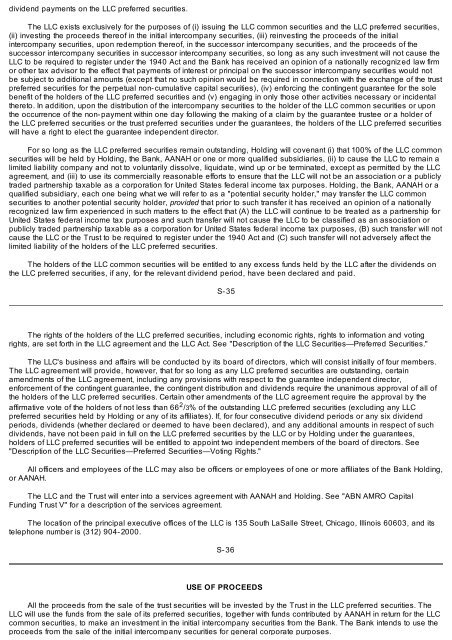

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

dividend payments on the LLC preferred securities.<br />

The LLC exists exclusively for the purposes of (i) issuing the LLC common securities and the LLC preferred securities,<br />

(ii) investing the proceeds thereof in the initial intercompany securities, (iii) reinvesting the proceeds of the initial<br />

intercompany securities, upon redemption thereof, in the successor intercompany securities, and the proceeds of the<br />

successor intercompany securities in successor intercompany securities, so long as any such investment will not cause the<br />

LLC to be required to register under the 1940 Act and the Bank has received an opinion of a nationally recognized law firm<br />

or other tax advisor to the effect that payments of interest or principal on the successor intercompany securities would not<br />

be subject to additional amounts (except that no such opinion would be required in connection with the exchange of the trust<br />

preferred securities for the perpetual non- cumulative capital securities), (iv) enforcing the contingent guarantee for the sole<br />

benefit of the holders of the LLC preferred securities and (v) engaging in only those other activities necessary or incidental<br />

thereto. In addition, upon the distribution of the intercompany securities to the holder of the LLC common securities or upon<br />

the occurrence of the non- payment within one day following the making of a claim by the guarantee trustee or a holder of<br />

the LLC preferred securities or the trust preferred securities under the guarantees, the holders of the LLC preferred securities<br />

will have a right to elect the guarantee independent director.<br />

For so long as the LLC preferred securities remain outstanding, <strong>Holding</strong> will covenant (i) that 100% of the LLC common<br />

securities will be held by <strong>Holding</strong>, the Bank, AANAH or one or more qualified subsidiaries, (ii) to cause the LLC to remain a<br />

limited liability company and not to voluntarily dissolve, liquidate, wind up or be terminated, except as permitted by the LLC<br />

agreement, and (iii) to use its commercially reasonable efforts to ensure that the LLC will not be an association or a publicly<br />

traded partnership taxable as a corporation for United States federal income tax purposes. <strong>Holding</strong>, the Bank, AANAH or a<br />

qualified subsidiary, each one being what we will refer to as a "potential security holder," may transfer the LLC common<br />

securities to another potential security holder, provided that prior to such transfer it has received an opinion of a nationally<br />

recognized law firm experienced in such matters to the effect that (A) the LLC will continue to be treated as a partnership for<br />

United States federal income tax purposes and such transfer will not cause the LLC to be classified as an association or<br />

publicly traded partnership taxable as a corporation for United States federal income tax purposes, (B) such transfer will not<br />

cause the LLC or the <strong>Trust</strong> to be required to register under the 1940 Act and (C) such transfer will not adversely affect the<br />

limited liability of the holders of the LLC preferred securities.<br />

The holders of the LLC common securities will be entitled to any excess funds held by the LLC after the dividends on<br />

the LLC preferred securities, if any, for the relevant dividend period, have been declared and paid.<br />

S- 35<br />

The rights of the holders of the LLC preferred securities, including economic rights, rights to information and voting<br />

rights, are set forth in the LLC agreement and the LLC Act. See "Description of the LLC Securities—Preferred Securities."<br />

The LLC's business and affairs will be conducted by its board of directors, which will consist initially of four members.<br />

The LLC agreement will provide, however, that for so long as any LLC preferred securities are outstanding, certain<br />

amendments of the LLC agreement, including any provisions with respect to the guarantee independent director,<br />

enforcement of the contingent guarantee, the contingent distribution and dividends require the unanimous approval of all of<br />

the holders of the LLC preferred securities. Certain other amendments of the LLC agreement require the approval by the<br />

affirmative vote of the holders of not less than 66 2 /3% of the outstanding LLC preferred securities (excluding any LLC<br />

preferred securities held by <strong>Holding</strong> or any of its affiliates). If, for four consecutive dividend periods or any six dividend<br />

periods, dividends (whether declared or deemed to have been declared), and any additional amounts in respect of such<br />

dividends, have not been paid in full on the LLC preferred securities by the LLC or by <strong>Holding</strong> under the guarantees,<br />

holders of LLC preferred securities will be entitled to appoint two independent members of the board of directors. See<br />

"Description of the LLC Securities—Preferred Securities—Voting Rights."<br />

All officers and employees of the LLC may also be officers or employees of one or more affiliates of the Bank <strong>Holding</strong>,<br />

or AANAH.<br />

The LLC and the <strong>Trust</strong> will enter into a services agreement with AANAH and <strong>Holding</strong>. See "<strong>ABN</strong> <strong>AMRO</strong> <strong>Capital</strong><br />

<strong>Funding</strong> <strong>Trust</strong> V" for a description of the services agreement.<br />

The location of the principal executive offices of the LLC is 135 South LaSalle Street, Chicago, Illinois 60603, and its<br />

telephone number is (312) 904- 2000.<br />

S- 36<br />

USE OF PROCEEDS<br />

All the proceeds from the sale of the trust securities will be invested by the <strong>Trust</strong> in the LLC preferred securities. The<br />

LLC will use the funds from the sale of its preferred securities, together with funds contributed by AANAH in return for the LLC<br />

common securities, to make an investment in the initial intercompany securities from the Bank. The Bank intends to use the<br />

proceeds from the sale of the initial intercompany securities for general corporate purposes.