School</strong> new construction project.<br />

May 19, 2010 – December 31, 2011<br />

357<strong>00</strong>90185-6229<br />

Linton/ Construction & Facilities<br />

Fee ..................................................... not to exceed $93,369.<strong>00</strong><br />

County <strong>School</strong> Facilities Fund<br />

Page 24

Item No. 13 f.<br />

ADVOCATES FOR LABOR COMPLIANCE, LLC<br />

Consultant to provide all required Labor Compliance monitoring<br />

per the <strong>School</strong> Facility Program regulations for the Expansion<br />

project at Woodbridge High <strong>School</strong>.<br />

May 19, 2010 – August 31, 2011<br />

3561290385-6229<br />

Linton/ Construction & Facilities<br />

Fee ..................................................... not to exceed $40,090.<strong>00</strong><br />

County <strong>School</strong> Facilities Fund<br />

ADVOCATES FOR LABOR COMPLIANCE, LLC<br />

Consultant to provide all required Labor Compliance monitoring<br />

per the <strong>School</strong> Facility Program regulations for the Pool project at<br />

Woodbridge High <strong>School</strong>.<br />

May 19, 2010 – August 31, 2011<br />

4061290285-6229<br />

Linton/ Construction & Facilities<br />

Fee ..................................................... not to exceed $35,280.<strong>00</strong><br />

County <strong>School</strong> Facilities Fund<br />

HOUSE EAR INSTITUTE<br />

Consultant to provide Independent Educational Evaluation (IEE) –<br />

Speech and Language Assessment for a special needs student.<br />

May 4, 2010 – June 30, 2010<br />

0101855710-5811<br />

Bevernick/Special Education Services<br />

Fee .......................................................... not to exceed $7<strong>00</strong>.<strong>00</strong><br />

Restricted General Fund (Categorical)<br />

JIREH INFORMATION SYSTEMS<br />

Consultant to provide online registration services for <strong>Irvine</strong> and<br />

University High <strong>School</strong>s, Rancho Middle <strong>School</strong> and Woodbury<br />

Elementary <strong>School</strong>.<br />

June 1, 2010 – June 30, 2011<br />

01<strong>00</strong>91<strong>00</strong>20-5810<br />

Parham/Education Services<br />

Fee ..................................................... not to exceed $20,5<strong>00</strong>.<strong>00</strong><br />

Unrestricted General Fund<br />

Page 25

Item No. 13 f.<br />

KNOWLAND CONSTRUCTION SERVICES<br />

Consultant to provide Division of the State Architect inspection<br />

services for the Deerfield Elementary <strong>School</strong> Modernization<br />

project.<br />

June 15, 2010 – September 30, 2011<br />

351209<strong>00</strong>85-6280<br />

Linton/Construction & Facilities<br />

Fee ................................................... not to exceed $180,<strong>00</strong>0.<strong>00</strong><br />

County <strong>School</strong> Facilities Fund<br />

PEEBLES, SCOTT, M.A., MFCC, H.B.<br />

Consultant to present education workshop to Meadow Park parents<br />

entitled “Secrets of Successful Parents: How to Motivate,<br />

Captivate, & Raise Successful Kids”.<br />

April 22, 2010<br />

0114220610-5810<br />

Livernois/Meadow Park<br />

Fee .......................................................... not to exceed $725.<strong>00</strong><br />

Restricted General Funds (Categorical)<br />

FISCAL IMPACT Restricted General Fund ...................... not to exceed $1,425.<strong>00</strong><br />

Unrestricted General Fund ................ not to exceed $20,5<strong>00</strong>.<strong>00</strong><br />

Community Facilities <strong>District</strong> ........... not to exceed $20,540.<strong>00</strong><br />

County <strong>School</strong> Facilities Fund ........ not to exceed $348,739.<strong>00</strong><br />

RECOMMENDATION Approve and/or ratify the Contract Services Action Report 2<strong>00</strong>9-<br />

