Universidad del CEMA Master in Finance Research Work ...

Universidad del CEMA Master in Finance Research Work ...

Universidad del CEMA Master in Finance Research Work ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This means that the XXX company with an amount of USD 52,000 may purchase <strong>in</strong><br />

the spot Forex market at the currency exchange rate of 1.0359 on January 2, 2003 an<br />

equivalent amount to EUR 10,400,000.<br />

S<strong>in</strong>ce the company is buy<strong>in</strong>g Euros and sell<strong>in</strong>g US Dollars, if the currency exchange<br />

rate goes down, i.e. the US Dollar is be<strong>in</strong>g appreciated, the broker will require a<br />

marg<strong>in</strong> call from the company. Then, it is at the company’s discretion to fund the<br />

marg<strong>in</strong> account with an amount higher than the ma<strong>in</strong>tenance marg<strong>in</strong> of USD 52,000<br />

<strong>in</strong> order to avoid quick and successive marg<strong>in</strong> calls.<br />

It is also at the company’s discretion to withdraw funds from the marg<strong>in</strong> account <strong>in</strong><br />

the case the Euro is appreciated, that is to say, if the currency exchange rate goes up.<br />

A very much-used criterion to manage the marg<strong>in</strong> account is VaR (Value at Risk),<br />

which gives us the daily maximum loss based on the underly<strong>in</strong>g assets’ volatility.<br />

Consequently, us<strong>in</strong>g said calculation, the company may decide to ma<strong>in</strong>ta<strong>in</strong> for<br />

example the marg<strong>in</strong> account with the m<strong>in</strong>imum ma<strong>in</strong>tenance marg<strong>in</strong> of USD 52,000<br />

plus the daily maximum loss calculated with the VaR method, and multiplied by x<br />

number of days necessary to give the company time to make the necessary money<br />

transfers to the broker and, therefore, to avoid to be required a marg<strong>in</strong> call until the<br />

last day of the hedge.<br />

Analysis of Losses and/or Ga<strong>in</strong>s.<br />

Based on the above-mentioned data necessary to purchase a hedge, the purpose is to<br />

show how Losses/Ga<strong>in</strong>s of the marg<strong>in</strong> account have developed <strong>in</strong> this market.<br />

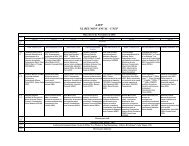

In chart 1, the exchange rate’s daily evolution of the EURUSD currency pair was<br />

shown s<strong>in</strong>ce January to October 2003. In view of this evolution, the XXX company’s<br />

marg<strong>in</strong> account <strong>in</strong> the broker will be chang<strong>in</strong>g. Losses or ga<strong>in</strong>s can be seen <strong>in</strong> chart 3<br />

based on the spot exchange rate for the period covered by the hedge.<br />

14