Detailed Version - UFA.com

Detailed Version - UFA.com

Detailed Version - UFA.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

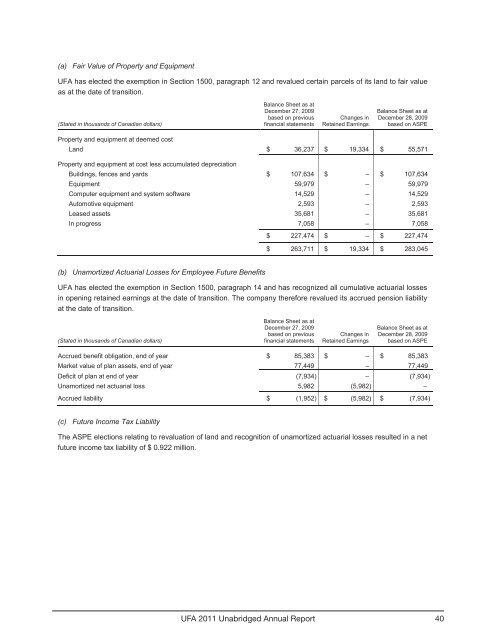

(a) Fair Value of Property and Equipment<br />

<strong>UFA</strong> has elected the exemption in Section 1500, paragraph 12 and revalued certain parcels of its land to fair value<br />

as at the date of transition.<br />

(Stated in thousands of Canadian dollars)<br />

Balance Sheet as at<br />

December 27, 2009<br />

based on previous<br />

financial statements<br />

Changes in<br />

Retained Earnings<br />

Balance Sheet as at<br />

December 28, 2009<br />

based on ASPE<br />

Property and equipment at deemed cost<br />

Land $ 36,237 $ 19,334 $ 55,571<br />

Property and equipment at cost less accumulated depreciation<br />

Buildings, fences and yards $ 107,634 $ – $ 107,634<br />

Equipment 59,979 – 59,979<br />

Computer equipment and system software 14,529 – 14,529<br />

Automotive equipment 2,593 – 2,593<br />

Leased assets 35,681 – 35,681<br />

In progress 7,058 – 7,058<br />

$ 227,474 $ – $ 227,474<br />

$ 263,711 $ 19,334 $ 283,045<br />

(b) Unamortized Actuarial Losses for Employee Future Benefits<br />

<strong>UFA</strong> has elected the exemption in Section 1500, paragraph 14 and has recognized all cumulative actuarial losses<br />

in opening retained earnings at the date of transition. The <strong>com</strong>pany therefore revalued its accrued pension liability<br />

at the date of transition.<br />

(Stated in thousands of Canadian dollars)<br />

Balance Sheet as at<br />

December 27, 2009<br />

based on previous<br />

financial statements<br />

Changes in<br />

Retained Earnings<br />

Balance Sheet as at<br />

December 28, 2009<br />

based on ASPE<br />

Accrued benefit obligation, end of year $ 85,383 $ – $ 85,383<br />

Market value of plan assets, end of year 77,449 – 77,449<br />

Deficit of plan at end of year (7,934) – (7,934)<br />

Unamortized net actuarial loss 5,982 (5,982) –<br />

Accrued liability $ (1,952) $ (5,982) $ (7,934)<br />

(c) Future In<strong>com</strong>e Tax Liability<br />

The ASPE elections relating to revaluation of land and recognition of unamortized actuarial losses resulted in a net<br />

future in<strong>com</strong>e tax liability of $ 0.922 million.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 13<br />

<strong>UFA</strong> 2011 Unabridged Annual Report 40