International tax planning through Brazilian notional interest ...

International tax planning through Brazilian notional interest ...

International tax planning through Brazilian notional interest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

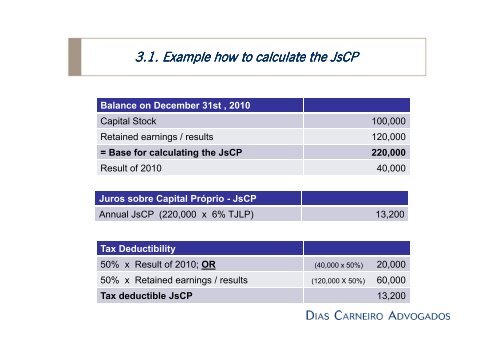

3.1. Example how to calculate the JsCP<br />

Balance on December 31st , 2010<br />

Capital Stock 100,000<br />

Retained earnings / results 120,000<br />

= Base for calculating the JsCP 220,000<br />

Result of 2010 40,000<br />

Juros sobre Capital Próprio - JsCP<br />

Annual JsCP (220,000 x 6% TJLP) 13,200<br />

Tax Deductibility<br />

50% x Result of 2010; OR (40,000 x 50%) 20,000<br />

50% x Retained earnings / results (120,000 X 50%) 60,000<br />

Tax deductible JsCP 13,200