Annual Report 2009 - Meezan Bank

Annual Report 2009 - Meezan Bank

Annual Report 2009 - Meezan Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to and forming part of the<br />

Financial Statements<br />

For the year ended December 31, <strong>2009</strong><br />

10.5.12 The paid up value of these sukuks is Rs. 3,750 per certificate.<br />

10.5.13 The tenure of these certificates is 7 years, with principal receivable in 2010-2015. The profit is calculated on the basis<br />

of six months Karachi inter-bank offer rate plus 150 basis points.<br />

10.5.14 The tenure of these certificates is 6 years, with principal receivable in <strong>2009</strong>-2014. The profit is calculated on the basis<br />

of six months Karachi inter-bank offer rate plus 200 basis points from year 1 to year 2 and plus 175 basis points from<br />

year 3 to year 6.<br />

10.5.15 The tenure of these certificates is 5 years, with principal receivable in <strong>2009</strong>-2013. The profit is calculated on the basis<br />

of three months Karachi inter-bank offer rate plus 110 basis points.<br />

10.5.16 The paid up value of these certificates is Rs. 100 per certificate.The tenure is 12 years, with principal receivable in<br />

2011-2020. The profit is calculated on the basis of three months Karachi inter-bank offer rate plus 300 basis points.<br />

10.5.17 The tenure of these certificates is 5.5 years, with principal receivable in 2010-2014. The profit is calculated on the<br />

basis of three months Karachi inter-bank offer rate plus 230 basis points.<br />

10.5.18 The tenure of these certificates is 6 years, with principal receivable in 2010-2013. The profit is calculated on the basis<br />

of six months Karachi inter-bank offer rate plus 170 basis points.<br />

10.5.19 The tenure of these certificates is 7 years, with principal receivable in 2012-2016. The profit is calculated on the basis<br />

of three months Karachi inter-bank offer rate plus 250 basis points.<br />

10.5.20 These sukuk certificates are backed by the Government of Pakistan's sovereign guarantee. The profit rate on these<br />

certificates comprise of six months weighted average yield of six months market T-Bills plus 45 basis points. These<br />

certificates will mature in 2011. These are carried at cost because of non availability of independent market value.<br />

10.5.21 These sukuk certificates are backed by the Government of Pakistan's sovereign guarantee. The profit rate on these<br />

certificates comprise of six months weighted average yield of six months market T-Bills plus 75 basis points. These<br />

certificates will mature in 2011. These are carried at cost because of non availability of independent market value.<br />

10.5.22 These sukuk certificates are backed by the Government of Pakistan's sovereign guarantee. The profit rate on these<br />

certificates comprise of six months weighted average yield of six months market T-Bills plus zero basis points. These<br />

certificates will mature in 2012. These are carried at cost because of non availability of independent market value.<br />

10.5.23 These sukuk certificates are backed by the Government of Pakistan's sovereign guarantee. The profit rate on these<br />

certificates comprise of six months weighted average yield of six months market T-Bills minus 5 basis points. These<br />

certificates will mature in 2012. These are carried at cost because of non availability of independent market value.<br />

10.5.24 The paid up value of these sukuks is Rs. 100,000 per certificate.<br />

10.5.25 The paid up value of these bonds is US$ 1. These bonds will mature in 2011. The profit is calculated on the basis<br />

of London inter-bank offer rate plus 40 basis points.<br />

10.6 Held to maturity securities<br />

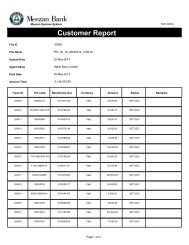

Note <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Name of the investee entity Number of Bonds / Cost<br />

Certificates Rupees in '000<br />

Sukuk Bonds / certificates<br />

Qatar Global Sukuk Bonds (Sukuk - Qatar) 10.6.1 200,000 1,000,000 16,848 31,639<br />

Dubai Sukuk Bonds (Sukuk - Dubai) - 7,000,000 - 553,690<br />

WAPDA First Sukuk Certificates (Sukuk - WAPDA) 10.6.2 230,000 230,000 1,150,000 1,150,000<br />

1,166,848 1,735,329<br />

10.6.1 The paid up value of Sukuk – Qatar is US $0.2 (2008:US $0.4) per bond. The return on Sukuk – Qatar is on the<br />

basis of London inter-bank offer rate plus a fixed credit spread of 40 basis points. These bonds will mature in 2010.<br />

10.6.2 The paid up value of Sukuk -WAPDA is Rs. 5,000 per certificate. The return on Sukuk - WAPDA is on a six monthly<br />

Karachi inter-bank offer rate plus a fixed credit spread of 35 basis points. These bonds will mature in 2012. These<br />

sukuk certificates are backed by the Government of Pakistan’s sovereign guarantee.<br />

72