Celebrating UFE Success! - Institute of Chartered Accountants of BC

Celebrating UFE Success! - Institute of Chartered Accountants of BC

Celebrating UFE Success! - Institute of Chartered Accountants of BC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

January 2010<br />

<strong>Celebrating</strong> <strong>UFE</strong><br />

<strong>Success</strong>!<br />

On the Cover<br />

Meet <strong>BC</strong>’s <strong>UFE</strong> honour<br />

roll students + get our <strong>UFE</strong><br />

results recap and the list <strong>of</strong><br />

<strong>BC</strong> passers<br />

In this issue<br />

Alexa Loo, CA, sets sights on 2010 Games<br />

Update on foreign affiliate residence<br />

Shareholder rights<br />

Member Pr<strong>of</strong>ile: Dave Oscienny, CA

T<br />

2<br />

d<br />

C<br />

2009 S

Congratulations<br />

to our newest generation <strong>of</strong> leaders!<br />

The partners, principals and staff at MacKay LLP would like to congratulate the 7 successful writers <strong>of</strong> the<br />

2009 Uniform Evaluation for <strong>Chartered</strong> <strong>Accountants</strong> in British Columbia. We commend the hard work,<br />

dedication and focus <strong>of</strong> our team members to achieve such impressive results on the 2009 <strong>UFE</strong>.<br />

Richard Doncom<br />

Kelowna<br />

Jena Friedrich<br />

Kelowna<br />

Nicole Parent<br />

Kelowna<br />

Dustin Stadnyk<br />

Kelowna<br />

Malcolm Ellison<br />

Vancouver<br />

Maryna Kirichuk<br />

Vancouver<br />

Peter Lok<br />

Vancouver<br />

<strong>Chartered</strong> <strong>Accountants</strong> & Business Advisors<br />

Kelowna<br />

500-1620 Dickson Avenue<br />

Kelowna, <strong>BC</strong> V1Y 9Y2<br />

Tel: (250) 763-5021<br />

Toll Free: 1 (866) 763-5021<br />

Surrey<br />

#112, 7565 - 132nd Street<br />

Surrey, <strong>BC</strong> V3W 1K5<br />

Tel: (604) 591-6181<br />

Vancouver<br />

1100 - 1177 West Hastings Street<br />

Vancouver, <strong>BC</strong> V6E 4T5<br />

Tel: (604) 687-4511<br />

Toll Free: 1 (800) 351-0426<br />

www.mackay.ca<br />

2009 <strong>Success</strong>ful <strong>UFE</strong> 00.indd 1 12/8/2009 1:41:24 PM

contents<br />

On the Cover<br />

6 Notes from the President<br />

Creating more student training<br />

positions<br />

8 For the Pr<strong>of</strong>ession<br />

<strong>UFE</strong> results recap for <strong>BC</strong> and<br />

CASB<br />

10 Research Corner<br />

Unreconciled differences<br />

12<br />

Meet <strong>BC</strong>’s <strong>UFE</strong><br />

Honour Roll<br />

Students!<br />

22<br />

Kudos to...<br />

<strong>BC</strong>’s 444 successful<br />

<strong>UFE</strong> candidates<br />

24<br />

Chasing a Dream<br />

Alexa Loo, CA, sets her<br />

sights on the 2010<br />

Olympic Winter Games<br />

28 Tax Traps & Tips<br />

An update on foreign affiliate<br />

residence<br />

30 Financial Facts & Money<br />

Matters<br />

Shareholder rights: More than<br />

meets the eye<br />

32 PD News<br />

Winter PD Highlights<br />

34 Plugged In<br />

News for and about members<br />

& students<br />

Movers & shakers in the<br />

pr<strong>of</strong>ession<br />

PRL Notice<br />

Notice from Member Services:<br />

Are you receiving the latest<br />

news?<br />

Volunteers Wanted<br />

Member Pr<strong>of</strong>ile:<br />

Dave Oscienny, CA<br />

42 Ethical Dilemmas<br />

Private trusts and client trust<br />

10%<br />

Cert no. SCS-COC-000648<br />

Jan 2010 ica.bc.ca 5

January 2010, No.484<br />

Published eight times annually by the<br />

<strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> <strong>Accountants</strong><br />

<strong>of</strong> British Columbia.<br />

Editor<br />

Michelle McRae<br />

More student training<br />

positions needed<br />

Design<br />

Blindfolio Design<br />

604-761-9212<br />

Advertising<br />

Advertising In Print<br />

Phone: 604-681-1811<br />

Fax: 604-681-0456<br />

Senior Director <strong>of</strong> External Affairs<br />

Lesley MacGregor<br />

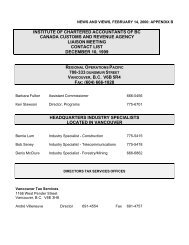

<strong>Institute</strong> Council<br />

Karen Keilty, FCA<br />

President<br />

Peter Norwood, FCA<br />

1st Vice-President<br />

Lenard Boggio, FCA<br />

2nd Vice-President<br />

Michael Macdonell, CA<br />

Treasurer<br />

Jack Arnold, CA<br />

Linda Lee Brougham, CA<br />

Kyman Chan, CA<br />

Karen Christiansen, CA<br />

John Crawford, CA<br />

Gordon Holloway, FCA<br />

David Hughes<br />

Anthony Mayer, CA<br />

Al McNair<br />

Sheila Nelson, CA<br />

John Sims, FCA<br />

James Topham, CA<br />

Kenneth Tung<br />

Praveen Vohora, CA<br />

Chief Executive Officer<br />

Richard Rees, FCA<br />

Beyond Numbers is printed in British Columbia and<br />

mailed eight times annually to more than 9,000<br />

chartered accountants and more than 1,800 CA students<br />

in public practice, industry, education, and government<br />

service throughout <strong>BC</strong>, Canada, and other countries.<br />

Beyond Numbers’ editorial and business <strong>of</strong>fices<br />

are located at:<br />

Suite 500, One Bentall Centre, 505 Burrard St., Box 22<br />

Vancouver, <strong>BC</strong> V7X 1M4<br />

Phone: 604-681-3264<br />

Toll-free in <strong>BC</strong>: 1-800-663-2677<br />

Fax: 604-681-1523<br />

Internet: www.ica.bc.ca<br />

Opinions expressed are not necessarily<br />

endorsed by the <strong>Institute</strong>.<br />

Beyond Numbers supports the CA pr<strong>of</strong>ession in <strong>BC</strong><br />

by sharing news from the <strong>Institute</strong> and news about<br />

members, by sharing viewpoints on issues <strong>of</strong> specific<br />

interest to members, and by promoting member<br />

involvement in <strong>Institute</strong> activities.<br />

Publications Mail Agreement No: 40062742<br />

Notes from the President<br />

Congratulations to <strong>BC</strong>’s 444 successful <strong>UFE</strong> candidates, and a special<br />

note <strong>of</strong> recognition to our 12 honour roll students (including this year’s<br />

National Gold Medallist), each <strong>of</strong> whom is pr<strong>of</strong>iled in our Cover Story on page 12.<br />

You represent the future <strong>of</strong> our pr<strong>of</strong>ession, and we are very proud <strong>of</strong> your<br />

achievement!<br />

As we celebrate the success <strong>of</strong> our <strong>UFE</strong> candidates, I want to ask each member<br />

to consider your role in helping to train future CAs. I ask this because the<br />

market continues to demand more CAs than are available, even though we<br />

currently have more members and students than ever before. The economic<br />

slump has led to fewer student training positions, and it is not uncommon now<br />

to see several candidates vying for each position; and those who do not<br />

secure a training position <strong>of</strong>ten end up pursuing other pr<strong>of</strong>essions. If we are to<br />

remain the pre-eminent accounting pr<strong>of</strong>ession in <strong>BC</strong> as demand continues to<br />

grow, the economy rallies, and more members retire, we must create more<br />

training positions.<br />

As detailed by Lara Greguric, CA, director <strong>of</strong> training <strong>of</strong>fices for the CA<br />

School <strong>of</strong> Business, in the September 2009 issue <strong>of</strong> the magazine, the new<br />

CA Practical Experience Requirements (PER) were mailed to each CA training<br />

<strong>of</strong>fice (CATO) in August 2009. As Lara explained, the new processes expand<br />

the areas in which students can be trained, giving CA firms the opportunity to<br />

create training positions in tax and finance, and allowing for new positions in<br />

industry. (With only one-third <strong>of</strong> our members working in public practice,<br />

these changes make obvious sense.)<br />

So I ask you to consider if your organization could train future CAs. I would<br />

also like to ask if there is anything the <strong>Institute</strong> could do to encourage you to<br />

start training students, or to train more students if your <strong>of</strong>fice is already a<br />

