ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

ABN AMRO Capital Funding Trust V ABN AMRO Holding N.V.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

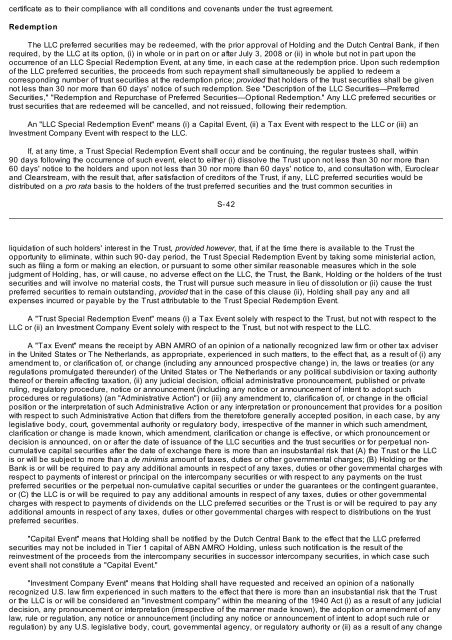

certificate as to their compliance with all conditions and covenants under the trust agreement.<br />

Redempt ion<br />

The LLC preferred securities may be redeemed, with the prior approval of <strong>Holding</strong> and the Dutch Central Bank, if then<br />

required, by the LLC at its option, (i) in whole or in part on or after July 3, 2008 or (ii) in whole but not in part upon the<br />

occurrence of an LLC Special Redemption Event, at any time, in each case at the redemption price. Upon such redemption<br />

of the LLC preferred securities, the proceeds from such repayment shall simultaneously be applied to redeem a<br />

corresponding number of trust securities at the redemption price; provided that holders of the trust securities shall be given<br />

not less than 30 nor more than 60 days' notice of such redemption. See "Description of the LLC Securities—Preferred<br />

Securities," "Redemption and Repurchase of Preferred Securities—Optional Redemption." Any LLC preferred securities or<br />

trust securities that are redeemed will be cancelled, and not reissued, following their redemption.<br />

An "LLC Special Redemption Event" means (i) a <strong>Capital</strong> Event, (ii) a Tax Event with respect to the LLC or (iii) an<br />

Investment Company Event with respect to the LLC.<br />

If, at any time, a <strong>Trust</strong> Special Redemption Event shall occur and be continuing, the regular trustees shall, within<br />

90 days following the occurrence of such event, elect to either (i) dissolve the <strong>Trust</strong> upon not less than 30 nor more than<br />

60 days' notice to the holders and upon not less than 30 nor more than 60 days' notice to, and consultation with, Euroclear<br />

and Clearstream, with the result that, after satisfaction of creditors of the <strong>Trust</strong>, if any, LLC preferred securities would be<br />

distributed on a pro rata basis to the holders of the trust preferred securities and the trust common securities in<br />

S- 42<br />

liquidation of such holders' interest in the <strong>Trust</strong>, provided however, that, if at the time there is available to the <strong>Trust</strong> the<br />

opportunity to eliminate, within such 90- day period, the <strong>Trust</strong> Special Redemption Event by taking some ministerial action,<br />

such as filing a form or making an election, or pursuant to some other similar reasonable measures which in the sole<br />

judgment of <strong>Holding</strong>, has, or will cause, no adverse effect on the LLC, the <strong>Trust</strong>, the Bank, <strong>Holding</strong> or the holders of the trust<br />

securities and will involve no material costs, the <strong>Trust</strong> will pursue such measure in lieu of dissolution or (ii) cause the trust<br />

preferred securities to remain outstanding, provided that in the case of this clause (ii), <strong>Holding</strong> shall pay any and all<br />

expenses incurred or payable by the <strong>Trust</strong> attributable to the <strong>Trust</strong> Special Redemption Event.<br />

A "<strong>Trust</strong> Special Redemption Event" means (i) a Tax Event solely with respect to the <strong>Trust</strong>, but not with respect to the<br />

LLC or (ii) an Investment Company Event solely with respect to the <strong>Trust</strong>, but not with respect to the LLC.<br />

A "Tax Event" means the receipt by <strong>ABN</strong> <strong>AMRO</strong> of an opinion of a nationally recognized law firm or other tax adviser<br />

in the United States or The Netherlands, as appropriate, experienced in such matters, to the effect that, as a result of (i) any<br />

amendment to, or clarification of, or change (including any announced prospective change) in, the laws or treaties (or any<br />

regulations promulgated thereunder) of the United States or The Netherlands or any political subdivision or taxing authority<br />

thereof or therein affecting taxation, (ii) any judicial decision, official administrative pronouncement, published or private<br />

ruling, regulatory procedure, notice or announcement (including any notice or announcement of intent to adopt such<br />

procedures or regulations) (an "Administrative Action") or (iii) any amendment to, clarification of, or change in the official<br />

position or the interpretation of such Administrative Action or any interpretation or pronouncement that provides for a position<br />

with respect to such Administrative Action that differs from the theretofore generally accepted position, in each case, by any<br />

legislative body, court, governmental authority or regulatory body, irrespective of the manner in which such amendment,<br />

clarification or change is made known, which amendment, clarification or change is effective, or which pronouncement or<br />

decision is announced, on or after the date of issuance of the LLC securities and the trust securities or for perpetual noncumulative<br />

capital securities after the date of exchange there is more than an insubstantial risk that (A) the <strong>Trust</strong> or the LLC<br />

is or will be subject to more than a de minimis amount of taxes, duties or other governmental charges; (B) <strong>Holding</strong> or the<br />

Bank is or will be required to pay any additional amounts in respect of any taxes, duties or other governmental charges with<br />

respect to payments of interest or principal on the intercompany securities or with respect to any payments on the trust<br />

preferred securities or the perpetual non- cumulative capital securities or under the guarantees or the contingent guarantee,<br />

or (C) the LLC is or will be required to pay any additional amounts in respect of any taxes, duties or other governmental<br />

charges with respect to payments of dividends on the LLC preferred securities or the <strong>Trust</strong> is or will be required to pay any<br />

additional amounts in respect of any taxes, duties or other governmental charges with respect to distributions on the trust<br />

preferred securities.<br />

"<strong>Capital</strong> Event" means that <strong>Holding</strong> shall be notified by the Dutch Central Bank to the effect that the LLC preferred<br />

securities may not be included in Tier 1 capital of <strong>ABN</strong> <strong>AMRO</strong> <strong>Holding</strong>, unless such notification is the result of the<br />

reinvestment of the proceeds from the intercompany securities in successor intercompany securities, in which case such<br />

event shall not constitute a "<strong>Capital</strong> Event."<br />

"Investment Company Event" means that <strong>Holding</strong> shall have requested and received an opinion of a nationally<br />

recognized U.S. law firm experienced in such matters to the effect that there is more than an insubstantial risk that the <strong>Trust</strong><br />

or the LLC is or will be considered an "investment company" within the meaning of the 1940 Act (i) as a result of any judicial<br />

decision, any pronouncement or interpretation (irrespective of the manner made known), the adoption or amendment of any<br />

law, rule or regulation, any notice or announcement (including any notice or announcement of intent to adopt such rule or<br />

regulation) by any U.S. legislative body, court, governmental agency, or regulatory authority or (ii) as a result of any change