Universidad del CEMA Master in Finance Research Work ...

Universidad del CEMA Master in Finance Research Work ...

Universidad del CEMA Master in Finance Research Work ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

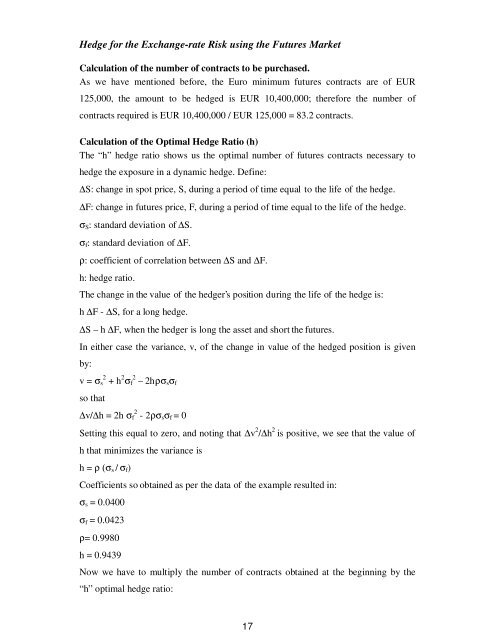

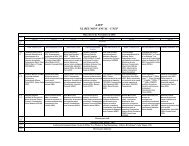

Hedge for the Exchange-rate Risk us<strong>in</strong>g the Futures Market<br />

Calculation of the number of contracts to be purchased.<br />

As we have mentioned before, the Euro m<strong>in</strong>imum futures contracts are of EUR<br />

125,000, the amount to be hedged is EUR 10,400,000; therefore the number of<br />

contracts required is EUR 10,400,000 / EUR 125,000 = 83.2 contracts.<br />

Calculation of the Optimal Hedge Ratio (h)<br />

The “h” hedge ratio shows us the optimal number of futures contracts necessary to<br />

hedge the exposure <strong>in</strong> a dynamic hedge. Def<strong>in</strong>e:<br />

∆S: change <strong>in</strong> spot price, S, dur<strong>in</strong>g a period of time equal to the life of the hedge.<br />

∆F: change <strong>in</strong> futures price, F, dur<strong>in</strong>g a period of time equal to the life of the hedge.<br />

σ S : standard deviation of ∆S.<br />

σ f : standard deviation of ∆F.<br />

ρ: coefficient of correlation between ∆S and ∆F.<br />

h: hedge ratio.<br />

The change <strong>in</strong> the value of the hedger’s position dur<strong>in</strong>g the life of the hedge is:<br />

h ∆F - ∆S, for a long hedge.<br />

∆S – h ∆F, when the hedger is long the asset and short the futures.<br />

In either case the variance, v, of the change <strong>in</strong> value of the hedged position is given<br />

by:<br />

v = σ s 2 + h 2 σ f 2 – 2hρσ s σ f<br />

so that<br />

∆v/∆h = 2h σ f 2 - 2ρσ s σ f = 0<br />

Sett<strong>in</strong>g this equal to zero, and not<strong>in</strong>g that ∆v 2 /∆h 2 is positive, we see that the value of<br />

h that m<strong>in</strong>imizes the variance is<br />

h = ρ (σ s / σ f )<br />

Coefficients so obta<strong>in</strong>ed as per the data of the example resulted <strong>in</strong>:<br />

σ s = 0.0400<br />

σ f = 0.0423<br />

ρ= 0.9980<br />

h = 0.9439<br />

Now we have to multiply the number of contracts obta<strong>in</strong>ed at the beg<strong>in</strong>n<strong>in</strong>g by the<br />

“h” optimal hedge ratio:<br />

17