CATO?<br />

We are currently working on a comprehensive national strategy to ensure the<br />

continued pre-eminence <strong>of</strong> the CA pr<strong>of</strong>ession in Canada, and one aspect <strong>of</strong><br />

this strategy is expanding student training opportunities. We will keep you<br />

informed as the national strategy evolves. You can expect to hear more about<br />

training issues and demographics in the coming year.<br />

In the meantime, I welcome you to send me comments and questions at<br />

president@ica.bc.ca.<br />

–Karen Keilty, FCA<br />

6 ica.bc.ca Jan 2010

For the Pr<strong>of</strong>ession<br />

Year Flow-Through %<br />

2006 97.0%<br />

2007 95.9%<br />

2008* (cumulative 2nd attempt only) 93.4%<br />

*Because students are given three attempts at writing the <strong>UFE</strong>, the 2008 statistic is incomplete.<br />

<strong>UFE</strong> Results Recap<br />

for <strong>BC</strong> and CASB<br />

By Dr. Sheila Elworthy, CA<br />

CASB VP <strong>of</strong> Learning<br />

C<br />

ASB students had remarkable success<br />

on the 2009 Uniform Evaluation<br />

(<strong>UFE</strong>). On one <strong>of</strong> the world’s most<br />

challenging exams, 1,037 students demonstrated<br />

that they have achieved the level <strong>of</strong> competency<br />

required to become a CA. Moreover, 898 <strong>of</strong><br />

these students did so on their first attempt.<br />

<strong>BC</strong> has many reasons to celebrate, with 444<br />

successful <strong>UFE</strong> candidates—393 <strong>of</strong> whom<br />

passed on their first attempt!<br />

In addition, 24 <strong>of</strong> this year’s 51 national<br />

honour roll spots went to CASB students, 12<br />

<strong>of</strong> whom are from <strong>BC</strong>. Top honours went to<br />

<strong>BC</strong> student Jolene Kendrew <strong>of</strong> Victoria, who<br />

placed first on the <strong>UFE</strong> in Canada and won<br />

the Governor General’s Gold Medal. A big<br />

congratulations to Jolene!<br />

<strong>UFE</strong> flow-through rate<br />

The flow-through rate measures the number <strong>of</strong><br />

students who write the <strong>UFE</strong> and are ultimately<br />

successful in obtaining the CA designation. This<br />

statistic is relevant because CASB students who<br />

have yet to take (or pass) the <strong>UFE</strong> can take heart<br />

in knowing that more than 94% <strong>of</strong> the students<br />

who have written the <strong>UFE</strong> in the past several<br />

years did ultimately pass the exam.<br />

<strong>BC</strong> school performance<br />

We’re always proud <strong>of</strong> the top performers who emerge from our <strong>BC</strong> schools. The following table shows<br />

the number <strong>of</strong> successful students from each institution:<br />

School<br />

<strong>Success</strong>ful <strong>UFE</strong> Candidates<br />

British Columbia <strong>Institute</strong> <strong>of</strong> Technology 13<br />

British Columbia <strong>Institute</strong> <strong>of</strong> Technology – Co-op Program 1<br />

Capilano University 4<br />

Kwantlen Polytechnic University 9<br />

Okanagan University College 11<br />

Royal Roads University 9<br />

Simon Fraser University 51<br />

Simon Fraser University Co-op Program 13<br />

Thompson Rivers University 2<br />

Thompson Rivers University Open Learning 16<br />

Trinity Western University 6<br />

University <strong>of</strong> British Columbia 151<br />

University <strong>of</strong> British Columbia Co-op Program 14<br />

University <strong>of</strong> the Fraser Valley 7<br />

University <strong>of</strong> Northern British Columbia 15<br />

University <strong>of</strong> Victoria 33<br />

Vancouver Island University 6<br />

Competency-based learning<br />

CASB is very proud <strong>of</strong> the work we’re doing with competency-based learning. To become a wellrounded<br />

CA, an individual needs education, experience, and evaluation. The <strong>UFE</strong> has been<br />

competency-based for many years, and practical experience requirements recently became competencybased<br />

as well. We see CASB as the third part <strong>of</strong> the equation, providing education that prepares<br />

students for their work experience, for success on the <strong>UFE</strong>, and for long-term careers as CAs.<br />

Time to celebrate!<br />

CASB congratulates the 444 <strong>BC</strong> candidates who successfully wrote the <strong>UFE</strong>, and we give special<br />

congratulations to <strong>BC</strong>’s 12 honour roll students! We remain very pleased with the success <strong>of</strong> our<br />

program—both in <strong>BC</strong> and in Western Canada.<br />

A word about this year’s results recap<br />

You may notice that the recap looks different this year. In conjunction with the CICA and the other<br />

provincial institutes, the ICA<strong>BC</strong> has adopted a new national agreement on how to present the results.<br />

This approach focuses on flow-through rates rather than pass rates. Extensive additional data continues<br />

to be provided to and reviewed by Councils, CASB, and educators. This national decision was made<br />

earlier in 2009, without reference to the current results.<br />

8 ica.bc.ca Jan 2010

Smart, naturally.<br />

Motivated, definitely.<br />

On our team—fortunately.<br />

At Grant Thornton, we recognize the difference that each person can make. Imagine the impact that the<br />

following 22 high-performing, committed individuals can have.<br />

We are delighted to congratulate these members <strong>of</strong> our team for having recently passed the Uniform<br />

Evaluation (<strong>UFE</strong>), as well as for the distinctive service they <strong>of</strong>fer our clients every day. They go the extra<br />

mile in all they do, and we are thrilled to play a part in their ongoing success!<br />

Front row (left to right): Robert Brown, Joyce Cheung, Sarah Kim, Emma Whibley, Nancy Lum, Gurpreet Lidhar, Jancie Chiu, Tina Walia and Josh Matte.<br />

back row (left to right): Mike Scarlett, Andreas L’Abbé, Troy Melnychuk, Chris Warburton, Kelly Latzel, Keith D’Souza, James Stewart (Honour Roll),<br />

Lawrence Schouten, Mark Fairweather, Amir Moghadasi, Angelina Zhao, Holly Palmer and Chris Diaz.<br />

In British Columbia.<br />

Across Canada.<br />

www.GrantThornton.ca<br />

Audit • Tax • Advisory<br />

Grant Thornton LLP. A Canadian Member <strong>of</strong> Grant Thornton International Ltd

Research Corner<br />

Unreconciled<br />

Differences<br />

By Dr. Kin Lo, CA, Ph.D.<br />

For decades, the US Securities and Exchange<br />

Commission (SEC) has required<br />

foreign private issuers (FPIs)—non-US<br />

companies that list their securities on a US<br />

exchange—to reconcile their financial statements<br />

to US generally accepted accounting principles<br />

(GAAP). This requirement makes perfect sense<br />

because investors in the US who are buying<br />

securities need financial statements that are<br />

comparable between US and non-US companies.<br />

So what would happen if the SEC dropped<br />

this requirement? Wouldn’t investors be worse<br />

<strong>of</strong>f as a result <strong>of</strong> less information being available?<br />

A number <strong>of</strong> published studies show that investors<br />

consider the information provided in the<br />

reconciliation to be material, so wouldn’t they<br />

feel short-changed if this information were no<br />

longer available?<br />

Well, the SEC did, in fact, drop the reconciliation<br />

requirement for FPIs that use international<br />

financial reporting standards (IFRS), effective<br />

November 15, 2007. However, as detailed in a<br />

new research paper presented at the Sauder<br />

School <strong>of</strong> Business on November 20, 2009, the<br />

reaction to this change was not as expected.<br />

In The market reaction to eliminating the<br />

reconciliation requirement for US Foreign Private<br />

Issuers, Richard Willis, along with his colleagues<br />

Paul Chaney and Debra Jeter at Vanderbilt<br />

University, studied the effects <strong>of</strong> this regulatory<br />

change on investors. Going into the project, the<br />

three researchers expected negative consequences.<br />

The actual results, however, turned out to be the<br />

opposite.<br />

On average, shares in FPIs outperformed other<br />

firms during the events that led up to the<br />

rescission <strong>of</strong> the reconciliation requirement,<br />

which suggests that investors viewed the regulatory<br />

change favourably. In addition, the study found<br />

that investors tend to react more favourably<br />

when: a) there are higher proprietary costs <strong>of</strong><br />

disclosure; b) there is less information asymmetry<br />

among investors; and c) an FPI has higher information<br />

quality.<br />

This research shows that more isn’t necessarily<br />

better when it comes to investment information.<br />

The results suggest that the requirement to<br />

reconcile amounts from IFRS to US GAAP<br />

yielded limited benefits and significant costs,<br />

and that neither <strong>of</strong> the two standards is so<br />

superior to the other as to justify the additional<br />

cost <strong>of</strong> a reconciliation. In this case, less truly<br />

does seem to be more.<br />

Kin Lo, CA, Ph.D., holds the CA Pr<strong>of</strong>essorship<br />

in Accounting in the Sauder School <strong>of</strong> Business at<br />

U<strong>BC</strong>. The CA Pr<strong>of</strong>essorship is funded by the CA<br />

