12th Annual Federal Workers' Compensation Conference S i #39 ...

12th Annual Federal Workers' Compensation Conference S i #39 ...

12th Annual Federal Workers' Compensation Conference S i #39 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

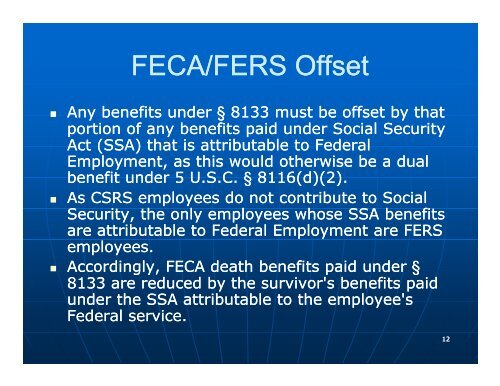

FECA/FERS Offset<br />

• Any benefits under § 8133 must be offset by that<br />

portion of any benefits paid under Social Security<br />

Act (SSA) that is attributable to <strong>Federal</strong><br />

Employment, as this would otherwise be a dual<br />

benefit under 5 U.S.C. § 8116(d)(2).<br />

• As CSRS employees do not contribute to Social<br />

Security, the only employees whose SSA benefits<br />

are attributable to <strong>Federal</strong> Employment are FERS<br />

employees.<br />

• Accordingly, FECA death benefits paid under §<br />

8133 are reduced by the survivor's benefits paid<br />

under the SSA attributable to the employee's<br />

<strong>Federal</strong> service.<br />

12