ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

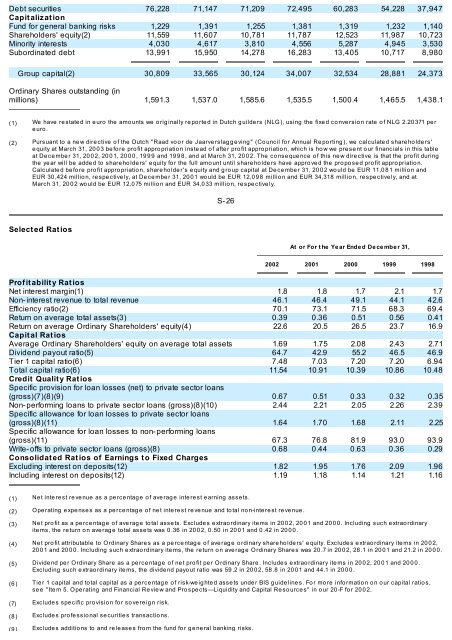

Debt securities 76,228 71,147 71,209 72,495 60,283 54,228 37,947<br />

Capit alizat ion<br />

Fund for general banking risks 1,229 1,391 1,255 1,381 1,319 1,232 1,140<br />

Shareholders' equity(2) 11,559 11,607 10,781 11,787 12,523 11,987 10,723<br />

Minority interests 4,030 4,617 3,810 4,556 5,287 4,945 3,530<br />

Subordinated debt 13,991 15,950 14,278 16,283 13,405 10,717 8,980<br />

Group capital(2) 30,809 33,565 30,124 34,007 32,534 28,881 24,373<br />

Ordinary Shares outstanding (in<br />

millions) 1,591.3 1,537.0 1,585.6 1,535.5 1,500.4 1,465.5 1,438.1<br />

(1) We have re state d in e uro the amo unts we o rig inally re po rte d in Dutch g uilde rs (NLG ), using the fixe d co nve rsio n rate o f NLG 2.20 371 pe r<br />

e uro .<br />

(2) Pursuant to a ne w dire ctive o f the Dutch " Raad vo o r de Jaarve rslag g e ving " (Co uncil fo r Annual Re po rting ), we calculate d share ho lde rs'<br />

e quity at March 31, 20 0 3 be fo re pro fit appro priatio n inste ad o f afte r pro fit appro priatio n, which is ho w we pre se nt o ur financials in this table<br />

at De ce mbe r 31, 20 0 2, 20 0 1, 20 0 0 , 19 9 9 and 19 9 8 , and at March 31, 20 0 2. The co nse que nce o f this ne w dire ctive is that the pro fit during<br />

the ye ar will be adde d to share ho lde rs' e quity fo r the full amo unt until share ho lde rs have appro ve d the pro po se d pro fit appro priatio n.<br />

Calculate d be fo re pro fit appro priatio n, share ho lde r's e quity and g ro up capital at De ce mbe r 31, 20 0 2 wo uld be EUR 11,0 8 1 millio n and<br />

EUR 30 ,424 millio n, re spe ctive ly, at De ce mbe r 31, 20 0 1 wo uld be EUR 12,0 9 8 millio n and EUR 34,318 millio n, re spe ctive ly, and at<br />

March 31, 20 0 2 wo uld be EUR 12,0 75 millio n and EUR 34,0 33 millio n, re spe ctive ly.<br />

S- 26<br />

Select ed Rat ios<br />

At or For t he Ye ar Ende d De ce mbe r 31,<br />

2002 2001 2000 1999 1998<br />

Prof it abilit y Rat ios<br />

Net interest margin(1) 1.8 1.8 1.7 2.1 1.7<br />

Non- interest revenue to total revenue 46.1 46.4 49.1 44.1 42.6<br />

Efficiency ratio(2) 70.1 73.1 71.5 68.3 69.4<br />

Return on average total assets(3) 0.39 0.36 0.51 0.56 0.41<br />

Return on average Ordinary Shareholders' equity(4) 22.6 20.5 26.5 23.7 16.9<br />

Capit al Rat ios<br />

Average Ordinary Shareholders' equity on average total assets 1.69 1.75 2.08 2.43 2.71<br />

Dividend payout ratio(5) 64.7 42.9 55.2 46.5 46.9<br />

Tier 1 capital ratio(6) 7.48 7.03 7.20 7.20 6.94<br />

Total capital ratio(6) 11.54 10.91 10.39 10.86 10.48<br />

Credit Qualit y Rat ios<br />

Specific provision for loan losses (net) to private sector loans<br />

(gross)(7)(8)(9) 0.67 0.51 0.33 0.32 0.35<br />

Non- performing loans to private sector loans (gross)(8)(10) 2.44 2.21 2.05 2.26 2.39<br />

Specific allowance for loan losses to private sector loans<br />

(gross)(8)(11) 1.64 1.70 1.68 2.11 2.25<br />

Specific allowance for loan losses to non- performing loans<br />

(gross)(11) 67.3 76.8 81.9 93.0 93.9<br />

Write- offs to private sector loans (gross)(8) 0.68 0.44 0.63 0.36 0.29<br />

Consolidat ed Rat ios of Earnings t o Fixed Charges<br />

Excluding interest on deposits(12) 1.82 1.95 1.76 2.09 1.96<br />

Including interest on deposits(12) 1.19 1.18 1.14 1.21 1.16<br />

(1) Ne t inte re st re ve nue as a pe rce ntag e o f ave rag e inte re st e arning asse ts.<br />

(2) O pe rating e xpe nse s as a pe rce ntag e o f ne t inte re st re ve nue and to tal no n-inte re st re ve nue .<br />

(3) Ne t pro fit as a pe rce ntag e o f ave rag e to tal asse ts. Exclude s e xtrao rdinary ite ms in 20 0 2, 20 0 1 and 20 0 0 . Including such e xtrao rdinary<br />

ite ms, the re turn o n ave rag e to tal asse ts was 0 .36 in 20 0 2, 0 .50 in 20 0 1 and 0 .42 in 20 0 0 .<br />

(4) Ne t pro fit attributable to O rdinary Share s as a pe rce ntag e o f ave rag e o rdinary share ho lde rs' e quity. Exclude s e xtrao rdinary ite ms in 20 0 2,<br />

20 0 1 and 20 0 0 . Including such e xtrao rdinary ite ms, the re turn o n ave rag e O rdinary Share s was 20 .7 in 20 0 2, 28 .1 in 20 0 1 and 21.2 in 20 0 0 .<br />

(5) Divide nd pe r O rdinary Share as a pe rce ntag e o f ne t pro fit pe r O rdinary Share . Include s e xtrao rdinary ite ms in 20 0 2, 20 0 1 and 20 0 0 .<br />

Excluding such e xtrao rdinary ite ms, the divide nd payo ut ratio was 59 .2 in 20 0 2, 58 .8 in 20 0 1 and 44.1 in 20 0 0 .<br />

(6 ) Tie r 1 capital and to tal capital as a pe rce ntag e o f risk-we ig hte d asse ts unde r BIS g uide line s. Fo r mo re info rmatio n o n o ur capital ratio s,<br />

se e " Ite m 5. O pe rating and Financial Re vie w and Pro spe cts—Liquidity and <strong>Capital</strong> Re so urce s" in o ur 20 -F fo r 20 0 2.<br />

(7) Exclude s spe cific pro visio n fo r so ve re ig n risk.<br />

(8 ) Exclude s pro fe ssio nal se curitie s transactio ns.<br />

(9 ) Exclude s additio ns to and re le ase s fro m the fund fo r g e ne ral banking risks.