Education Foundation <strong>of</strong> <strong>BC</strong>. Send your questions<br />

on accounting research to Kin at kin.lo@sauder.<br />

ubc.ca.<br />

1<br />

At the time <strong>of</strong> this writing, The market<br />

reaction to eliminating the reconciliation<br />

requirement for US Foreign Private Issuers<br />

was a working paper. Interested parties can<br />

obtain a copy by contacting Pr<strong>of</strong>essor<br />

Richard Willis at richard.willis@owen.<br />

vanderbilt.edu.<br />

2<br />

The ICA<strong>BC</strong> provides financial support for<br />

accounting research workshops at U<strong>BC</strong>.<br />

Close the doors<br />

and walk away. Happy.<br />

The decision to sell a business is difficult,<br />

the process shouldn’t be. PricewaterhouseCoopers<br />

has an experienced, dedicated team to help you<br />

navigate the personal and financial issues around<br />

the transfer <strong>of</strong> business ownership.<br />

For more information,<br />

please contact:<br />

Jim McGuigan<br />

604 806 7594<br />

jim.j.mcguigan@ca.pwc.com<br />

Randy Garg<br />

604 806 7081<br />

randy.garg@ca.pwc.com<br />

Pirooz Pourdad<br />

604 806 7805<br />

pirooz.pourdad@ca.pwc.com<br />

www.pwc.com/ca<br />

© 2009 PricewaterhouseCoopers LLP. All rights reserved. “PricewaterhouseCoopers” refers to PricewaterhouseCoopers LLP, an Ontario limited liability partnership, or, as the context requires, the<br />

PricewaterhouseCoopers global network or other member firms <strong>of</strong> the network, each <strong>of</strong> which is a separate and independent legal entity. 1608-01<br />

10 ica.bc.ca Jan 2010

once again, an amazing pass<br />

rate for our ufe writers.<br />

10 ties cut in 2009!<br />

congratulations to<br />

Andy Tugume, Sarah Hundal, Alex Stewart, Priyanka Parkash,<br />

Margaret Puhacz, Mathew Lee, Elyse de Jong, Vipin Sachdeva,<br />

Garry Sum, Rosanne Lamarche<br />

Marine Building, 7th Floor 355 Burrard St. I Vancouver <strong>BC</strong> I V6C 2G8<br />

Tel: 604 687 1231 I Fax: 604 688 4675 I smytheratcliffe.com<br />

Jan 2010 ica.bc.ca 11

On the Cover<br />

Meet <strong>BC</strong>’s <strong>UFE</strong> Honour Roll<br />

Students for 2009!<br />

By Michelle McRae, Editor<br />

It is with great pleasure that we introduce the 12 <strong>BC</strong> students who made the national honour roll for the 2009 <strong>UFE</strong>:<br />

Jolene Kendrew (National Gold Medallist), Leanna Ho, Siobhan Hughes, Morgan Kenny, Grace Loh, Ilya Margulis,<br />

Sumeet Sangha, Matt Stevens, James Stewart, Dylan Vokey, Nina Wang, and Sean Wilson.<br />

Jolene Alice<br />

Kendrew<br />

(née Boehm) –<br />

National Gold<br />

Medallist<br />

<strong>UFE</strong> writers will tell you<br />

that walking out on that<br />

third day <strong>of</strong> the exam<br />

can leave you feeling<br />

numb, depressed, anxious, relieved… or some<br />

combination there<strong>of</strong>. Jolene Kendrew had<br />

hoped to emerge with a sense <strong>of</strong> confidence, but<br />

instead found herself full <strong>of</strong> doubt.<br />

“The experience was more emotionally and<br />

mentally draining than I expected it to be,” she<br />

says. “When I walked out <strong>of</strong> the exam, I was<br />

relieved that the three days were finally over, but<br />

I was completely exhausted. In the end, I felt<br />

just like everyone said I would—awful!”<br />

So it came as a complete shock when Jolene<br />

learned she’d not only made the national<br />

honour roll, but placed first in Canada, netting<br />

the Governor General’s Gold Medal.<br />

“I couldn’t believe it,” she says.<br />

Looking back, Jolene says the most challenging<br />

aspect <strong>of</strong> the entire <strong>UFE</strong> process was learning to<br />

walk away at 5:00pm and focus her energy on<br />

something other than the upcoming exam.<br />

“I knew that a balanced study plan was crucial<br />

for success,” she says, “but it was still difficult to<br />

walk away when a simulation didn’t go well.”<br />

The support <strong>of</strong> a few key people helped her<br />

stay focused and positive.<br />

“I couldn’t have managed this process without<br />

my husband Jeff supporting me and encouraging<br />

me to take time <strong>of</strong>f when I was burning out,”<br />

Jolene says. “And Jennifer Reed, CA, the acting<br />

director <strong>of</strong> finance for the City <strong>of</strong> Colwood, provided<br />

me with much needed encouragement<br />

and advice on surviving the summer—especially<br />

during the ‘low’ moments.”<br />

12 ica.bc.ca Jan 2010

P L A T I N U M M E M B E R<br />

She also gives credit to her study buddy, Laura<br />

Belding, an articling student with KPMG LLP<br />

in Victoria.<br />

“Laura kept the two <strong>of</strong> us on track,” Jolene<br />

says. “The hours <strong>of</strong> constructive discussion and<br />

feedback we shared helped us both continuously<br />

improve.”<br />

The pair met at KPMG, where Jolene completed<br />

her articles. She’d joined the Victoria <strong>of</strong>fice<br />

in 2006 after earning a bachelor <strong>of</strong> commerce<br />

degree with a specialization in general business<br />

from the University <strong>of</strong> Victoria.<br />

Jolene completed her articling experience in<br />

2008, and accepted a position in local government.<br />

Today, she’s the acting deputy director <strong>of</strong><br />

finance for the City <strong>of</strong> Colwood, a municipality<br />

just west <strong>of</strong> Victoria.<br />

Looking to the future, she says she hopes to get<br />

involved in CA education.<br />

“Growing up in Kelowna, I always wanted to<br />

be a teacher, because I loved helping others<br />

learn,” she says. “So I’d like to get involved in<br />

teaching and mentoring future CAs— through<br />

CASB and perhaps other post-secondary institutions.”<br />

With the <strong>UFE</strong> now behind her, Jolene is one<br />

step closer to this goal. Her advice to future<br />

writers is to seek encouragement and help when<br />

needed.<br />

“There will be moments where you feel like<br />

you’ve stopped improving, and those are the<br />

most difficult to get through,” she cautions.<br />

“Take breaks when you’re burning out and<br />

never give up—if you take the steps advised by<br />

those who came before you, you will be successful!”<br />

Jolene enjoys spending time with friends and<br />

family, running, highland dancing, and reading.<br />

09.OBRTurnbullAd1 12/9/09 11:28 AM Page 1<br />

Leanna Ho<br />

“When I walked out <strong>of</strong><br />

the <strong>UFE</strong>, I was very<br />

excited and relieved to<br />

finally be done,” says<br />

Leanna Ho. “I didn’t<br />

know what the outcome<br />

would be, but I knew I’d<br />

done my best.”<br />

For Leanna, the toughest part <strong>of</strong> the whole<br />

process was maintaining her confidence level.<br />

“When you’re preparing for the <strong>UFE</strong>, there are<br />

times when everything seems to fall into place<br />

with relatively little effort,” she says. “But then<br />

there are also days when nothing seems to work.<br />

The challenge, I think, lies in not getting<br />

discouraged on those days when you may not be<br />

performing at your peak. And what’s important<br />

is that you learn from your mistakes.”<br />

Also key, says Leanna, is developing a coherent<br />

preparation strategy.<br />

“The most rewarding part <strong>of</strong> my <strong>UFE</strong> experience<br />

was creating a study plan and sticking to<br />

it,” she recounts. “It gave me the confidence<br />

<strong>of</strong> knowing that I’d done the best I could to<br />

prepare myself for the exam.”<br />

Clearly, sticking to this study plan paid <strong>of</strong>f<br />

for the honour roll student. Also instrumental<br />

to her success, she says, was the help <strong>of</strong> her colleagues<br />

at Deloitte & Touche LLP in Vancouver.<br />

“My study partners, Kevin Burkett and Rob<br />

Kozak, provided support, and their critical analysis<br />

<strong>of</strong> my papers was really helpful,” Leanna<br />

says. “Also, Josh Samson, CA, was really<br />

supportive, my mentor Pejman Mahlooji, CA,<br />

helped me manage the stress, and my mentor<br />

Robyn Corney, CA, provided valuable advice<br />

to improve my case writing, and reminded me to<br />

take time <strong>of</strong>f from studying.”<br />

Leanna also gives credit to loved ones.<br />

“My parents were always supporting and<br />

encouraging me, and my brother Alex lent me<br />

his lucky t-shirt,” she says. “My friends, too,<br />

were really supportive and helped me relax and<br />

enjoy my time away from studying.”<br />

Now as she works on completing her articling<br />

experience at Deloitte, Leanna is focused on the<br />

mining sector. The University <strong>of</strong> <strong>BC</strong> graduate<br />

earned a bachelor <strong>of</strong> science in mathematics<br />

in 2006, and completed U<strong>BC</strong>’s Diploma in<br />

Accounting program in 2007. In the future, she<br />

hopes to work and travel internationally.<br />

In the meantime, however, Leanna <strong>of</strong>fers<br />

some advice to next year’s <strong>UFE</strong> writers: “Try to<br />

maintain a positive attitude, and make sure to take<br />

time away from studying to enjoy the summer.”<br />

Leanna enjoys playing ice hockey, roller hockey,<br />

and s<strong>of</strong>tball, and also enjoys travelling.<br />

Siobhan<br />

Hughes<br />

Growing up, Siobhan<br />

Hughes imagined she<br />

would some day have a<br />

career in the sports<br />

industry. Siobhan never<br />

thought she would end<br />

up in accounting, like<br />

her father, Aidan Hughes, CA. After learning<br />

about the flexibility <strong>of</strong> the CA designation,<br />

however, Siobhan eventually decided to enrol as<br />

an accounting major in the Sauder School <strong>of</strong><br />

Business Co-op program at the University <strong>of</strong><br />

<strong>BC</strong>. She graduated from U<strong>BC</strong> with a bachelor<br />

