Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

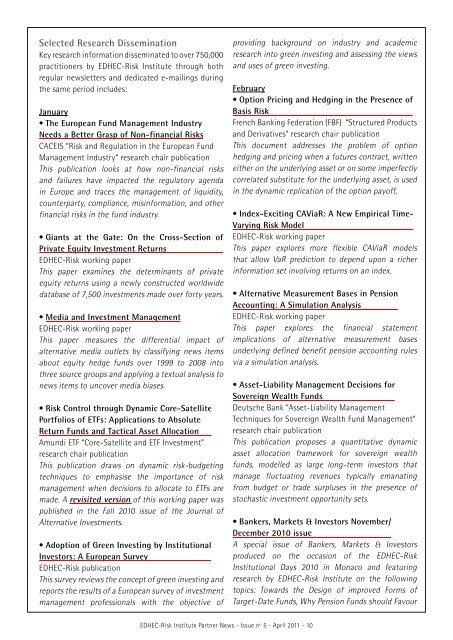

Selected Research Dissemination<br />

Key research information disseminated to over 750,000<br />

practitioners by <strong>EDHEC</strong>-<strong>Risk</strong> <strong>Institute</strong> through both<br />

regular newsletters and dedicated e-mailings during<br />

the same period includes:<br />

January<br />

• The European Fund Management Industry<br />

Needs a Better Grasp of Non-financial <strong>Risk</strong>s<br />

CACEIS “<strong>Risk</strong> and Regulation in the European Fund<br />

Management Industry“ research chair publication<br />

This publication looks at how non-financial risks<br />

and failures have impacted the regulatory agenda<br />

in Europe and traces the management of liquidity,<br />

counterparty, compliance, misinformation, and other<br />

financial risks in the fund industry.<br />

• Giants at the Gate: On the Cross-Section of<br />

Private Equity Investment Returns<br />

<strong>EDHEC</strong>-<strong>Risk</strong> working paper<br />

This paper examines the determinants of private<br />

equity returns using a newly constructed worldwide<br />

database of 7,500 investments made over forty years.<br />

• Media and Investment Management<br />

<strong>EDHEC</strong>-<strong>Risk</strong> working paper<br />

This paper measures the differential impact of<br />

alternative media outlets by classifying news items<br />

about equity hedge funds over 1999 to 2008 into<br />

three source groups and applying a textual analysis to<br />

news items to uncover media biases.<br />

• <strong>Risk</strong> Control through Dynamic Core-Satellite<br />

Portfolios of ETFs: Applications to Absolute<br />

Return Funds and Tactical Asset Allocation<br />

Amundi ETF “Core-Satellite and ETF Investment”<br />

research chair publication<br />

This publication draws on dynamic risk-budgeting<br />

techniques to emphasise the importance of risk<br />

management when decisions to allocate to ETFs are<br />

made. A revisited version of this working paper was<br />

published in the Fall 2010 issue of the Journal of<br />

Alternative Investments.<br />

• Adoption of Green Investing by Institutional<br />

Investors: A European Survey<br />

<strong>EDHEC</strong>-<strong>Risk</strong> publication<br />

This survey reviews the concept of green investing and<br />

reports the results of a European survey of investment<br />

management professionals with the objective of<br />

providing background on industry and academic<br />

research into green investing and assessing the views<br />

and uses of green investing.<br />

February<br />

• Option Pricing and Hedging in the Presence of<br />

Basis <strong>Risk</strong><br />

French Banking Federation (FBF) “Structured Products<br />

and Derivatives” research chair publication<br />

This document addresses the problem of option<br />

hedging and pricing when a futures contract, written<br />

either on the underlying asset or on some imperfectly<br />

correlated substitute for the underlying asset, is used<br />

in the dynamic replication of the option payoff.<br />

• Index-Exciting CAViaR: A New Empirical Time-<br />

Varying <strong>Risk</strong> Model<br />

<strong>EDHEC</strong>-<strong>Risk</strong> working paper<br />

This paper explores more flexible CAViaR models<br />

that allow VaR prediction to depend upon a richer<br />

information set involving returns on an index.<br />

• Alternative Measurement Bases in Pension<br />

Accounting: A Simulation Analysis<br />

<strong>EDHEC</strong>-<strong>Risk</strong> working paper<br />

This paper explores the financial statement<br />

implications of alternative measurement bases<br />

underlying defined benefit pension accounting rules<br />

via a simulation analysis.<br />

• Asset-Liability Management Decisions for<br />

Sovereign Wealth Funds<br />

Deutsche Bank “Asset-Liability Management<br />

Techniques for Sovereign Wealth Fund Management”<br />

research chair publication<br />

This publication proposes a quantitative dynamic<br />

asset allocation framework for sovereign wealth<br />

funds, modelled as large long-term investors that<br />

manage fluctuating revenues typically emanating<br />

from budget or trade surpluses in the presence of<br />

stochastic investment opportunity sets.<br />

• Bankers, Markets & Investors November/<br />

December 2010 issue<br />

A special issue of Bankers, Markets & Investors<br />

produced on the occasion of the <strong>EDHEC</strong>-<strong>Risk</strong><br />

Institutional Days 2010 in Monaco and featuring<br />

research by <strong>EDHEC</strong>-<strong>Risk</strong> <strong>Institute</strong> on the following<br />

topics: Towards the Design of improved Forms of<br />

Target-Date Funds, Why Pension Funds should Favour<br />

<strong>EDHEC</strong>-<strong>Risk</strong> <strong>Institute</strong> <strong>Partner</strong> <strong>News</strong> - Issue nº 5 - April 2011 - 10