chilean tax structure - TTN Transnational Taxation Network

chilean tax structure - TTN Transnational Taxation Network

chilean tax structure - TTN Transnational Taxation Network

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

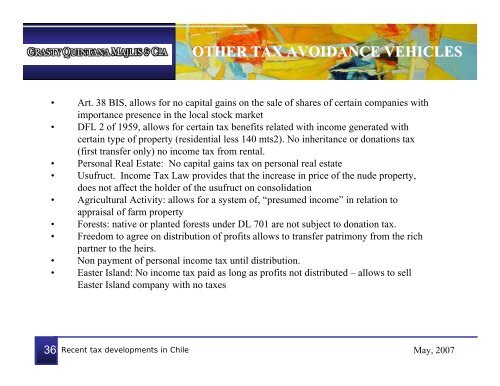

OTHER TAX AVOIDANCE VEHICLES<br />

• Art. 38 BIS, allows for no capital gains on the sale of shares of certain companies with<br />

importance presence in the local stock market<br />

• DFL 2 of 1959, allows for certain <strong>tax</strong> benefits related with income generated with<br />

certain type of property (residential less 140 mts2). No inheritance or donations <strong>tax</strong><br />

(first transfer only) no income <strong>tax</strong> from rental.<br />

• Personal Real Estate: No capital gains <strong>tax</strong> on personal real estate<br />

• Usufruct. Income Tax Law provides that the increase in price of the nude property,<br />

does not affect the holder of the usufruct on consolidation<br />

• Agricultural Activity: allows for a system of, “presumed income” in relation to<br />

appraisal of farm property<br />

• Forests: native or planted forests under DL 701 are not subject to donation <strong>tax</strong>.<br />

• Freedom to agree on distribution of profits allows to transfer patrimony from the rich<br />

partner to the heirs.<br />

• Non payment of personal income <strong>tax</strong> until distribution.<br />

• Easter Island: No income <strong>tax</strong> paid as long as profits not distributed – allows to sell<br />

Easter Island company with no <strong>tax</strong>es<br />

36<br />

Recent <strong>tax</strong> developments in Chile<br />

May, 2007