<strong>of</strong> commerce degree (with honours) in May<br />

2009.<br />

Protect it. Grow it.<br />

In That Order<br />

Ross Turnbull, CA, CBV, CFA<br />

Director, Portfolio Manager<br />

Average Monthly Performance<br />

(Dec/94 – Nov/09)<br />

3.5%<br />

4.0%<br />

Performance Since Inception<br />

(Dec/94 – Nov/09)<br />

781%<br />

Tel 604 844 5363<br />

Toll Free 1 888 886 3586<br />

rturnbull@odlumbrown.com<br />

up months<br />

(60% <strong>of</strong> time)<br />

down months<br />

(40% <strong>of</strong> time)<br />

275%<br />

odlumbrown.com<br />

trust • vision • investment integrity<br />

*The Model is an all-equity portfolio established by the Research Department in December 1994, with a<br />

hypothetical investment <strong>of</strong> $250,000. The Model provides a basis with which to measure the quality <strong>of</strong><br />

our advice and the effectiveness <strong>of</strong> our disciplined investment strategy. Trades are made using the<br />

closing price on the day a change is announced. These are gross figures before fees. Past performance is<br />

not indicative <strong>of</strong> future performance. MEMBER CIPF<br />

-1.9%<br />

-3.8%<br />

ob model portfolio*<br />

s&p/tsx total return index<br />

Portfolio measurements and comparisons are done at mid-month and not month end.<br />

ob model<br />

portfolio*<br />

s&p/tsx total<br />

return index<br />

Jan 2010 ica.bc.ca 13

Siobhan is currently articling with Ernst &<br />

Young LLP in Vancouver, and works in the<br />

firm’s assurance group, focusing primarily on<br />

public mining companies. She hopes to work<br />

abroad in the future, but is content, for the time<br />

being, to simply enjoy her success on the <strong>UFE</strong>.<br />

For helping her succeed, Siobhan credits a few<br />

key supporters.<br />

“My boyfriend, Craig Hall, CA, went through<br />

the <strong>UFE</strong> process in 2008 and was a tremendous<br />

help to me,” she says. “He gave me advice,<br />

helped me stay calm, and provided the support<br />

I needed. Also, my E&Y study partners, Peter<br />

Portka and Richard Rawnsley, were great at<br />

helping me stay focused, while still managing to<br />

make me laugh. And my parents provided<br />

constant support—this has been a difficult<br />

process at times, but they were always there<br />

when I needed them.”<br />

Most challenging about the <strong>UFE</strong> process, she<br />

says, was staying motivated.<br />

“There were study days when a hard practice<br />

simulation would just deflate my confidence,”<br />

she remembers. “Learning to take what you can<br />

from those simulations and move on is a tough<br />

thing to do.”<br />

Tough, but well worth the effort.<br />

“I didn’t feel overly confident after the last day<br />

<strong>of</strong> the exam, but I felt that it went alright,” she<br />

dap_beyondnumbers_sep09.eps 9/9/2009 1:56:57 PM<br />

remembers. “Mainly, I was just happy to be<br />

done, and ready to celebrate with my friends.<br />

It’s a great feeling when you walk out—all the<br />

stress is replaced with excitement!”<br />

Her advice to future <strong>UFE</strong> writers is as to try to<br />

enjoy the summer.<br />

“Don’t study too late, and take Fridays <strong>of</strong>f<br />

when you need to,” she says, adding: “Also,<br />

make sure you have the right study group—<br />

people you can get along with for two months<br />

but who aren’t afraid to tell you when you’re<br />

wrong.”<br />

Siobhan enjoys travelling, spending time with<br />

friends and family, watching hockey games, and<br />

practising yoga.<br />

Morgan Kenny<br />

“I never believed past<br />

writers when they said<br />

it’s impossible to tell<br />

how you’ve done on the<br />

exam, but it’s true,” says<br />

Morgan Kenny. “I had<br />

no idea if I’d passed.”<br />

Even more challenging<br />

than the exam itself, she says, was maintaining<br />

her confidence level in the months leading up to<br />

the exam.<br />

“It’s a long summer, and sometimes it can<br />

seem like you’re not making much progress,”<br />

she explains. “So it can be challenging to<br />

maintain perspective and not let the stress<br />

overwhelm you.”<br />

Morgan says the support <strong>of</strong> family, friends,<br />

and study partners helped her stay positive.<br />

“My mom, dad, and brothers had complete<br />

confidence in me, and always reminded me<br />

to have fun and take breaks,” she says. “My<br />

roommate was always willing to listen, even in<br />

my most irrational moments—she knows more<br />

about the <strong>UFE</strong> than any non-CA student<br />

should! My study partners at KPMG LLP in<br />

Vancouver—Danny Gollogy and Dan Jover—<br />

believed in me even when I didn’t. They made<br />

me laugh all summer, and at the same time,<br />

continuously challenged me.<br />

“I was also fortunate to have an amazing<br />

support team at my firm,” Morgan adds. “I’m<br />

grateful to my mentor, Joel Boyd, CA, everyone<br />

at Brentwood, and the KPMG marking pool<br />

for their invaluable feedback and well-timed<br />

words <strong>of</strong> encouragement.”<br />

Her advice to future writers is to keep the<br />

positivity flowing.<br />

“Believe in yourself as best you can,” she says,<br />

“and surround yourself with people who will<br />

believe in you even when you can’t.”<br />

With the <strong>UFE</strong> now behind her, Morgan is<br />

focusing on completing her articling experience<br />

at KPMG. She’s currently working in the<br />

information, communication, and entertainment<br />

assurance practice, with both public and<br />

private sector clients.<br />

Her work enables Morgan to draw on a<br />

multi-disciplined background that includes<br />

a bachelor <strong>of</strong> science degree with a major in<br />

computer science and a minor in commerce<br />

from the University <strong>of</strong> <strong>BC</strong> (2006) and completion<br />

<strong>of</strong> U<strong>BC</strong>’s Diploma in Accounting program<br />

(2007).<br />

“I’ve been able to put many <strong>of</strong> the skills I<br />

learned during my computer science degree to<br />

use while working at KPMG,” she says, “and<br />

I’m extremely happy with the path I’ve taken.”<br />

Morgan was born in Fremont, California, and<br />

raised in Nanoose Bay, on Vancouver Island. In<br />

her spare time, she enjoys swimming, playing on the<br />

KPMG dodgeball team, socializing with friends,<br />

and playing golf, which she took up over the <strong>UFE</strong><br />

summer.<br />

14 ica.bc.ca Jan 2010

© 2009 Ernst & Young LLP. All rights reserved.<br />

Tomorrow’s leaders<br />

Congratulations to the Vancouver <strong>of</strong>fice’s<br />

successful <strong>UFE</strong> writers.<br />

What’s next?<br />

ey.com/ca<br />

Pam Calderon Di Chen Eason Chen David Choi Paul Cormack Dave Evans Richard Gill<br />

Dave Harper John Inthavixay Ashley Kates Dasha Kotliarova Juliana Kung Carol Lee Louisa Lun<br />

Diana Martins Corinne Meldrum John Miller Scott Nichols Laurel O’Brien Peter Portka Richard Rawnsley<br />

Aly Sheriff Michelle So Peter Venetsanos Georg Woernle Jeremy Wong Jessy Xu Jessica Zhan<br />

Jan 2010 ica.bc.ca 15

Grace Loh<br />

“I would describe the<br />

feeling I had walking out<br />

<strong>of</strong> the <strong>UFE</strong> as surreal,”<br />

says Grace Loh. “After<br />

an intensive two-year<br />

period <strong>of</strong> study and<br />

work, and an even more<br />

demanding summer, I<br />

was simply relieved that it was over.”<br />

An articling student with mid-sized firm D&H<br />

Group LLP in Vancouver, Grace is currently<br />

focused on providing audit, assurance, and<br />

business advisory services to private enterprises.<br />

Prior to joining the CASB program, Grace<br />

earned a bachelor <strong>of</strong> commerce degree, majoring<br />

in finance (2003) and a bachelor <strong>of</strong> laws<br />

(2006)—both from the University <strong>of</strong> <strong>BC</strong>.<br />

Her subsequent decision to pursue the CA<br />

designation was based on several factors.<br />

“I respected how the program combined<br />

practical work experience with comprehensive<br />

training and evaluation,” she says. “I also recognized<br />

that the CA designation opens a lot <strong>of</strong><br />

doors, and I was excited to work with and learn<br />

from knowledgeable pr<strong>of</strong>essionals.”<br />

Grace says the pr<strong>of</strong>essionals at D&H were vital<br />

to her success on the <strong>UFE</strong>.<br />

“The partners and staff provided ongoing<br />

encouragement and support throughout the<br />

<strong>UFE</strong> process,” she says. “My <strong>UFE</strong> coaches at<br />

