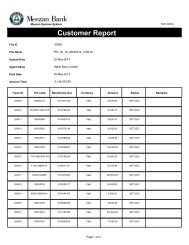

Annual Report 2009 - Meezan Bank

Annual Report 2009 - Meezan Bank

Annual Report 2009 - Meezan Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Charity<br />

During the year, an amount of Rs. 51.170 million was transferred to the Charity account and an amount of Rs. 14.605<br />

million was disbursed after the approval of the Shariah Advisor. Details of charity are available in note # 18.4 1 . Moreover,<br />

as per the directive of SSB a charitable foundation by the name of Ihsan Trust has been established to ensure effective<br />

utilization and disbursement of charity funds.<br />

Recommendations<br />

Based on the review of various transactions, it is recommended that:<br />

n For the placement of excess liquidity, the <strong>Bank</strong> shall explore new avenues of investment instead of only relying on the<br />

Commodity Murabaha transactions. Furthermore, the <strong>Bank</strong> should explore doing Commodity Murabaha transactions<br />

through the Commodity Exchange.<br />

n In view of the growing branch network and induction of new employees, the <strong>Bank</strong> should continue its focus on employees<br />

training related to Islamic banking products and services offered by the <strong>Bank</strong> with specific focus on front-line staff.<br />

n The Corporate, Commercial & SME department and all Regions of the bank shall organize special training workshops<br />

for the executives of their financing clients and continue the practice of conducting customer awareness seminars.<br />

n The <strong>Bank</strong> should try to initiate execution of Musharakah transactions using the approved models of Running Musharakah<br />

facility and transaction-based Musharakah with its customers.<br />

n In the area of retail banking, new deposit schemes that could give higher returns and added benefits to lower income<br />

segments and senior citizens shall be introduced.<br />

n Efforts should be made to implement Islamic Microfinancing schemes in Pakistan.<br />

n It is recommended that for residential area branches, separate Women-banking counters should be established to<br />

facilitate female customers and arrangements should be made to ensure minimal interaction of female staff with male<br />

customers at the branches.<br />

n To strengthen the Shariah-compliance framework in the bank, the scope of external audit shall also include the review<br />

of bank's activities in light of the guidelines given by the Shariah Supervisory Board, Shariah Advisor, PDSC and SBP<br />

guidelines for Shariah compliance issued from time to time.<br />

Conclusion<br />

As per the charter of the <strong>Bank</strong>, it is mandatory on all of the management & employees to ensure application of Shariah<br />

principles and guidelines issued by the Shariah Supervisory Board and Shariah Advisor and to ensure Shariah-compliance<br />

in all activities of the bank. The prime responsibility for ensuring Shariah-compliance of the <strong>Bank</strong>'s operations thus lies<br />

with the management.<br />

Based on the extensive reviews of sample cases for each class of transaction, related documentation, processes, the profit<br />

distribution mechanism for the depositors and management's representation made in this regard, in our opinion, the affairs,<br />

activities and transactions, performed by the bank during the year comply with the rules & principles of Islamic Shariah<br />

in light of the guidelines and directives given by the Shariah Supervisory Board, Shariah Advisor of <strong>Meezan</strong> <strong>Bank</strong> and<br />

SBP guidelines related to Shariah-compliance. The non-compliant income identified during the review is being transferred<br />

to the charity account.<br />

May Allah bless us with the best Tawfeeq to accomplish His cherished tasks, make us successful in this world and in the<br />

Hereafter, and forgive our mistakes.<br />

Wassalam Alaikum Wa Rahmat Allah Wa Barakatuh.<br />

Dr. Muhammad Imran Usmani<br />

Member Shariah Supervisory Board & Shariah Advisor<br />

Dated: Safar 09, 1431 H / January 25, 2010 AD<br />

1 For details see “Utilization of Charity Fund”<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

41