TCM - INDIA INTERNATIONAL CREDIT REPORT ... - Cerved

TCM - INDIA INTERNATIONAL CREDIT REPORT ... - Cerved

TCM - INDIA INTERNATIONAL CREDIT REPORT ... - Cerved

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

thereby restricting any further improvement. + Subdued growth in the domestic automobile industry<br />

vis-a- vis FY04.<br />

Growth<br />

We believe that AIGL holds a healthy growth potential in coming years. Few of the key growth<br />

drivers are as under: The automotive segment is expected to grow by 12-15 per cent in FY05, OEMs<br />

segment to grow by 20 per cent. AIGL being a dominant player in OEM segment, we believe that it<br />

will benefit from the higher growth in the segment. Replacement market in the automotive segment<br />

too provides a good growth opportunity for the company in time to come. It currently holds 55 per<br />

cent market share in automotive replacement market in terms of value. The float glass segment is<br />

likely to grow by over 11 per cent during the current fiscal on rising penetration levels, growing<br />

industrial sector and healthy economic growth prospects. The expansion plans augur well for AIGL's<br />

growth prospects as it would help the company to accommodate the demand from various business<br />

segments in the time to come<br />

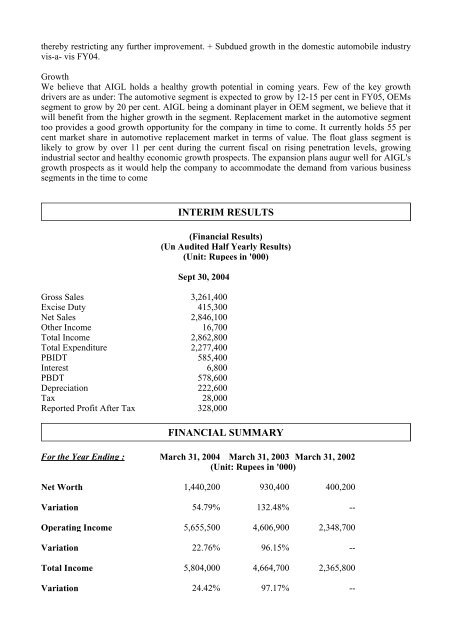

INTERIM RESULTS<br />

(Financial Results)<br />

(Un Audited Half Yearly Results)<br />

(Unit: Rupees in '000)<br />

Sept 30, 2004<br />

Gross Sales 3,261,400<br />

Excise Duty 415,300<br />

Net Sales 2,846,100<br />

Other Income 16,700<br />

Total Income 2,862,800<br />

Total Expenditure 2,277,400<br />

PBIDT 585,400<br />

Interest 6,800<br />

PBDT 578,600<br />

Depreciation 222,600<br />

Tax 28,000<br />

Reported Profit After Tax 328,000<br />

FINANCIAL SUMMARY<br />

For the Year Ending : March 31, 2004 March 31, 2003 March 31, 2002<br />

(Unit: Rupees in '000)<br />

Net Worth 1,440,200 930,400 400,200<br />

Variation 54.79% 132.48% --<br />

Operating Income 5,655,500 4,606,900 2,348,700<br />

Variation 22.76% 96.15% --<br />

Total Income 5,804,000 4,664,700 2,365,800<br />

Variation 24.42% 97.17% --