D&H, Jack Chan, CA, and Jennifer Manarin,<br />

CA, provided valuable guidance; and my mentors<br />

there—Jason Chang, CA, Jessica Chou, CA,<br />

and Loan Nguyen, CA—helped me build my<br />

confidence and develop a disciplined approach<br />

to case writing.<br />

“I’m also indebted to Michelle Young and my<br />

study partner Connie Shum, both also at<br />

D&H,” Grace adds. “Michelle kept me grounded,<br />

and Connie provided infinite patience and<br />

honest feedback. I’m privileged to have shared<br />

this experience with them.”<br />

Lastly, Grace credits her family and friends for<br />

providing “unconditional support and letting<br />

me chart my own path.”<br />

Looking back, she says the most challenging<br />

aspect <strong>of</strong> the <strong>UFE</strong> process was overcoming the<br />

idea <strong>of</strong> the <strong>UFE</strong>. “Adjusting my mindset to<br />

perceive the <strong>UFE</strong> as simply another exam (albeit<br />

a very long and arduous one) took time,” she says.<br />

The most rewarding aspect was the sense <strong>of</strong><br />

accomplishment she felt after writing the exam.<br />

“Regardless <strong>of</strong> whether I passed or failed,” Grace<br />

says, “it marked the end <strong>of</strong> a rigorous period <strong>of</strong><br />

my life.”<br />

Her advice to future <strong>UFE</strong> writers is to take<br />

time to debrief their practice cases thoroughly:<br />

“Ultimately, I found that there was no better<br />

way to learn than from my own omissions and<br />

errors.”<br />

Grace enjoys travelling, reading, and learning<br />

different languages.<br />

Ilya Margulis<br />

“As I looked up at my<br />

timer to see that there<br />

were only 30 minutes<br />

left in the exam, I got<br />

this excited and jittery<br />

feeling, knowing that I<br />

was only minutes away<br />

from finishing one <strong>of</strong> the<br />

most challenging things I’d ever faced in my<br />

life,” remembers Ilya Margulis. “I literally had to<br />

force myself to focus on finishing the exam, and<br />

then I walked out <strong>of</strong> there in a sort <strong>of</strong> daze, not<br />

knowing if I had done well, but knowing that I<br />

had put in the best effort I could.”<br />

Ilya is a senior accountant with Walsh King<br />

LLP in Vancouver, where he currently focuses<br />

on audit and tax work. He is a graduate <strong>of</strong> the<br />

University <strong>of</strong> <strong>BC</strong>’s Co-op program, having<br />

completed a bachelor <strong>of</strong> commerce degree with<br />

a dual specialty <strong>of</strong> accounting and management<br />

information systems in 2007.<br />

According to Ilya, the most challenging aspect<br />

<strong>of</strong> the <strong>UFE</strong> experience was the level <strong>of</strong> commitment<br />

involved.<br />

“It was hard to wake up every morning and<br />

write practice exams every day for weeks on<br />

end,” he says. “But when the time came to<br />

actually write the exam, I was finally able to kick<br />

into that ‘extra gear’ and focus.”<br />

For helping him succeed on the <strong>UFE</strong>, Ilya<br />

gives credit to a number <strong>of</strong> supporters.<br />

“My family helped by providing encouragement<br />

and believing in me; the management <strong>of</strong><br />

Walsh King helped by providing me with work<br />

experience I could lean on during the exam; and<br />

my co-workers and friends who had already gone<br />

through this process provided valuable feedback<br />

and support, and marked exams for me,” he<br />

says. “In particular, I want to thank Kulwant<br />

Sidhu, CA, a tax consultant at Walsh King;<br />

Kevin Walsh, CA, a tax manager at Walsh<br />

King; and Matt Stradiotti, CA, <strong>of</strong> The Bowra<br />

Group, for helping me get through the months<br />

<strong>of</strong> study with minimal stress.”<br />

Stress management, he says, is key to success<br />

on the <strong>UFE</strong>.<br />

“My most important piece <strong>of</strong> advice for<br />

future writers is to do everything possible to<br />

keep your stress level down, and to not study to<br />

the point <strong>of</strong> exhaustion,” says Ilya. “It’s incredibly<br />

important to keep a steady routine that includes<br />

16 ica.bc.ca Jan 2010

plenty <strong>of</strong> time for sleep and fun. And be sure to<br />

seek out and follow the advice <strong>of</strong> people who’ve<br />

been through the process already—they understand<br />

what you’re going through.”<br />

Born in Moscow, Ilya moved to Canada at age 7,<br />

and grew up in Richmond, <strong>BC</strong>. He enjoys spending<br />

time with friends and family, watching movies and<br />

hockey, rollerblading, and spending time outdoors.<br />

Sumeet Sangha<br />

“Growing up, my career<br />

choices were all over the<br />

place,” recalls Sumeet<br />

Sangha. “I never saw<br />

myself as an accountant,<br />

but as I grew older, I<br />

realized that becoming a<br />

CA would provide me<br />

with a wide array <strong>of</strong> opportunities and career<br />

flexibility.”<br />

So after earning a bachelor <strong>of</strong> business administration<br />

(with a concentration in accounting)<br />

from Simon Fraser University in 2007, Sumeet<br />

began articling with BDO Dunwoody LLP, in<br />

the firm’s Langley <strong>of</strong>fice. Currently, his focus is<br />

on assurance.<br />

Looking back over the <strong>UFE</strong> experience,<br />

Sumeet says the biggest challenge was actually<br />

learning to study less.<br />

“I knew the <strong>UFE</strong> was going to be the biggest<br />

exam I’d ever written, and my natural instinct<br />

was to study every waking hour and cram as<br />

much information into my head as possible,” he<br />

explains. “So I had to learn how to take my<br />

mind <strong>of</strong>f the exam at the end <strong>of</strong> each study day,<br />

and take time to relax and recharge my batteries<br />

to keep my focus throughout the summer.”<br />

That’s why Sumeet advises future <strong>UFE</strong> writers<br />

to maintain a level <strong>of</strong> balance.<br />

“It’s important to not let the <strong>UFE</strong> process<br />

overwhelm you,” he says. “Maintaining a<br />

balance during the preparation will enable you<br />

to walk into the exam feeling fresh and sharp<br />

mentally.”<br />

Sumeet says friends and family helped him<br />

achieve this balance by “keeping me level-headed,<br />

and providing the support I needed to get<br />

through the exam.” He also credits his success<br />

on the <strong>UFE</strong> to the support <strong>of</strong> several key people<br />

at his firm.<br />

“David Reznick, CA, my <strong>UFE</strong> mentor, and<br />

Dan Rudd, CA—both from BDO—shared<br />

their <strong>UFE</strong> experiences with me, and provided<br />

various tips and pointers to help me succeed,” he<br />

says. “And my study partner at BDO, Justin<br />

Leung, provided the feedback and constructive<br />

criticism I needed to address my weaknesses.”<br />

Sumeet remembers feeling a mixture <strong>of</strong> relief<br />

and uncertainty after the last day <strong>of</strong> the <strong>UFE</strong>.<br />

Now, with this hurdle past him, he says he’s<br />

excited to see what the future holds.<br />

Sumeet enjoys golfing, playing basketball, hanging<br />

out with his friends, and watching sports.<br />

Matt Stevens<br />

As a kid growing up in<br />

North Vancouver, Matt<br />

Stevens dreamt <strong>of</strong> a career<br />

playing pro-football<br />

with the Green Bay<br />

Packers. “I was a wide<br />

receiver growing up,” he<br />

says, “and Brett Favre<br />

was in his prime in those days.”<br />

By the time he got to university, however,<br />

finance had won out over pro-sports. Matt went<br />

on to earn a bachelor <strong>of</strong> accounting from the<br />

University <strong>of</strong> <strong>BC</strong> in 2007, and completed an<br />

