Bonds

Bonds

Bonds

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

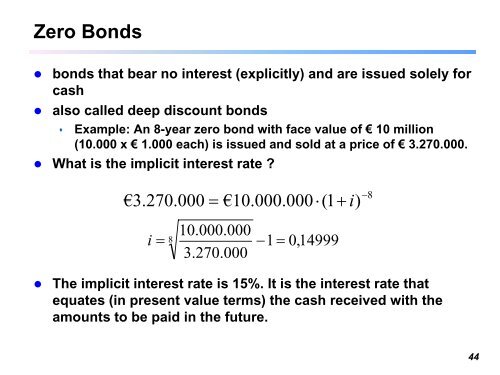

Zero <strong>Bonds</strong><br />

• bonds that bear no interest (explicitly) and are issued solely for<br />

cash<br />

• also called deep discount bonds<br />

Example: An 8-year zero bond with face value of € 10 million<br />

(10.000 x € 1.000 each) is issued and sold at a price of € 3.270.000.<br />

• What is the implicit interest rate ?<br />

€3.270.000<br />

= €10.000.000⋅(1<br />

+ i)<br />

−8<br />

i =<br />

10.000.000<br />

8 −1<br />

3.270.000<br />

=<br />

0,14999<br />

• The implicit interest rate is 15%. It is the interest rate that<br />

equates (in present value terms) the cash received with the<br />

amounts to be paid in the future.<br />

44