chilean tax structure - TTN Transnational Taxation Network

chilean tax structure - TTN Transnational Taxation Network

chilean tax structure - TTN Transnational Taxation Network

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHILEAN TAX TAX<br />

STRUCTURE<br />

STRUCTURE<br />

CHILEAN TAX STRUCTURE<br />

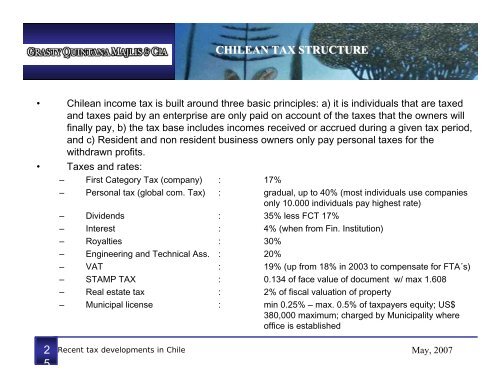

• Chilean income <strong>tax</strong> is built around three basic principles: a) it is individuals that are <strong>tax</strong>ed<br />

and <strong>tax</strong>es paid by an enterprise are only paid on account of the <strong>tax</strong>es that the owners will<br />

finally pay, b) the <strong>tax</strong> base includes incomes received or accrued during a given <strong>tax</strong> period,<br />

and c) Resident and non resident business owners only pay personal <strong>tax</strong>es for the<br />

withdrawn profits.<br />

• Taxes and rates:<br />

– First Category Tax (company) : 17%<br />

– Personal <strong>tax</strong> (global com. Tax) : gradual, up to 40% (most individuals use companies<br />

only 10.000 individuals pay highest rate)<br />

– Dividends : 35% less FCT 17%<br />

– Interest : 4% (when from Fin. Institution)<br />

– Royalties : 30%<br />

– Engineering and Technical Ass. : 20%<br />

– VAT : 19% (up from 18% in 2003 to compensate for FTA´s)<br />

– STAMP TAX : 0.134 of face value of document w/ max 1.608<br />

– Real estate <strong>tax</strong> : 2% of fiscal valuation of property<br />

– Municipal license : min 0.25% – max. 0.5% of <strong>tax</strong>payers equity; US$<br />

380,000 maximum; charged by Municipality where<br />

office is established<br />

2<br />

5<br />

Recent <strong>tax</strong> developments in Chile May, 2007