MPAcc degree at the University <strong>of</strong> Saskatchewan<br />

in the summer <strong>of</strong> 2009.<br />

Now articling with KPMG LLP in the firm’s<br />

Vancouver <strong>of</strong>fice, Matt is focusing on real estate<br />

and financial institutions. In the future, he<br />

hopes to gain some international experience,<br />

live in a different culture, and also work with a<br />

start-up company.<br />

“As long as I’m in a position where I’m con-

tinually learning and being challenged, I think<br />

I’ll be happy with my work,” he says.<br />

As for the challenges <strong>of</strong> the <strong>UFE</strong> process, Matt<br />

says his biggest obstacle was staying focused<br />

during the three days <strong>of</strong> the exam.<br />

“The cases are broad enough that you could<br />

write for hours and still have things you want to<br />

say, so it was a struggle to put each case behind<br />

me and focus on the next,” he explains. “I<br />

understand now why people say they want to<br />

quit after the first day. I did feel a bit better after<br />

the second and third days, but I still had no idea<br />

if I’d done well.”<br />

For helping him “survive” the <strong>UFE</strong>, Matt credits<br />

the support <strong>of</strong> friends, mentors, and family.<br />

“I feel privileged to have studied with Mike<br />

Woeller and Graham Hindson, my study<br />

buddies at KPMG,” he says. “The three <strong>of</strong> us<br />

challenged each other every day for four weeks.<br />

And my mentors at KPMG—Jeff Louie, CA;<br />

Roopa Dave, CA (now with the <strong>BC</strong> Children’s<br />

and Women’s Hospital); and Nicole Comey, CA,<br />

provided intellectual and emotional support<br />

whenever I needed it, and then some. The whole<br />

support network at KPMG and the pr<strong>of</strong>essors <strong>of</strong><br />

the MPAcc program were also huge factors.<br />

“Lastly,” Matt adds, “I thank my family—<br />

especially my mom, my dad, and my sister—for<br />

their ongoing support throughout the articling<br />

process and in life.”<br />

Matt’s advice to future <strong>UFE</strong> writers? “It sounds<br />

clichéd,” he says, “but I think confidence is the<br />

key. Don’t let a bad day ruin your mindset,<br />

because you can recover from it, and it’s likely<br />

that you’ve done way better than you think.”<br />

Matt enjoys skiing, playing golf, reading books,<br />

and watching movies. He also enjoys “tumbling,”<br />

which he describes as “a European sport requiring<br />

equilibrium and perseverance that is played in<br />

teams <strong>of</strong> ten.” The moustache Matt’s sporting<br />

in his photo was grown for “Mo’vember,” an<br />

international charitable event that happens every<br />

November to raise funds for men’s health issues. In<br />

Canada, money raised during Mo’vember goes<br />

directly to Prostate Cancer Canada.<br />

James Stewart<br />

“It was a very intense and<br />

exhausting three days,”<br />

says James Stewart <strong>of</strong><br />

the <strong>UFE</strong>. “Walking out<br />

<strong>of</strong> the exam, I just felt<br />

relieved that it was over.”<br />

James is an articling student<br />

at Grant Thornton<br />

LLP in Kelowna, where he’s currently focused<br />

on audit. In 2004-2005, he completed two<br />

co-op terms at Grant Thornton while also<br />

completing his university degree at Okanagan<br />

University College (which split into Okanagan<br />

College and U<strong>BC</strong>-Okanagan in his final year).<br />

James took the business program’s accounting<br />

option and earned a bachelor <strong>of</strong> business<br />

administration in 2007.<br />

With regard to the <strong>UFE</strong>, James says the most<br />

challenging thing about the entire experience<br />

was not the exam itself, but the fatigue that set<br />

in during the last few weeks <strong>of</strong> study.<br />

“At that point, I was tired <strong>of</strong> studying and<br />

writing practice questions,” he recounts. “I was<br />

concerned that I might be burning out and just<br />

wanted it all to be over with.”<br />

With the <strong>UFE</strong> now safely behind him and<br />

WOLRIGE MAHON LLP IS PROUD TO CONGRATULATE OUR 2009 <strong>UFE</strong> WRITERS!<br />

From left to right:Jacqueline Cua, May Cheng, Beatrix Wiriahardja, Jeanne Lee, Travis Taylor, Aliya Rawji, Mona King, Gabriela Oteiza Dunn<br />

Our firm consistently demonstrates high <strong>UFE</strong> pass rates year<br />

after year producing top notch CA pr<strong>of</strong>essionals to handle the<br />

business needs <strong>of</strong> our valued clients.<br />

The <strong>UFE</strong> is a milestone career achievement that will allow our<br />

<strong>UFE</strong> Grads to accelerate their careers in one <strong>of</strong> <strong>BC</strong>’s largest<br />

independent CA firms.<br />

900 - 400 Burrard Street<br />

Vancouver, <strong>BC</strong> V6C 3B7<br />

Tel: 604-684-6212<br />

www.wolrigemahon.com<br />

18 ica.bc.ca Jan 2010

study burnout no longer a concern, James gives<br />

credit for his success to the support <strong>of</strong> his study<br />

partners at Grant Thornton.<br />

“I definitely want to thank my fellow <strong>UFE</strong><br />

writers at the firm: Mike Scarlett, Gurpreet<br />

Lidhar, Chris Warburton, and Mark Fairweather,”<br />

says James. “I wasn’t really nervous walking<br />

into each day <strong>of</strong> the exam, and I think that was<br />

largely due to the study routine the five <strong>of</strong> us<br />

had developed, which allowed us to get used to<br />

writing with other people in the room.<br />

“I also want to thank my family, my friends,<br />

and my girlfriend for supporting me throughout<br />

the whole <strong>UFE</strong> process,” he says.<br />

His advice to future writers is to find a study<br />

plan that works for them.<br />

“And be sure to take a few days <strong>of</strong>f if you feel<br />

like you’re starting to burnout,” James adds.<br />

“Also, I recommend finding a hobby or activity<br />

that will take your mind <strong>of</strong>f <strong>of</strong> studying and<br />

the exam. My summer golf membership was<br />

probably one <strong>of</strong> the best investments I made!”<br />

James grew up in Salmon Arm and moved to<br />

Kelowna after graduating from high school. He<br />

enjoys playing golf, volleyball, and s<strong>of</strong>tball.<br />

Dylan Vokey<br />

“I felt an enormous sense<br />

<strong>of</strong> relief, but I had no<br />

idea how I’d done,” says<br />

Dylan Vokey, remembering<br />

his post-<strong>UFE</strong><br />

mood. “I’m sure I was<br />

just as nervous as the<br />

next writer about my<br />

results until I received the good news from my<br />

firm.”<br />

The firm is KPMG LLP in Burnaby, where<br />

Dylan is currently focusing on audits for midsized<br />

private companies. The articling student<br />

graduated from Simon Fraser University in June<br />

2009 with a bachelor <strong>of</strong> business administration<br />

and a certificate in liberal arts. Through his<br />

co-op terms with KPMG, Dylan had the opportunity<br />

to write the <strong>UFE</strong> right after graduation,<br />

before starting his articles full-time.<br />

Looking back, he says his biggest <strong>UFE</strong><br />

challenge as learning to trust his gut.<br />

“The analytical side <strong>of</strong> my brain was approaching<br />

each new case with the previous one still in<br />

mind,” Dylan recounts. “It wasn’t until I began<br />

to follow my instincts fully, in the final week <strong>of</strong><br />

studying, that I was able to adapt to each new<br />

scenario thrown at me, and <strong>of</strong>fer analyses and<br />

solutions that were truly my own.”<br />

He credits the “enormous” support provided<br />

by his firm for much <strong>of</strong> his success on the <strong>UFE</strong>.<br />

“KPMG provided rigorous in-house preparation<br />

and a strong support system, and my<br />

KPMG <strong>UFE</strong> mentor, Steven Bao, CA, had an<br />

uncanny ability to call me at exactly the right<br />

time,” Dylan says. “Also, my study buddy<br />

Dorothy Woo and her mentor Ian Wells, CA<br />

(both at KPMG) marked my responses and<br />

really helped me keep on my toes.<br />

“I am also grateful for the support <strong>of</strong> my<br />

parents Richard and Arlene Vokey, former<br />

journalists and now novelists, and my wonderful<br />

girlfriend Rebecca, a literature student,” he says.<br />

“They helped me find my personal approach to<br />

the <strong>UFE</strong>: ‘First, find the plot; second, finish the<br />

story.’”<br />

As for how his own story will unfold, Dylan is<br />

weighing several possibilities.<br />

“I’ve always had an interest in corporate<br />

finance and private equity,” he says. “But I also<br />

like the idea <strong>of</strong> graduate school.”<br />

Dylan was born in Makati in the Philippines,<br />

and raised in Port Moody, <strong>BC</strong>. He enjoys reading,<br />

writing, and travelling. He also trains in Hapkido<br />

and plays soccer and tennis to stay in shape.<br />

Congratulations to our 16 successful 2009 <strong>UFE</strong> writers.<br />

FROM THE LEFT (top):<br />

Greg Kaniewski, Jamie Soo,<br />

Cara Pavlakovic, Anne Chow,<br />

Kelly Taylor, Alexis Ahn,<br />

Meg Wilson, Richard<br />

Konings, Jana Moore,<br />

Ivy Wang, Brian Pogue<br />

FROM THE LEFT (bottom):<br />

Michael Auras, Chris Scalena,<br />

Sara Maseko, Christina<br />

Helsing, Kim Antifave<br />

DMCL <strong>Chartered</strong> <strong>Accountants</strong> is proud – with a 94% pass rate –<br />

to recognize the commitment required to be the best!<br />

OUR FUTURE CHARTERED ACCOUNTANTS<br />

www.dmcl.ca<br />

DMCL_numbers_ad.indd 1<br />

12/14/09 9:21:49 AM<br />

Jan 2010 ica.bc.ca 19

They came,<br />

they wrote, they<br />

conquered*<br />

Congratulations to our 53 successful writers<br />

<strong>of</strong> the 2009 Uniform Evaluation for<br />

<strong>Chartered</strong> <strong>Accountants</strong> in British Columbia<br />

