20-India's Manufacturing Strategy - Global Perspective.pdf - Mimts.org

20-India's Manufacturing Strategy - Global Perspective.pdf - Mimts.org

20-India's Manufacturing Strategy - Global Perspective.pdf - Mimts.org

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>India's</strong> <strong>Manufacturing</strong> <strong>Strategy</strong>: <strong>Global</strong> <strong>Perspective</strong> 61<br />

SHARP SLOWDOWN IN MANU1<br />

The manufacturing sector grew at an average<br />

annual rate of 6% in the 14 years between 1990-91<br />

and <strong>20</strong>03-04. This was higher than the 5.8%<br />

growth in Industry and the 5.7% GDP growth<br />

during this period. However, manufacturing sector<br />

growth has fallen<br />

ACTUREVG SECTOR GROWTH<br />

sharply in the last seven years as compared to the<br />

first seven years of the reforms period. It has<br />

slumped from 7.4% to just4.7% later. •<br />

<strong>Manufacturing</strong>sect<strong>org</strong>rowthinthelatterperiodwas<br />

lower than the 5.1% growth clocked by industry and<br />

the 5.7% growth of GDP during the period.<br />

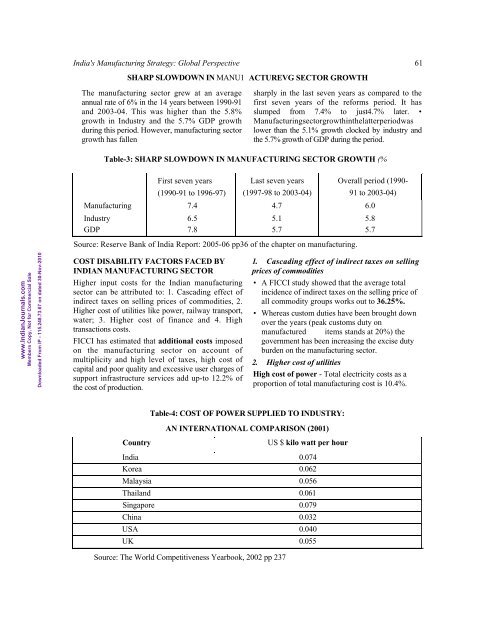

Table-3: SHARP SLOWDOWN IN MANUFACTURING SECTOR GROWTH (%<br />

First seven years<br />

(1990-91 to 1996-97)<br />

Last seven years<br />

(1997-98 to <strong>20</strong>03-04)<br />

Overall period (1990-<br />

91 to <strong>20</strong>03-04)<br />

<strong>Manufacturing</strong> 7.4 4.7 6.0<br />

Industry 6.5 5.1 5.8<br />

GDP 7.8 5.7 5.7<br />

Source: Reserve Bank of India Report: <strong>20</strong>05-06 pp36 of the chapter on manufacturing.<br />

www.IndianJournals.com<br />

Members Copy, Not for Commercial Sale<br />

Downloaded From IP - 115.248.73.67 on dated 30-Nov-<strong>20</strong>10<br />

COST DISABILITY FACTORS FACED BY<br />

INDIAN MANUFACTURING SECTOR<br />

Higher input costs for the Indian manufacturing<br />

sector can be attributed to: 1. Cascading effect of<br />

indirect taxes on selling prices of commodities, 2.<br />

Higher cost of utilities like power, railway transport,<br />

water; 3. Higher cost of finance and 4. High<br />

transactions costs.<br />

FICCI has estimated that additional costs imposed<br />

on the manufacturing sector on account of<br />

multiplicity and high level of taxes, high cost of<br />

capital and poor quality and excessive user charges of<br />

support infrastructure services add up-to 12.2% of<br />

the cost of production.<br />

1. Cascading effect of indirect taxes on selling<br />

prices of commodities<br />

• A FICCI study showed that the average total<br />

incidence of indirect taxes on the selling price of<br />

all commodity groups works out to 36.25%.<br />

• Whereas custom duties have been brought down<br />

over the years (peak customs duty on<br />

manufactured items stands at <strong>20</strong>%) the<br />

government has been increasing the excise duty<br />

burden on the manufacturing sector.<br />

2. Higher cost of utilities<br />

High cost of power - Total electricity costs as a<br />

proportion of total manufacturing cost is 10.4%.<br />

Country<br />

Table-4: COST OF POWER SUPPLIED TO INDUSTRY:<br />

AN INTERNATIONAL COMPARISON (<strong>20</strong>01)<br />

US $ kilo watt per hour<br />

India 0.074<br />

Korea 0.062<br />

Malaysia 0.056<br />

Thailand 0.061<br />

Singapore 0.079<br />

China 0.032<br />

USA 0.040<br />

UK 0.055<br />

Source: The World Competitiveness Yearbook, <strong>20</strong>02 pp 237