10/16, as submitted.<br />

IUSD/Howell<br />

Board Agenda<br />

May 18, 2010<br />

Page 26

Item No. 13 g.<br />

TOPIC CLASSIFIED PERSONNEL ACTION REPORT 2<strong>00</strong>9-10/16<br />

RECOMMENDED<br />

FOR EMPLOYMENT<br />

Name Assign/Location Effective Date<br />

HOURLY<br />

Benhamida, Ellyn Inst. Asst./Woodbury 4/26/10<br />

Galvan, Arturo Custodian II-Weekend 5/9/10<br />

Lee, Hai Nutrition Asst. I/Nutrition Serv. 4/27/10<br />

Plett, Ashton Inst. Asst./Early Start @ ECLC 5/17/10<br />

Thomas, Andrew Inst. Asst./Venado 4/9/10<br />

SUBSTITUTES<br />

Alfaro, Erik Custodial/Facilities Support 4/26/10<br />

Becerra Jr., Gerardo Custodial/Facilities Support 4/26/10<br />

Bellinger, Nicholas Inst. Asst./Special Programs 5/3/10<br />

Ceja, Daniel Custodial/Facilities Support 4/27/10<br />

Corral, Manuel Custodial/Facilities Support 4/27/10<br />

Do, Kimberly Noon Duty/College Park 5/7/10<br />

Duggan, Sheila Inst. Asst./Special Programs 5/3/10<br />

Gibbon, Sandra Clerk/Health Services 3/30/10<br />

Prunty, Cynthia Nutrition Asst./Nutrition Services 5/3/10<br />

Tejada, Eder Nutrition Asst./Nutrition Services 5/3/10<br />

Vaca Jr., Jose Custodial/Facilities Support 4/26/10<br />

Vieyra, Joseph Nutrition Asst./Nutrition Services 5/3/10<br />

RETIREMENT Clement, Donna Inst. Asst./Meadow Park 6/23/10<br />

Drayer, Barbara Admin. Asst. to Principal/ 6/20/10<br />

Vista Verde<br />

Dugan, Glenda Inst. Asst./Brywood 6/23/10<br />

Fong, Terena Media Tech I/Culverdale 6/23/10<br />

Good, Vicki Clerk IV/Woodbridge 6/30/10<br />

Hanna, Darlene Clerk IV/Northwood High 6/30/10<br />

Jefferson, Rebecca Inst. Asst./Bonita Canyon 6/23/10<br />

Koch-Jones, Judith Guidance Para II 6/30/10<br />

MacAllister, Terryl Clerk II/Eastshore 6/30/10<br />

Tapangco, Diane Admin. Asst. to Principal/ 6/30/10<br />

Oak Creek<br />

Young, Sharleen Clerk III/University High 6/30/10<br />

Zuber, Donald Head Custodian IV/College Park 6/30/10<br />

RECOMMENDATION Approve and/or ratify the Classified Personnel Action Report 2<strong>00</strong>9-<br />

10/16 as submitted for Employment and Retirement.<br />

IUSD/Walker/Tona<br />

Board Agenda<br />

May 18, 2010<br />

Page 27

Item No. 13 h.<br />

TOPIC CERTIFICATED PERSONNEL ACTION REPORT 2<strong>00</strong>9-10/16<br />

RECOMMENDED<br />

FOR EMPLOYMENT<br />

Name Assign/Location Effective Date<br />

SUBSTITUTES<br />

Hobbins, Katie Elementary/Secondary 5/4/10<br />

Mc Laughlin, John Elementary/Secondary 5/4/10<br />

Wondra, Adam Elementary/Secondary 5/4/10<br />

RETIREMENT(S) Altimari-Brown, Gail Social Science/Irvin HS 7/1/10<br />

Bell, William Science/Woodbridge HS 8/1/10<br />

Bova, Michael Special Ed./University HS 7/1/10<br />

Candy, Vivian English/<strong>Irvine</strong> HS 7/1/10<br />

Henry, Valerie TOSA/Science Resources 6/23/10<br />

Hinshaw, Maureen Primary/Santiago Hills 6/23/10<br />

Knapper, Dona Nurse/Health Services 6/23/10<br />

McKenzie, Patricia TOSA/Guidance Resources 6/23/10<br />

Miles, Janet SLP/ECLC 6/23/10<br />

Uyeda, Patricia Ed Specialist/Woodbury/Special Ed 6/23/10<br />

West, Suzanne Upper/Santiago Hills 6/23/10<br />

Willingham, Cynthia Math/Woodbridge HS 6/23/10<br />

RECOMMENDATION Approve and/or ratify the Certificated Personnel Action Report 2<strong>00</strong>9-<br />

10/16 Board as submitted for Employment and Retirements.<br />

IUSD/Walker/Krumes<br />

Board Agenda<br />

May 18, 2010<br />

Page 28

Item No. 13 i.<br />

TOPIC<br />

DESCRIPTION<br />

FIVE YEAR DEFERRED MAINTENANCE PLAN<br />

The Board has previously authorized routine submittal of the Five<br />

Year Plan updates for deferred maintenance to the Office of Public<br />

<strong>School</strong> Construction and the State Allocation Board, pursuant to<br />

