Detailed Version - UFA.com

Detailed Version - UFA.com

Detailed Version - UFA.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

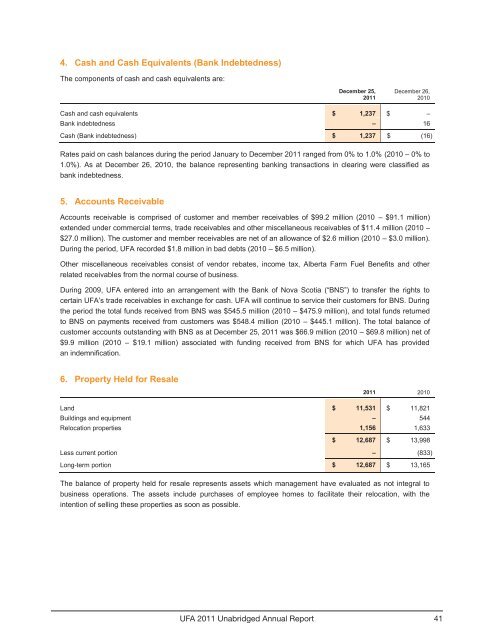

4. Cash and Cash Equivalents (Bank Indebtedness)<br />

The <strong>com</strong>ponents of cash and cash equivalents are:<br />

December 25,<br />

2011<br />

December 26,<br />

2010<br />

Cash and cash equivalents $ 1,237 $ –<br />

Bank indebtedness – 16<br />

Cash (Bank indebtedness) $ 1,237 $ (16)<br />

Rates paid on cash balances during the period January to December 2011 ranged from 0% to 1.0% (2010 – 0% to<br />

1.0%). As at December 26, 2010, the balance representing banking transactions in clearing were classified as<br />

bank indebtedness.<br />

5. Accounts Receivable<br />

Accounts receivable is <strong>com</strong>prised of customer and member receivables of $99.2 million (2010 – $91.1 million)<br />

extended under <strong>com</strong>mercial terms, trade receivables and other miscellaneous receivables of $11.4 million (2010 –<br />

$27.0 million). The customer and member receivables are net of an allowance of $2.6 million (2010 – $3.0 million).<br />

During the period, <strong>UFA</strong> recorded $1.8 million in bad debts (2010 – $6.5 million).<br />

Other miscellaneous receivables consist of vendor rebates, in<strong>com</strong>e tax, Alberta Farm Fuel Benefits and other<br />

related receivables from the normal course of business.<br />

During 2009, <strong>UFA</strong> entered into an arrangement with the Bank of Nova Scotia (“BNS”) to transfer the rights to<br />

certain <strong>UFA</strong>’s trade receivables in exchange for cash. <strong>UFA</strong> will continue to service their customers for BNS. During<br />

the period the total funds received from BNS was $545.5 million (2010 – $475.9 million), and total funds returned<br />

to BNS on payments received from customers was $548.4 million (2010 – $445.1 million). The total balance of<br />

customer accounts outstanding with BNS as at December 25, 2011 was $66.9 million (2010 – $69.8 million) net of<br />

$9.9 million (2010 – $19.1 million) associated with funding received from BNS for which <strong>UFA</strong> has provided<br />

an indemnification.<br />

6. Property Held for Resale<br />

2011 2010<br />

Land $ 11,531 $ 11,821<br />

Buildings and equipment – 544<br />

Relocation properties 1,156 1,633<br />

$ 12,687 $ 13,998<br />

Less current portion – (833)<br />

Long-term portion $ 12,687 $ 13,165<br />

The balance of property held for resale represents assets which management have evaluated as not integral to<br />

business operations. The assets include purchases of employee homes to facilitate their relocation, with the<br />

intention of selling these properties as soon as possible.<br />

14 NOTES TO CONSOLODIATED FINANCIAL STATEMENTS<br />

<strong>UFA</strong> 2011 Unabridged Annual Report 41