Centaur Holdings plc - Hemscott IR

Centaur Holdings plc - Hemscott IR

Centaur Holdings plc - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

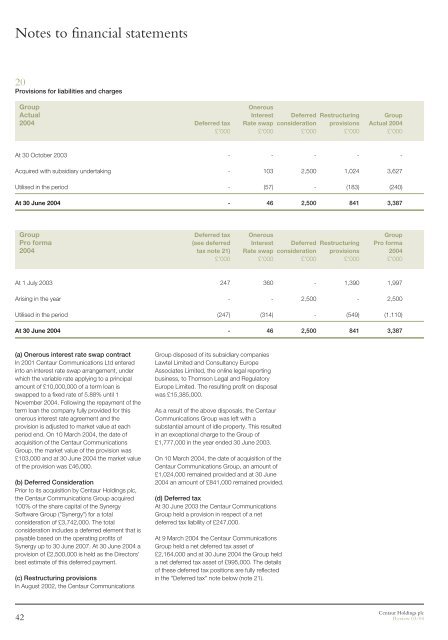

Notes to financial statements<br />

20<br />

Provisions for liabilities and charges<br />

Group<br />

Onerous<br />

Actual Interest Deferred Restructuring Group<br />

2004 Deferred tax Rate swap consideration provisions Actual 2004<br />

£’000 £’000 £’000 £’000 £’000<br />

At 30 October 2003 - - - - -<br />

Acquired with subsidiary undertaking - 103 2,500 1,024 3,627<br />

Utilised in the period - (57) - (183) (240)<br />

At 30 June 2004 - 46 2,500 841 3,387<br />

Group Deferred tax Onerous Group<br />

Pro forma (see deferred Interest Deferred Restructuring Pro forma<br />

2004 tax note 21) Rate swap consideration provisions 2004<br />

£’000 £’000 £’000 £’000 £’000<br />

At 1 July 2003 247 360 - 1,390 1,997<br />

Arising in the year - - 2,500 - 2,500<br />

Utilised in the period (247) (314) - (549) (1,110)<br />

At 30 June 2004 - 46 2,500 841 3,387<br />

(a) Onerous interest rate swap contract<br />

In 2001 <strong>Centaur</strong> Communications Ltd entered<br />

into an interest rate swap arrangement, under<br />

which the variable rate applying to a principal<br />

amount of £10,000,000 of a term loan is<br />

swapped to a fixed rate of 5.88% until 1<br />

November 2004. Following the repayment of the<br />

term loan the company fully provided for this<br />

onerous interest rate agreement and the<br />

provision is adjusted to market value at each<br />

period end. On 10 March 2004, the date of<br />

acquisition of the <strong>Centaur</strong> Communications<br />

Group, the market value of the provision was<br />

£103,000 and at 30 June 2004 the market value<br />

of the provision was £46,000.<br />

(b) Deferred Consideration<br />

Prior to its acquisition by <strong>Centaur</strong> <strong>Holdings</strong> <strong>plc</strong>,<br />

the <strong>Centaur</strong> Communications Group acquired<br />

100% of the share capital of the Synergy<br />

Software Group ("Synergy") for a total<br />

consideration of £3,742,000. The total<br />

consideration includes a deferred element that is<br />

payable based on the operating profits of<br />

Synergy up to 30 June 2007. At 30 June 2004 a<br />

provision of £2,500,000 is held as the Directors’<br />

best estimate of this deferred payment.<br />

(c) Restructuring provisions<br />

In August 2002, the <strong>Centaur</strong> Communications<br />

Group disposed of its subsidiary companies<br />

Lawtel Limited and Consultancy Europe<br />

Associates Limited, the online legal reporting<br />

business, to Thomson Legal and Regulatory<br />

Europe Limited. The resulting profit on disposal<br />

was £15,385,000.<br />

As a result of the above disposals, the <strong>Centaur</strong><br />

Communications Group was left with a<br />

substantial amount of idle property. This resulted<br />

in an exceptional charge to the Group of<br />

£1,777,000 in the year ended 30 June 2003.<br />

On 10 March 2004, the date of acquisition of the<br />

<strong>Centaur</strong> Communications Group, an amount of<br />

£1,024,000 remained provided and at 30 June<br />

2004 an amount of £841,000 remained provided.<br />

(d) Deferred tax<br />

At 30 June 2003 the <strong>Centaur</strong> Communications<br />

Group held a provision in respect of a net<br />

deferred tax liability of £247,000.<br />

At 9 March 2004 the <strong>Centaur</strong> Communications<br />

Group held a net deferred tax asset of<br />

£2,164,000 and at 30 June 2004 the Group held<br />

a net deferred tax asset of £995,000. The details<br />

of these deferred tax positions are fully reflected<br />

in the "Deferred tax" note below (note 21).<br />

<strong>Centaur</strong> <strong>Holdings</strong> <strong>plc</strong><br />

42 Review 03/04