Education Code Sections 17582-17588 and 17591. The approved<br />

plan is due to the state by June 30.<br />

The Plan, included in this report, shows the aggregate need of<br />

deferred maintenance repairs over the next five years to be<br />

$99,381,643. It is recognized that the <strong>District</strong> does not anticipate<br />

receiving state funding for this entire amount. The list<br />

compromises more of an eligibility plan than an action plan. At its<br />

best the program will provide one-half of one percent of the<br />

<strong>District</strong>’s annual expenditures. In previous years the <strong>District</strong> has<br />

attempted to budget one-half of one percent in anticipation of a<br />

State match. Historically, the <strong>District</strong> has spent approximately $1.2<br />

million on deferred maintenance projects annually.<br />

The Deferred Maintenance Program was designated as a Tier III<br />

Program as a part of the 2<strong>00</strong>9-10 State Budget. Due to budget<br />

constraints, IUSD redirected the State’s contribution of $9<strong>00</strong>,<strong>00</strong>0<br />

from Deferred Maintenance and to the General Fund for 2<strong>00</strong>9-10<br />

and 2010-11.<br />

Listed below are funded projects scheduled for 2010-11 taken from<br />

the Five Year Deferred Maintenance Plan.<br />

Site Work Projected $ Amount<br />

University High Roof Replacement - 4<strong>00</strong> Bldg $160,<strong>00</strong>0<br />

Turtle Rock Concrete – Front Sidewalk $35,<strong>00</strong>0<br />

<strong>Irvine</strong> High Concrete – Locker room $15,<strong>00</strong>0<br />

Venado Concrete – Lunch Area $25,<strong>00</strong>0<br />

Southlake Replace Skylights $10,<strong>00</strong>0<br />

Santiago Hills Light Poles – Parking Lot $15,<strong>00</strong>0<br />

Relocatables Roof, carpet, paint, etc $70,<strong>00</strong>0<br />

College Park Restroom Partitions – MPR $13,<strong>00</strong>0<br />

ECLC Roof Repairs $20,<strong>00</strong>0<br />

Eastshore Rain Gutters $30,<strong>00</strong>0<br />

Southlake Fire Alarm $45,<strong>00</strong>0<br />

Stonecreek Sump Pump – Relocatables $10,<strong>00</strong>0<br />

ECLC Clocks $15,<strong>00</strong>0<br />

University High Paint Ext – Theater / 7<strong>00</strong> Bldg $50,<strong>00</strong>0<br />

TOTAL $513,<strong>00</strong>0<br />

Page 29

Item No. 13 i.<br />

The projects below are not funded and will be completed when<br />

funding is available.<br />

<strong>Irvine</strong> High Roof – Math Building $230,<strong>00</strong>0<br />

University Park Replace Relocatables Switchgear $ 25,<strong>00</strong>0<br />

<strong>Irvine</strong> High “H” Bldg – Roof Coating $ 45,<strong>00</strong>0<br />

Venado Window Replacement $ 20,<strong>00</strong>0<br />

ECLC Fire Alarm Replacement $ 35,<strong>00</strong>0<br />

Canyon View HVAC Controls $ 78,<strong>00</strong>0<br />

Springbrook Paint – Interior $ 38,<strong>00</strong>0<br />

Culverdale Paint – Exterior $ 55,<strong>00</strong>0<br />

<strong>District</strong>wide Light Pole Repairs $ 15,<strong>00</strong>0<br />

Lakeside Concrete $ 18,<strong>00</strong>0<br />

Venado Terrazo Repairs $ 10,<strong>00</strong>0<br />

Sierra Vista Paring Lot Asphalt $ 25,<strong>00</strong>0<br />

University Park Rain Gutters $ 10,<strong>00</strong>0<br />

Alderwood Parking Lot Asphalt $ 15,<strong>00</strong>0<br />

University High 5<strong>00</strong> Bldg Recoat Roof $ 50,<strong>00</strong>0<br />

