Annual report to use! - Prospects

Annual report to use! - Prospects

Annual report to use! - Prospects

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Audi<strong>to</strong>rs <strong>report</strong><br />

Independent audi<strong>to</strong>rs’ <strong>report</strong> <strong>to</strong> the members of<br />

Higher Education Careers Services Unit (A company<br />

limited by guarantee)<br />

We have audited the financial statements on pages 17<br />

<strong>to</strong> 30.<br />

This <strong>report</strong> is made solely <strong>to</strong> the charitable company’s<br />

members, as a body, in accordance with Section 235 of<br />

the Companies Act 1985. Our audit work has been<br />

undertaken so that we might state <strong>to</strong> the charitable<br />

company’s members those matters we are required <strong>to</strong><br />

state <strong>to</strong> the members in our audi<strong>to</strong>r’s <strong>report</strong> and for no<br />

other purpose. To the fullest extent permitted by law, we<br />

do not accept or assume responsibility <strong>to</strong> anyone other<br />

than the charitable company and the charitable<br />

company’s members as a body, for our audit work, for<br />

this <strong>report</strong>, or for the opinions we have formed.<br />

Respective responsibilities of trustees and audi<strong>to</strong>rs<br />

The trustees, who are also the direc<strong>to</strong>rs of Higher<br />

Education Careers Services Unit for the purposes of<br />

company law, are responsible for preparing the trustees’<br />

<strong>report</strong> and, as described on page 15, the financial<br />

statements, in accordance with applicable United<br />

Kingdom law and accounting standards. Our responsibilities,<br />

as independent audi<strong>to</strong>rs, are established in the United<br />

Kingdom by statute, the Auditing Practices Board and by<br />

our profession’s ethical guidance.<br />

We <strong>report</strong> <strong>to</strong> you our opinion as <strong>to</strong> whether the financial<br />

statements give a true and fair view and are properly<br />

prepared in accordance with the Companies Act 1985.<br />

We also <strong>report</strong> <strong>to</strong> you if, in our opinion, the trustees’<br />

<strong>report</strong> is not consistent with the financial statements, if<br />

the charity has not kept proper accounting records, if we<br />

have not received all the information and explanations<br />

we require for our audit, or if information specified by<br />

law regarding direc<strong>to</strong>rs’ remuneration and transactions<br />

with the group are not disclosed.<br />

Basis of audit opinion<br />

We conducted our audit in accordance with Auditing<br />

Standards issued by the Auditing Practices Board. An<br />

audit includes examination, on a test basis, of evidence<br />

relevant <strong>to</strong> the amounts and disclosures in the financial<br />

statements. It also includes an assessment of the<br />

significant estimates and judgements made by the<br />

trustees in the preparation of the financial statements,<br />

and of whether the accounting policies are appropriate<br />

<strong>to</strong> the charitable group’s circumstances, consistently<br />

applied and adequately disclosed.<br />

We planned and performed our audit so as <strong>to</strong> obtain all<br />

the information and explanations which we considered<br />

necessary in order <strong>to</strong> provide us with sufficient evidence<br />

<strong>to</strong> give reasonable assurance that the financial<br />

statements are free from material misstatement, whether<br />

ca<strong>use</strong>d by fraud or other irregularity or error. In forming<br />

our opinion we also evaluated the overall adequacy of<br />

the presentation of information in the financial<br />

statements.<br />

Opinion<br />

In our opinion the financial statements give a true and<br />

fair view of the state of the affairs of the charitable<br />

company and the group as at 31 January 2004 and of the<br />

group’s incoming resources and application of resources,<br />

including its income and expenditure, in the year then<br />

ended and have been properly prepared in accordance<br />

with the Companies Act 1985.<br />

KPMG LLP Chartered Accountants Registered Audi<strong>to</strong>r<br />

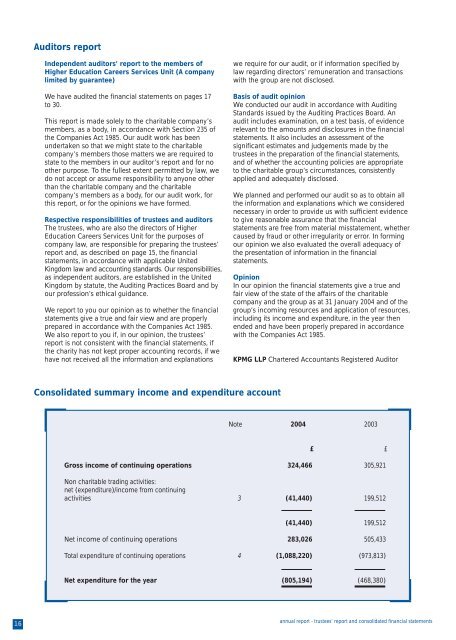

Consolidated summary income and expenditure account<br />

Note 2004 2003<br />

£ £<br />

Gross income of continuing operations 324,466 305,921<br />

Non charitable trading activities:<br />

net (expenditure)/income from continuing<br />

activities 3 (41,440) 199,512<br />

(41,440) 199,512<br />

Net income of continuing operations 283,026 505,433<br />

Total expenditure of continuing operations 4 (1,088,220) (973,813)<br />

Net expenditure for the year (805,194) (468,380)<br />

16<br />

annual <strong>report</strong> - trustees’ <strong>report</strong> and consolidated financial statements