Universidad del CEMA Master in Finance Research Work ...

Universidad del CEMA Master in Finance Research Work ...

Universidad del CEMA Master in Finance Research Work ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

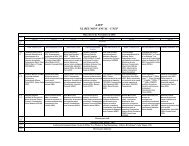

EURUSD Price<br />

1.18<br />

1.16<br />

1.14<br />

1.12<br />

1.1<br />

1.08<br />

1.06<br />

1.04<br />

EURUSD Spot Exchange Rate<br />

EURUSD Futures Exchange Rate<br />

1.02<br />

1/2/03 2/1/03 3/3/03 4/2/03 5/2/03 6/1/03 7/1/03 7/31/03 8/30/03 9/29/03<br />

DATE<br />

Chart 1: Bloomberg Source<br />

The data on the spot FX market corresponds to the clos<strong>in</strong>g of each day and this<br />

happens every day at 15:00hs NY. This co<strong>in</strong>cides with the open<strong>in</strong>g of the next day’s<br />

trad<strong>in</strong>g session, s<strong>in</strong>ce, as we have mentioned before, the currency spot FX market<br />

rema<strong>in</strong>s open 24 hours a day. The reason why the spot FX market makes a rollover of<br />

positions at 15:00hs NY time is to calculate the open positions’ overnight <strong>in</strong>terest<br />

rates. In the case of the futures contract, the data provided is that one of that trad<strong>in</strong>g<br />

session’s clos<strong>in</strong>g price.<br />

In chart 2, it is shown a Bloomberg screen where the characteristics of the Euro<br />

futures contract used for hedg<strong>in</strong>g are shown. This data was obta<strong>in</strong>ed on November 4,<br />

2003.<br />

12