Centaur Holdings plc - Hemscott IR

Centaur Holdings plc - Hemscott IR

Centaur Holdings plc - Hemscott IR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

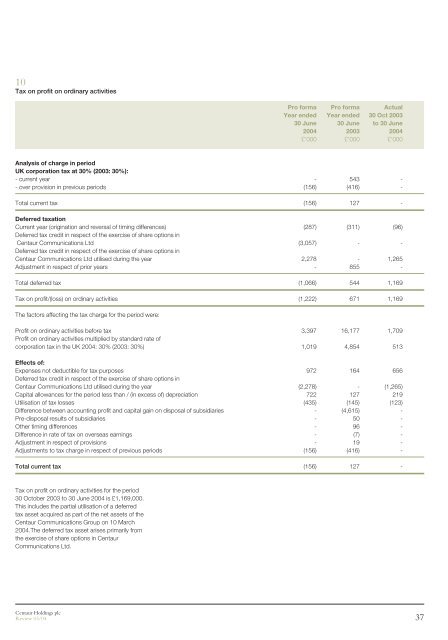

Tax on profit on ordinary activities<br />

Pro forma Pro forma Actual<br />

Year ended Year ended 30 Oct 2003<br />

30 June 30 June to 30 June<br />

20042003 2004<br />

£’000 £’000 £’000<br />

Analysis of charge in period<br />

UK corporation tax at 30% (2003: 30%):<br />

- current year - 543 -<br />

- over provision in previous periods (156) (416) -<br />

Total current tax (156) 127 -<br />

Deferred taxation<br />

Current year (origination and reversal of timing differences) (287) (311) (96)<br />

Deferred tax credit in respect of the exercise of share options in<br />

<strong>Centaur</strong> Communications Ltd (3,057) - -<br />

Deferred tax credit in respect of the exercise of share options in<br />

<strong>Centaur</strong> Communications Ltd utilised during the year 2,278 - 1,265<br />

Adjustment in respect of prior years - 855 -<br />

Total deferred tax (1,066) 544 1,169<br />

Tax on profit/(loss) on ordinary activities (1,222) 671 1,169<br />

The factors affecting the tax charge for the period were:<br />

Profit on ordinary activities before tax 3,397 16,177 1,709<br />

Profit on ordinary activities multiplied by standard rate of<br />

corporation tax in the UK 2004: 30% (2003: 30%) 1,019 4,854 513<br />

Effects of:<br />

Expenses not deductible for tax purposes 972 164 656<br />

Deferred tax credit in respect of the exercise of share options in<br />

<strong>Centaur</strong> Communications Ltd utilised during the year (2,278) - (1,265)<br />

Capital allowances for the period less than / (in excess of) depreciation 722 127 219<br />

Utilisation of tax losses (435) (145) (123)<br />

Difference between accounting profit and capital gain on disposal of subsidiaries - (4,615) -<br />

Pre-disposal results of subsidiaries - 50 -<br />

Other timing differences - 96 -<br />

Difference in rate of tax on overseas earnings - (7) -<br />

Adjustment in respect of provisions - 19 -<br />

Adjustments to tax charge in respect of previous periods (156) (416) -<br />

Total current tax (156) 127 -<br />

Tax on profit on ordinary activities for the period<br />

30 October 2003 to 30 June 2004 is £1,169,000.<br />

This includes the partial utilisation of a deferred<br />

tax asset acquired as part of the net assets of the<br />

<strong>Centaur</strong> Communications Group on 10 March<br />

2004.The deferred tax asset arises primarily from<br />

the exercise of share options in <strong>Centaur</strong><br />

Communications Ltd.<br />

<strong>Centaur</strong> <strong>Holdings</strong> <strong>plc</strong><br />

Review 03/04 37