Carmen Amezquita Hernandez • Rebecca Aziz • Michelle Baldwin • Whitney Ball • Lisa Blandford • Lucie Bohan<br />

Amy Bonner • Tracy Borralho • Sarah Brunet • Iryna Chernykh • Simon Chu • Darb Dhillon • Carlyn Elliott<br />

Theresa Engbert • Brent Friesen • Jenny-Claire Ganasi • Laurel Gillis • Ben Groot • Philip Hancyk • Kristen Hodge<br />

Tiffany Hsiao • Anil Jiwani • Gaurav Kapadia • Samantha Kong • Trisha Kramer • Jennifer Lam • Belinda Lau • Irwan Lau<br />

Ariel Laver • Carol Lee • Kerry Liu • Miguel Martinez • Jaime McCulloch • Trevor Melnychuk • Na’im Merchant<br />

Mike Mosindy • Akemi Nakanishi • Jason Ng • Joshua Ngo • Hayley Owens • Manny Sandhu • Nicole Schecker<br />

Allan Spissinger • Grace Tu • Kelly Tupper • Laura van Bodegom • David Wilcox • Ken Woiden • Jasmine Wong<br />

Patrick Wong • Ethan Yoo • Tommaso Zamperini • Lan Zhang<br />

© 2009 PricewaterhouseCoopers LLP. All rights reserved. “PricewaterhouseCoopers” refers to PricewaterhouseCoopers LLP, an Ontario limited liability partnership, or, as the context requires, the PricewaterhouseCoopers<br />

global network or other member firms <strong>of</strong> the network, each <strong>of</strong> which is a separate and independent legal entity. 1667-10 1231

Ni (Nina) Wang<br />

“Overcoming anxiety and<br />

believing in yourself is<br />

extremely important,” says<br />

Nina Wang. “For me, the<br />

most challenging thing<br />

about the <strong>UFE</strong> was trying<br />

to stay focused and<br />

confident throughout the<br />

summer—especially toward the end <strong>of</strong> the<br />

process.”<br />

This includes the actual writing <strong>of</strong> the exam.<br />

“The <strong>UFE</strong> covers a broad range <strong>of</strong> knowledge,<br />

so staying focused and confident over the three<br />

days is quite challenging,” she says. “I was<br />

definitely relieved when the exam was finally<br />

over—I didn’t know whether I had done well,<br />

but I knew I had given it my all.”<br />

A graduate <strong>of</strong> Simon Fraser University, Nina<br />

earned a bachelor <strong>of</strong> business administration<br />

degree with a concentration in accounting and<br />

finance in 2008. She is currently articling with<br />

Deloitte & Touche LLP in Vancouver, with a<br />

primary focus on telecommunications companies.<br />

“I chose the CA pr<strong>of</strong>ession because it will open<br />

multiple opportunities in my life and provide<br />

flexibility for international learning,” she says.<br />

“In the future, I can see myself making a<br />

difference as a CA, and having an impact on<br />

people and things around me.”<br />

Looking back over the <strong>UFE</strong> experience, Nina<br />

says she’s grateful for the amount <strong>of</strong> knowledge<br />

she gained throughout the summer leading up<br />

to the exam.<br />

“I learned so much through my firm in-house,<br />

through module 6, through self-study sessions,<br />

and through discussions with my study group,”<br />

she says. “Along the way, I also had the<br />

opportunity to establish close relationships<br />

with my study group members: Ryan Chan,<br />

Nancy Kurokawa, and Andrew Lau. They were<br />

instrumental to my success.”<br />

These study buddies were part <strong>of</strong> a larger<br />

support team <strong>of</strong> family, friends, and colleagues.<br />

“My grandparents and my parents have<br />

provided tremendous support throughout my<br />

life, and were very supportive during the<br />

summer leading up to the exam,” Nina says.<br />

“My boyfriend and <strong>UFE</strong> mentor Sam K. Wong,<br />

CA, a controller with Pathway Capital Ltd.,<br />

provided a lot <strong>of</strong> support and advice as well.<br />

My other mentor, Jason Tong, CA, a senior<br />

accountant at Deloitte, also provided valuable<br />

support and guidance. I thank him, and<br />

everyone at the firm—especially those on the<br />

<strong>UFE</strong> Committee—for their help.”<br />

Her advice to future <strong>UFE</strong> writers is to remain relaxed and confident throughout the study process and<br />

during the exam.<br />

“Believe in yourself,” Nina says, “and trust your pr<strong>of</strong>essional judgment.”<br />

Nina was born and raised in China, and came to Canada by herself in the fall <strong>of</strong> 2002, after graduating<br />

from high school. She enjoys watching movies—especially international films.<br />

Sean Wilson<br />

“The opportunity to travel and continue my education,” says Sean Wilson,<br />

when asked what drew him to the CA pr<strong>of</strong>ession. The University <strong>of</strong> <strong>BC</strong><br />

graduate attended the Sauder School <strong>of</strong> Business and earned a bachelor <strong>of</strong><br />

commerce, specializing in accounting, in November 2008. Today, he’s articling<br />

with KPMG LLP in the firm’s Vancouver <strong>of</strong>fice, and focusing on industrial<br />

markets (mining).<br />

“I’m very interested in renewable energy,” he says, “and I’d like to be involved<br />

in this sector in some capacity in the future.”<br />

Sean also intends to fulfil a childhood dream <strong>of</strong> becoming a pilot, and hopes to get his private licence<br />

soon. For the moment, however, he’s still reeling from news <strong>of</strong> his success on the <strong>UFE</strong>.<br />

“The exam itself seemed way harder than any <strong>of</strong> the practice exams I had done, just because there was<br />

just so much riding on it,” he says. “Walking out on the last day <strong>of</strong> the exam was surreal. So many<br />

people had come to support all <strong>of</strong> the writers—it was really amazing.”<br />

For Sean, the most challenging thing about the entire <strong>UFE</strong> process was the final week <strong>of</strong> studying.<br />

“By then, my study group and I were getting a little burned out, so we really had to refocus and relax<br />

before we could keep on studying,” he explains. “At the same time, one <strong>of</strong> the most rewarding things<br />

about this experience was the relationship I built with my study partners Jon Stewart and Linda<br />

Schucr<strong>of</strong>t.”<br />

Sean credits Jon and Linda, both <strong>of</strong> whom are also at KPMG, for helping him succeed on the <strong>UFE</strong>,<br />

and also gives thanks to his mentor at KPMG, Peter Waignein, CA.<br />

“I also want to thank my parents Larry and Trish,” he says, “and my girlfriend Cami.”<br />

Sean’s advice to future <strong>UFE</strong> writers is tw<strong>of</strong>old: “Understand the exam and how it’s marked before<br />

jumping in and studying,” he says. “And definitely don’t over study—take <strong>of</strong>f at 4pm, and don’t study<br />

on weekends!”<br />

Born in Singapore, Sean came to Canada in 1990 and grew up in North Vancouver. He enjoys coaching<br />

and playing field hockey, hiking the Grouse Grind, and travelling. Sean recently returned from a trip to<br />

India, and previously travelled for an entire year through Europe, Southeast Asia, and China. The moustache<br />

Sean’s sporting in his photo was grown for “Mo’vember,” an international charitable event that happens<br />

every November to raise funds for men’s health issues. In Canada, money raised during Mo’vember goes<br />

directly to Prostate Cancer Canada.<br />

Congrats once again to <strong>BC</strong>’s<br />

12 honour roll students for a<br />

job well done!<br />

Photography:<br />

Jolene Kendrew was photographed by Deddeda Stemler, <strong>of</strong> Photography by Deddeda in Victoria.<br />

James Stewart was photographed by Michael Heroux, <strong>of</strong> Free Spirit Studio in Kelowna. All other students<br />

were photographed by Kent Kallberg <strong>of</strong> Kent Kallberg Studios Ltd. in Vancouver.<br />

