Bonds

Bonds

Bonds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

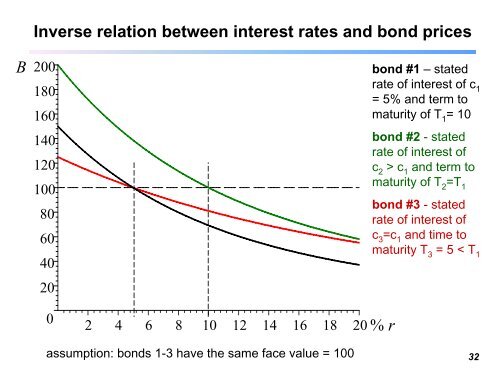

Inverse relation between interest rates and bond prices<br />

B<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

2 4 6 8 10 12 14 16 18 20 % r<br />

bond #1 – stated<br />

rate of interest of c 1<br />

= 5% and term to<br />

maturity of T 1<br />

= 10<br />

bond #2 -stated<br />

rate of interest of<br />

c 2<br />

> c 1<br />

and term to<br />

maturity of T 2<br />

=T 1<br />

bond #3 -stated<br />

rate of interest of<br />

c 3<br />

=c 1<br />

and time to<br />

maturity T 3<br />

= 5 < T 1<br />

assumption: bonds 1-3 have the same face value = 100<br />

32