Bonds

Bonds

Bonds

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

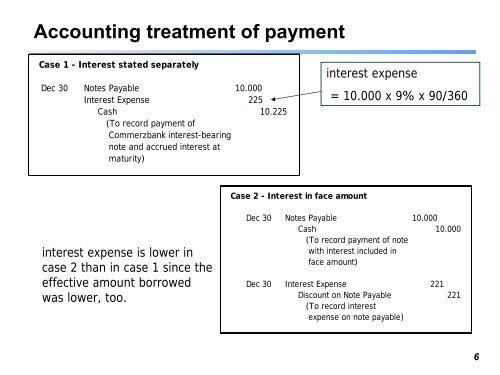

Accounting treatment of payment<br />

Case 1 - Interest stated separately<br />

Dec 30 Notes Payable 10.000<br />

Interest Expense _225<br />

Cash 10.225<br />

(To record payment of<br />

Commerzbank interest-bearing<br />

note and accrued interest at<br />

maturity)<br />

interest expense<br />

= 10.000 x 9% x 90/360<br />

Case 2 - Interest in face amount<br />

interest expense is lower in<br />

case 2 than in case 1 since the<br />

effective amount borrowed<br />

was lower, too.<br />

Dec 30 Notes Payable 10.000<br />

Cash 10.000<br />

(To record payment of note<br />

with interest included in<br />

face amount)<br />

Dec 30 Interest Expense ____221<br />

Discount on Note Payable 221<br />

(To record interest<br />

expense on note payable)<br />

6