Detailed Version - UFA.com

Detailed Version - UFA.com

Detailed Version - UFA.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

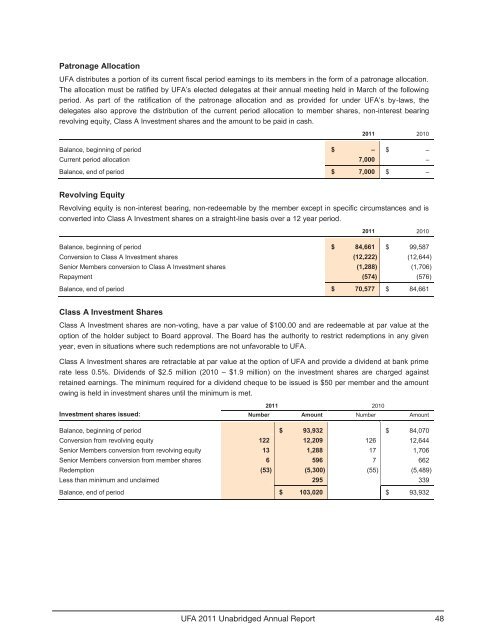

Patronage Allocation<br />

<strong>UFA</strong> distributes a portion of its current fiscal period earnings to its members in the form of a patronage allocation.<br />

The allocation must be ratified by <strong>UFA</strong>’s elected delegates at their annual meeting held in March of the following<br />

period. As part of the ratification of the patronage allocation and as provided for under <strong>UFA</strong>’s by-laws, the<br />

delegates also approve the distribution of the current period allocation to member shares, non-interest bearing<br />

revolving equity, Class A Investment shares and the amount to be paid in cash.<br />

2011 2010<br />

Balance, beginning of period $ – $ –<br />

Current period allocation 7,000 –<br />

Balance, end of period $ 7,000 $ –<br />

Revolving Equity<br />

Revolving equity is non-interest bearing, non-redeemable by the member except in specific circumstances and is<br />

converted into Class A Investment shares on a straight-line basis over a 12 year period.<br />

2011 2010<br />

Balance, beginning of period $ 84,661 $ 99,587<br />

Conversion to Class A Investment shares (12,222) (12,644)<br />

Senior Members conversion to Class A Investment shares (1,288) (1,706)<br />

Repayment (574) (576)<br />

Balance, end of period $ 70,577 $ 84,661<br />

Class A Investment Shares<br />

Class A Investment shares are non-voting, have a par value of $100.00 and are redeemable at par value at the<br />

option of the holder subject to Board approval. The Board has the authority to restrict redemptions in any given<br />

year, even in situations where such redemptions are not unfavorable to <strong>UFA</strong>.<br />

Class A Investment shares are retractable at par value at the option of <strong>UFA</strong> and provide a dividend at bank prime<br />

rate less 0.5%. Dividends of $2.5 million (2010 – $1.9 million) on the investment shares are charged against<br />

retained earnings. The minimum required for a dividend cheque to be issued is $50 per member and the amount<br />

owing is held in investment shares until the minimum is met.<br />

2011 2010<br />

Investment shares issued: Number Amount Number Amount<br />

Balance, beginning of period $ 93,932 $ 84,070<br />

Conversion from revolving equity 122 12,209 126 12,644<br />

Senior Members conversion from revolving equity 13 1,288 17 1,706<br />

Senior Members conversion from member shares 6 596 7 662<br />

Redemption (53) (5,300) (55) (5,489)<br />

Less than minimum and unclaimed 295 339<br />

Balance, end of period $ 103,020 $ 93,932<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 21<br />

<strong>UFA</strong> 2011 Unabridged Annual Report 48