Centaur Holdings plc - Hemscott IR

Centaur Holdings plc - Hemscott IR

Centaur Holdings plc - Hemscott IR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

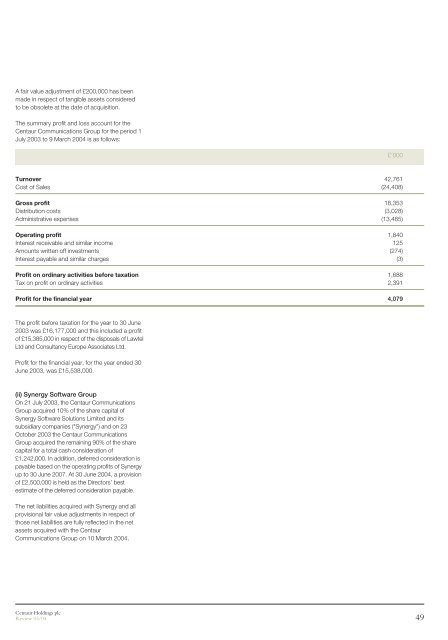

A fair value adjustment of £200,000 has been<br />

made in respect of tangible assets considered<br />

to be obsolete at the date of acquisition.<br />

The summary profit and loss account for the<br />

<strong>Centaur</strong> Communications Group for the period 1<br />

July 2003 to 9 March 2004 is as follows:<br />

£’000<br />

Turnover 42,761<br />

Cost of Sales (24,408)<br />

Gross profit 18,353<br />

Distribution costs (3,028)<br />

Administrative expenses (13,485)<br />

Operating profit 1,840<br />

Interest receivable and similar income 125<br />

Amounts written off investments (274)<br />

Interest payable and similar charges (3)<br />

Profit on ordinary activities before taxation 1,688<br />

Tax on profit on ordinary activities 2,391<br />

Profit for the financial year 4,079<br />

The profit before taxation for the year to 30 June<br />

2003 was £16,177,000 and this included a profit<br />

of £15,385,000 in respect of the disposals of Lawtel<br />

Ltd and Consultancy Europe Associates Ltd.<br />

Profit for the financial year, for the year ended 30<br />

June 2003, was £15,538,000.<br />

(ii) Synergy Software Group<br />

On 21 July 2003, the <strong>Centaur</strong> Communications<br />

Group acquired 10% of the share capital of<br />

Synergy Software Solutions Limited and its<br />

subsidiary companies ("Synergy") and on 23<br />

October 2003 the <strong>Centaur</strong> Communications<br />

Group acquired the remaining 90% of the share<br />

capital for a total cash consideration of<br />

£1,242,000. In addition, deferred consideration is<br />

payable based on the operating profits of Synergy<br />

up to 30 June 2007. At 30 June 2004, a provision<br />

of £2,500,000 is held as the Directors’ best<br />

estimate of the deferred consideration payable.<br />

The net liabilities acquired with Synergy and all<br />

provisional fair value adjustments in respect of<br />

those net liabilities are fully reflected in the net<br />

assets acquired with the <strong>Centaur</strong><br />

Communications Group on 10 March 2004.<br />

<strong>Centaur</strong> <strong>Holdings</strong> <strong>plc</strong><br />

Review 03/04 49