<strong>Irvine</strong> High Admin – Air Handler $ 78,<strong>00</strong>0<br />

TOTAL $747,<strong>00</strong>0<br />

DEFERRED MAINTENANCE PROJECTS 2010-2011<br />

TOTAL $1,260,<strong>00</strong>0<br />

FISCAL IMPACT<br />

RECOMMENDATION<br />

Due to contributions to the Deferred Maintenance Fund in prior<br />

years, there is no impact to the General Fund.<br />

Approve the Five Year Deferred Maintenance Plan<br />

IUSD/Howell/Hoffman<br />

Board Agenda<br />

May 18, 2010<br />

Attachment<br />

Page 30

STATE OF CALIFORNIA<br />

FIVE YEAR PLAN<br />

DEFERRED MAINTENANCE PROGRAM<br />

SAB 40-20 (REV 01/05)<br />

STATE ALLOCATION BOARD<br />

OFFICE OF PUBLIC SCHOOL CONSTRUCTION<br />

Page 1 of 3<br />

GENERAL INFORMATION<br />

This Form is a summary of proposed deferred maintenance projects the applicant district plans on completing annually over the next five fiscal years using the Basic Grant,<br />

pursuant to Education Code Section 17591. The fiscal year the plan commences is determined by the fiscal year in which it was filed. New and revised plans are accepted on a<br />

continuous basis for the current fiscal year up to the last working day in June. Revisions are not accepted for prior fiscal years.<br />

SPECIFIC INSTRUCTIONS<br />

Part I—Authorized <strong>District</strong> Representative<br />

Complete to designate or change the authorized district representative. Enter the name of the district employee that can act on behalf of the district. A consultant who is on<br />

contract with the district to communicate with the OPSC on behalf of the district’s board may be listed.<br />

Part II—Estimated Fiscal Year Data<br />

ITEM DESCRIPTION INSTRUCTIONS<br />

1 Number of Projects List the number of eligible projects in each of the project categories shown (refer to Regulation Section 1866.4.1).<br />

2–6 Current and subsequent fiscal years Enter the total estimated costs in each project category for each fiscal year identified for the projects reported in column 1.<br />

7 Total Estimated Cost For each project category enter the totals of columns 2–6.<br />

8 Grand Total Total all columns.<br />

9 Remarks Include any additional information for each category. If the district is applying for extreme hardship grants for any of the<br />

projects listed on the plan, identify those projects in this space. If additional space is needed, you may attach a separate<br />

sheet with your remarks to this form.<br />

10 <strong>School</strong> Information List the facilities where deferred maintenance projects are planned as reported in column 1 on this Five Year Plan (refer to<br />

Regulation Section 1866.4.1). If additional space is needed, you may attach a separate sheet.<br />

11 Certification Review and complete (refer to Regulation Section 1866.4.and EC Section 17584.1).<br />

When completed mail this form to:<br />

Office of Public <strong>School</strong> Construction<br />

Attn: Deferred Maintenance Program<br />

1130 K Street, Suite 4<strong>00</strong><br />

Sacramento, CA 95814<br />

NOTE: Any Five Year Plan, SAB 40-20, not conforming to State Allocation Board (SAB) guidelines will be returned to the district. If you need assistance in completing this form,<br />

please contact the Office of Public <strong>School</strong> Construction, at 916.445.3160.<br />

Page 31

STATE OF CALIFORNIA<br />

FIVE YEAR PLAN<br />

DEFERRED MAINTENANCE PROGRAM<br />

SAB 40-20 (REV 01/05)<br />

STATE ALLOCATION BOARD<br />

OFFICE OF PUBLIC SCHOOL CONSTRUCTION<br />

Page 2 of 3<br />

SCHOOL DISTRICT<br />

FIVE-DIGIT DISTRICT CODE NUMBER (SEE CALIFORNIA PUBLIC SCHOOL DIRECTORY)<br />

COUNTY<br />

CURRENT FISCAL YEAR<br />

The district:<br />

has not previously submitted a Five Year Plan.<br />

is submitting this updated/revised Five Year Plan which supersedes the plan currently on file with SAB.<br />

Part I—Authorized <strong>District</strong> Representative<br />

The following individual has been designated as a district representative by the school board minutes:<br />