Jan 2010 ica.bc.ca 21

22 ica.bc.ca Jan 2010<br />

Jolene<br />

KENDREW<br />

Governor General’s Gold Medal<br />

Leanna<br />

HO<br />

Siobhan<br />

HUGHES<br />

Morgan<br />

KENNY<br />

Grace<br />

LOH<br />

Ilya<br />

MARGULIS<br />

Sumeet<br />

SANGHA<br />

Matthew<br />

STEVENS<br />

James<br />

STEWART<br />

Dylan<br />

VOKEY<br />

Ni (Nina)<br />

WANG<br />

Sean<br />

WILSON<br />

Saare<br />

ADAMS<br />

Ji Young<br />

AHN<br />

Pablo<br />

AIRO<br />

Megan<br />

ALLEN<br />

Rishma<br />

ALLIBHAI<br />

Carmen<br />

AMÉZQUITA HERNANDEZ<br />

Janet<br />

ANNABLE<br />

Kimberly<br />

ANTIFAVE<br />

Teresa<br />

AUGUSTYN<br />

Michael<br />

AURAS<br />

Rebecca<br />

AZIZ<br />

Sharlene<br />

BABICH<br />

Michelle<br />

BALDWIN-PINCH<br />

Whitney<br />

BALL<br />

Wanvisa<br />

BANTERNGHANSA<br />

Tanya<br />

BASTIAN<br />

Jared<br />

BEHR<br />

Laura<br />

BELDING<br />

David<br />

BELL<br />

Celina<br />

BELLINGHAM<br />

Tanya<br />

BENNETT<br />

Binny<br />

BHINDER<br />

Lisa<br />

BLANDFORD<br />

Lucie<br />

BOHAN<br />

Brad<br />

BOLGER<br />

Amy<br />

BONNER<br />

Tracy<br />

BORRALHO<br />

Lyndon<br />

BRAUN<br />

Robert<br />

BROWN<br />

Sarah<br />

BRUNET<br />

Michelle<br />

BUREE<br />

Kevin<br />

BURKETT<br />

Patrick<br />

CAFFREY<br />

Pamela<br />

CALDERON<br />

Lucy<br />

CAO<br />

Ying Ying<br />

CEN<br />

Dathie<br />

CHAN<br />

Edmund<br />

CHAN<br />

Eugenia<br />

CHAN<br />

Jennifer<br />

CHAN<br />

Kelly<br />

CHAN<br />

Martin<br />

CHAN<br />

Ryan<br />

CHAN<br />

Vicki<br />

CHAN<br />

Vincent<br />

CHAN<br />

Hermandeep<br />

CHANDI<br />

Alex<br />

CHANG<br />

YooJin<br />

CHANG<br />

Neil<br />

CHAPMAN<br />

Ling<br />

CHE<br />

Congratulations to <strong>BC</strong>’s 444 <strong>Success</strong>ful<br />

<strong>UFE</strong> Candidates <strong>of</strong> 2009!<br />

Cong<br />

CHEN<br />

Di<br />

CHEN<br />

Henry<br />

CHEN<br />

Stephanie<br />

CHEN<br />

Jie<br />

CHENG<br />

May<br />

CHENG<br />

Wai<br />

CHENG<br />

Iryna<br />

CHERNYKH<br />

Bernadette<br />

CHEUNG<br />

Joyce<br />

CHEUNG<br />

Jancie<br />

CHIU<br />

Daniel<br />

CHO<br />

Lindsay<br />

CHOA<br />

David<br />

CHOI<br />

Karen<br />

CHONG<br />

Alex<br />

CHOW<br />

Anne<br />

CHOW<br />

Christine<br />

CHU<br />

Simon<br />

CHU<br />

Vanessa<br />

COATTA<br />

Michael<br />

COOK<br />

Paul<br />

CORMACK<br />

Danielle<br />

COSTELLO<br />

Sean<br />

COWAN<br />

Jacqueline Trina CUA<br />

Robin<br />

DANIELS<br />

Elyse<br />

DE JONG<br />

Sherry-Anna<br />

DEISSNER<br />

Shivreet<br />

DEOL<br />

Amindeep<br />

DHA<br />

Navneet<br />

DHALIWAL<br />

Jatinder<br />

DHAMRAT<br />

Darbjeet<br />

DHILLON<br />

Sukhdeep<br />

DHILLON<br />

Christopher<br />

DIAZ<br />

Michael<br />

DILLABAUGH<br />

Alissa<br />

DILWORTH<br />

Rebecca<br />

DIXON<br />

Michelle<br />

DODD<br />

Aaron<br />

DODSWORTH<br />

Richard<br />

DONCOM<br />

Colin<br />

D’SOUZA<br />

Michael<br />

DUDENHOEFFER<br />

Carlyn<br />

ELLIOTT<br />

Malcolm<br />

ELLISON<br />

Theresa<br />

ENGBERT<br />

David<br />

EVANS<br />

Mark<br />

FAIRWEATHER<br />

Ling<br />

FANG<br />

Alexandre<br />

FARRELL<br />

Fonny<br />

FONG<br />

Jason<br />

FONG<br />

James<br />

FOUCAULT<br />

Joann<br />

FRANCIS<br />

Jena<br />

FRIEDRICH<br />

Brent<br />

FRIESEN<br />

Ian<br />

FRIPP<br />

Andrea<br />

FUNK<br />

Tanya<br />

GALL<br />

Jenny-Claire<br />

GANASI<br />

Ying<br />

GAO<br />

Peter<br />

GEH<br />

Megan<br />

GEIER<br />

Navjot<br />

GILL<br />

Richard<br />

GILL<br />

Tara<br />

GILL<br />

Laurel<br />

GILLIS<br />

Lindsay<br />

GLAVAN<br />

Michal<br />

GOLDSTEIN<br />

Daniel<br />

GOLLOGLY<br />

Neil<br />

GOODMAN<br />

Weiwei<br />

GOU<br />

Natasha<br />

GREGORY<br />

Halwinder<br />

GREWAL<br />

Parvinder<br />

GREWAL<br />

Simardeep<br />

GREWAL<br />

Benjamin<br />

GROOT<br />

Mackenzie<br />

GUY<br />

Philip<br />

HANCYK<br />

Jon<br />

HARDING<br />

David<br />

HARPER<br />

Matthew<br />

HARPER<br />

Katherine<br />

HAY<br />

Jason<br />

HAYLOCK<br />

Christina<br />

HELSING<br />

Ehren<br />

HESS<br />

Graham<br />

HINDSON<br />

Kristen<br />

HODGE<br />

Lara<br />

HOLTBY<br />

Berwin<br />

HONG<br />

Andrew<br />

HOPPER<br />

Julie<br />

HORTON<br />

Julie<br />

HOWALD<br />

Jui-Yao<br />

HSIAO<br />

Tiffany<br />

HSIAO<br />

Jovi<br />

HSIEH<br />

Wei-Lun<br />

HU<br />

Vivien<br />

HUANG<br />

Rosanna<br />

HUI<br />

Dylan<br />

HUME<br />

Sarah<br />

HUNDAL<br />

Gordon<br />

HUNT<br />

Brooke<br />

HURFORD<br />

John<br />

INTHAVIXAY<br />

Shera<br />

IP<br />

Deepk<br />

JASWAL<br />

Anil<br />

JIWANI<br />

Kristin<br />

JOHNSON<br />

Daniel<br />

JOVER<br />

Eva<br />

JUTRAS<br />

Michael<br />

KANEVSKY<br />

Jagdeep<br />

KANG<br />

Gregory<br />

KANIEWSKI<br />

Gaurav<br />

KAPADIA<br />

Ashley<br />

KATES<br />

Diane<br />

KEE<br />

Stephanie<br />

KEE<br />

Brandon<br />

KELLEY<br />

Jeremy<br />

KELLY<br />

Daniel<br />

KEOGH<br />

Danielle<br />

KILLAM<br />

Peter<br />

KIM<br />

Sarah<br />

KIM<br />

Mona<br />

KING<br />

William<br />

KING<br />

Rebecca<br />

KINKEAD<br />

Maryna<br />

KIRICHUK<br />

MaryAnn<br />

KNOLL<br />

Victor<br />

KO<br />

Irina<br />

KOLBINA<br />

Enoch<br />

KONG<br />

Samantha<br />

KONG<br />

Richard<br />

KONINGS<br />

Jason<br />

KOONER<br />

Daria<br />

KOTLIAROVA<br />

Robert<br />

KOZAK<br />

Trisha<br />

KRAMER<br />

Jenia<br />

KRASTEVA<br />

Samantha<br />

KRULITSKI<br />

Juliana<br />

KUNG<br />

Nancy<br />

KUROKAWA<br />

Yvonne<br />

KWOK<br />

National<br />

Honour Roll

Jan 2010 ica.bc.ca 23<br />

Andreas<br />

L’ABBE<br />

Hussein<br />

LALANI<br />

Jennifer<br />

LAM<br />

Patricia<br />

LAM<br />

Rosanne<br />

LAMARCHE<br />

Christopher<br />

LARONGE<br />

Kelly<br />

LATZEL<br />

Andrew<br />

LAU<br />

Belinda<br />

LAU<br />

Irwan<br />

LAU<br />

Maggie<br />

LAU<br />

Michael<br />

LAUGA<br />

Brett<br />

LAURITZEN<br />

Ariel<br />

LAVER<br />

Albert<br />

LAW<br />

Hang<br />

LE<br />

Carol K.L.<br />

LEE<br />

Carol Y-C<br />

LEE<br />

Jeanne<br />

LEE<br />

Kevin K.M.<br />

LEE<br />

Kevin T.<br />

LEE<br />

Kyung<br />

LEE<br />

Mathew<br />

LEE<br />

Praise<br />

LEE<br />

Vanessa<br />

LEE<br />

Young Ju<br />

LEE<br />

Alistair<br />

LEUNG<br />

Jamie<br />

LEUNG<br />

Janey<br />

LEUNG<br />

Justin<br />

LEUNG<br />

Leslie<br />

LEUNG<br />

Lisa<br />

LEUNG<br />

Rita<br />

LEUNG<br />