International tax planning through Brazilian notional interest ...

International tax planning through Brazilian notional interest ...

International tax planning through Brazilian notional interest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

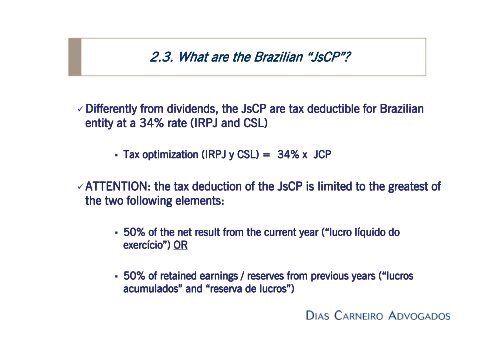

2.3. What are the <strong>Brazilian</strong> “JsCP<br />

JsCP”?<br />

Differently from dividends, the JsCP are <strong>tax</strong> deductible for <strong>Brazilian</strong><br />

entity at a 34% rate (IRPJ<br />

and CSL)<br />

• Insertar texto<br />

Tax optimization (IRPJ<br />

(<br />

y CSL) = 34% x JCP<br />

ATTENTION: the <strong>tax</strong> deduction of the JsCP is limited to the greatest of<br />

the two following elements:<br />

50% of the net result from the current year (“lucro<br />

líquido do<br />

exercício”)<br />

OR<br />

50% of retained earnings / reserves from previous years (“lucros<br />

acumulados” and “reserva<br />

de lucros”)