DISTRICT REPRESENTATIVE<br />

TITLE<br />

BUSINESS ADDRESS<br />

TELEPHONE NUMBER<br />

E-MAIL ADDRESS<br />

FAX NUMBER<br />

Part II—Estimated Fiscal Year Data<br />

PROJECT CATEGORY<br />

1.<br />

NUMBER OF<br />

PROJECTS<br />

2.<br />

CURRENT<br />

FISCAL YEAR<br />

3.<br />

SECOND<br />

FISCAL YEAR<br />

4.<br />

THIRD<br />

FISCAL YEAR<br />

5.<br />

FOURTH<br />

FISCAL YEAR<br />

6.<br />

FIFTH<br />

FISCAL YEAR<br />

7.<br />

TOTAL<br />

ESTIMATE COST<br />

Asbestos<br />

Classroom Lighting<br />

Electrical<br />

Floor Covering<br />

HVAC<br />

Lead<br />

Painting<br />

Paving<br />

Plumbing<br />

Roofing<br />

Underground Tanks<br />

Wall Systems<br />

8. Grand Total<br />

9. Remarks<br />

Page 32

STATE OF CALIFORNIA<br />

FIVE YEAR PLAN<br />

DEFERRED MAINTENANCE PROGRAM<br />

SAB 40-20 (REV 01/05)<br />

STATE ALLOCATION BOARD<br />

OFFICE OF PUBLIC SCHOOL CONSTRUCTION<br />

Page 3 of 3<br />

10. List the school names where deferred maintenance projects are planned in this Five Year Plan:<br />

11. Certifications<br />

I certify as <strong>District</strong> Representative that:<br />

• this work does not include ineligible items and that all work will be completed in accordance with program requirements, applicable laws and regulations. The district shall<br />

maintain proper documentation in the event of an audit; and,<br />

• the district understands that should an audit reveal that these funds were expended for other than eligible deferred maintenance costs, the SAB will require the district to<br />

return all inappropriately expended funds; and,<br />

• the plans and proposals for expenditures of funds as outlined in this report were discussed in a public hearing at a <strong>regular</strong>ly scheduled school board <strong>meeting</strong> on<br />

___________________________ ; and the district has complied with all the other requirements of Education Code Sections 17584.1 and 17584.2; and,<br />

• Beginning with the 2<strong>00</strong>5/2<strong>00</strong>6 fiscal year, the district has complied with Education Code Section 17070.75 (e) by establishing a facilities inspection system to ensure that each<br />

of its schools is maintained in good repair; and,<br />

• This Form is an exact duplicate (verbatim) of the form provided by the OPSC. In the event a conflict should exist, then the language in the OPSC form will prevail.<br />

• I certify under penalty of perjury under the laws of the State of California that the statements in this application and supporting documents are true and correct.<br />

SIGNATURE OF DISTRICT REPRESENTATIVE<br />

DATE<br />

Page 33

Item No. 13 j.<br />

TOPIC<br />

DESCRIPTION<br />

GIFTS<br />

The sites listed have been offered the following gifts:<br />

University High <strong>School</strong><br />

Donation: $350.<strong>00</strong><br />

Donor: Phil LeMay<br />

Canyon View Elementary <strong>School</strong><br />

Donation: $309.<strong>00</strong><br />

Donor: David Joa<br />

RECOMMENDATION<br />

Accept the gifts to the <strong>District</strong>, as listed.<br />

IUSD/Gross<br />

Board Agenda<br />

May 18, 2010<br />

Page 34

Item No. 13 k.<br />

TOPIC<br />

DESCRIPTION<br />

CONFERENCE ATTENDANCE<br />

Board approval and/or ratification is required for the attendance of<br />

staff at the following out-of-state events:<br />

Event: Naviance Conference<br />

Location: Minneapolis, MN<br />

Dates: July 29-31, 2010<br />

Attendee: Melissa Figge and Elizabeth Taylor<br />

Cost: $1,5<strong>00</strong>.<strong>00</strong><br />

Budget: 016127<strong>00</strong>10-5210<br />

FISCAL IMPACT<br />

RECOMMENDATION<br />

$1,5<strong>00</strong>.<strong>00</strong> Restricted General Fund<br />

Approve out-of-state conference attendance for staff, as follows:<br />

1) Melissa Figge and Elizabeth Taylor to Minneapolis, MN from<br />

July 29-31, 2010 for $1,5<strong>00</strong>.<strong>00</strong>.<br />

IUSD/Gross<br />

Board Agenda<br />

May 18, 2010<br />

Page 35

Item No. 13 l.<br />

TOPIC<br />

DESCRIPTION<br />

FIELD TRIPS AND EXCURSIONS<br />

<strong>District</strong> policy states that field trips or excursions to destinations outside<br />

the State of California, requiring solicitation of funds in excess of<br />

$1,5<strong>00</strong>, or requiring teacher release from <strong>regular</strong> duties shall receive<br />

Board approval prior to planning the field trip or excursion.<br />

<strong>District</strong> policy further states that no expenses of pupils participating in a<br />

field trip or excursion shall be paid with school district funds, unless the<br />

field trip is required as part of an approved program. If an individual<br />

cannot raise the funds, a scholarship or other form of financial support<br />

shall be provided. The source of this financial support shall not be from<br />

any IUSD account.<br />