Detailed Version - UFA.com

Detailed Version - UFA.com

Detailed Version - UFA.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

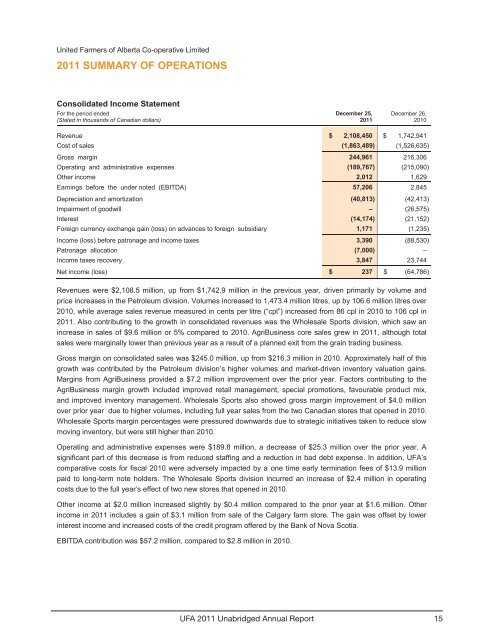

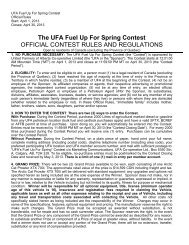

United Farmers of Alberta Co-operative Limited<br />

2011 SUMMARY OF OPERATIONS<br />

Consolidated In<strong>com</strong>e Statement<br />

For the period ended<br />

(Stated in thousands of Canadian dollars)<br />

December 25,<br />

2011<br />

December 26,<br />

2010<br />

Revenue $ 2,108,450 $ 1,742,941<br />

Cost of sales (1,863,489) (1,526,635)<br />

Gross margin 244,961 216,306<br />

Operating and administrative expenses (189,767) (215,090)<br />

Other in<strong>com</strong>e 2,012 1,629<br />

Earnings before the under noted (EBITDA) 57,206 2,845<br />

Depreciation and amortization (40,813) (42,413)<br />

Impairment of goodwill – (26,575)<br />

Interest (14,174) (21,152)<br />

Foreign currency exchange gain (loss) on advances to foreign subsidiary 1,171 (1,235)<br />

In<strong>com</strong>e (loss) before patronage and in<strong>com</strong>e taxes 3,390 (88,530)<br />

Patronage allocation (7,000) –<br />

In<strong>com</strong>e taxes recovery 3,847 23,744<br />

Net in<strong>com</strong>e (loss) $ 237 $ (64,786)<br />

Revenues were $2,108.5 million, up from $1,742.9 million in the previous year, driven primarily by volume and<br />

price increases in the Petroleum division. Volumes increased to 1,473.4 million litres, up by 106.6 million litres over<br />

2010, while average sales revenue measured in cents per litre (“cpl”) increased from 86 cpl in 2010 to 106 cpl in<br />

2011. Also contributing to the growth in consolidated revenues was the Wholesale Sports division, which saw an<br />

increase in sales of $9.6 million or 5% <strong>com</strong>pared to 2010. AgriBusiness core sales grew in 2011, although total<br />

sales were marginally lower than previous year as a result of a planned exit from the grain trading business.<br />

Gross margin on consolidated sales was $245.0 million, up from $216.3 million in 2010. Approximately half of this<br />

growth was contributed by the Petroleum division‟s higher volumes and market-driven inventory valuation gains.<br />

Margins from AgriBusiness provided a $7.2 million improvement over the prior year. Factors contributing to the<br />

AgriBusiness margin growth included improved retail management, special promotions, favourable product mix,<br />

and improved inventory management. Wholesale Sports also showed gross margin improvement of $4.0 million<br />

over prior year due to higher volumes, including full year sales from the two Canadian stores that opened in 2010.<br />

Wholesale Sports margin percentages were pressured downwards due to strategic initiatives taken to reduce slow<br />

moving inventory, but were still higher than 2010.<br />

Operating and administrative expenses were $189.8 million, a decrease of $25.3 million over the prior year. A<br />

significant part of this decrease is from reduced staffing and a reduction in bad debt expense. In addition, <strong>UFA</strong>‟s<br />

<strong>com</strong>parative costs for fiscal 2010 were adversely impacted by a one time early termination fees of $13.9 million<br />

paid to long-term note holders. The Wholesale Sports division incurred an increase of $2.4 million in operating<br />

costs due to the full year‟s effect of two new stores that opened in 2010.<br />

Other in<strong>com</strong>e at $2.0 million increased slightly by $0.4 million <strong>com</strong>pared to the prior year at $1.6 million. Other<br />

in<strong>com</strong>e in 2011 includes a gain of $3.1 million from sale of the Calgary farm store. The gain was offset by lower<br />

interest in<strong>com</strong>e and increased costs of the credit program offered by the Bank of Nova Scotia.<br />

EBITDA contribution was $57.2 million, <strong>com</strong>pared to $2.8 million in 2010.<br />

2011 SUMMARY OF OPERATIONS 13<br />

<strong>UFA</strong> 2011 Unabridged Annual Report 15