Annual Report 2009 - Meezan Bank

Annual Report 2009 - Meezan Bank

Annual Report 2009 - Meezan Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Murabaha transactions (including Islamic Export Refinance Scheme) constitute around 47% of the total financing portfolio<br />

as compared to 45% last year, while the share of Diminishing Musharakah & Istisna increased from 14.5% & 4% to 23%<br />

& 8% respectively. However, Ijarah transactions’ share moved downward from 23% to 17%. These ratios suggest that<br />

the percentage of Murabaha in the overall financing figure has remained at the same level, however the Istisna-based<br />

financing has gained popularity. The <strong>Bank</strong>'s total financing portfolio reached Rs. 46.716 billion as on December 31, <strong>2009</strong>.<br />

All these transactions were executed using Shariah-compliant financing agreements.<br />

It is a matter of great concern that due to excess liquidity, the bank has executed local currency Commodity Murabaha<br />

transactions amounting to Rs. 34.499 billion as compared to last two years' figures of Rs. 18.108 billion and Rs. 8.850<br />

billion respectively, while the remaining excess liquidity was used in inter-bank Musharakah. In the absence of short-term<br />

placement avenues this mode was inevitably used. However, the <strong>Bank</strong>, in consultation with other players in the market,<br />

should try to explore other opportunities for short-term liquidity management.<br />

Review of Liabilities<br />

On the liability side, the <strong>Bank</strong> offered different Shariah-compliant deposit products based on the mode of Mudarabah.<br />

The total deposits of the <strong>Bank</strong> reached Rs. 100.333 billion as at December 31, <strong>2009</strong>. During the year, the <strong>Bank</strong> accepted<br />

deposits on the modes of Musharakah for short-term liquidity management from inter-bank market and corporate clients.<br />

Throughout the year, the process of the allocation of assets & funds to various deposit pools, announcement of overall<br />

profit sharing ratios for Mudarabah based deposits, monthly allocation of the weightages and distribution of income to<br />

deposit accounts were monitored and reviewed in accordance with Shariah rules & principles.<br />

Shariah Audit & Compliance Reviews<br />

To ensure that all the products and services being offered by the bank strictly adhere to conjunctions of Shariah, the PDSC<br />

department actively monitored various operational activities of the <strong>Bank</strong> throughout the year. During the year, credit approvals,<br />

restructuring of financing facilities, customer-specific transaction process flows, text of Letters of Guarantee (LGs)<br />

and security documents were reviewed to ensure Shariah-compliance while offering financing products to the customers.<br />

During <strong>2009</strong>, over 400 customer-specific transactional process flows (of Murabaha, Diminishing Musharakah, Istisna,<br />

Tijarah & Ijarah) were revised / developed for SME customers and more than 380 Credit approvals and Restructuring<br />

of facilities were reviewed. For Corporate customers, over 400 customer-specific transactional process flows (of Murabaha,<br />

Diminishing Musharakah, Istisna, Tijarah & Ijarah) were revised / developed, 100 security documents, 120 credit approvals<br />

and restructuring of more than 10 clients were reviewed<br />

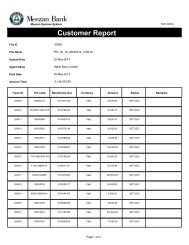

Summary of Direct Payment in Murabaha Financing for <strong>Meezan</strong> <strong>Bank</strong><br />

MURABAHA FINANCING - DIRECT PAYMENT 2008 <strong>2009</strong> Growth<br />

Overall Portfolio 38% 67% 76%<br />

Customer Wise Breakup<br />

Corporate 28% 60% 114%<br />

SME/Commercial 70% 85% 21%<br />

Region Wise Breakup<br />

NORTH 56% 88% 57%<br />

SOUTH 46% 81% 76%<br />

CENTRAL 30% 54% 80%<br />

As per the directive of SSB to increase direct payments in Murabaha, it is a matter of appreciation that <strong>Bank</strong> has increased<br />

the overall percentage of direct payments. In the year <strong>2009</strong>, a significant growth of 76% was registered in terms of direct<br />

payment for Murabaha financing as the overall percentage of direct payment was increased to 67% in the year <strong>2009</strong> against<br />

38% in the year 2008.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

39