Annual Report 2005 - Bank am Bellevue

Annual Report 2005 - Bank am Bellevue

Annual Report 2005 - Bank am Bellevue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22<br />

Consolidated financial statements<br />

Notes<br />

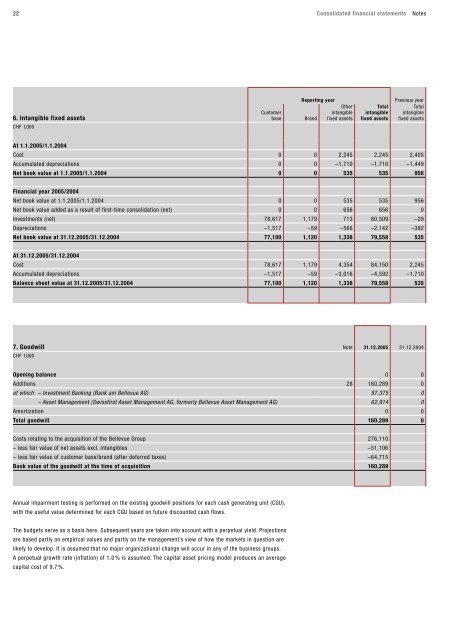

6. Intangible fixed assets<br />

CHF 1,000<br />

Customer<br />

base<br />

<strong>Report</strong>ing year<br />

Other<br />

intangible<br />

Brand fixed assets<br />

Total<br />

intangible<br />

fixed assets<br />

Previous year<br />

Total<br />

intangible<br />

fixed assets<br />

At 1.1.<strong>2005</strong>/1.1.2004<br />

Cost 0 0 2,245 2,245 2,405<br />

Accumulated depreciations 0 0 –1,710 –1,710 –1,449<br />

Net book value at 1.1.<strong>2005</strong>/1.1.2004 0 0 535 535 956<br />

Financial year <strong>2005</strong>/2004<br />

Net book value at 1.1.<strong>2005</strong>/1.1.2004 0 0 535 535 956<br />

Net book value added as a result of first-time consolidation (net) 0 0 656 656 0<br />

Investments (net) 78,617 1,179 713 80,509 –29<br />

Depreciations –1,517 –59 –566 –2,142 –392<br />

Net book value at 31.12.<strong>2005</strong>/31.12.2004 77,100 1,120 1,338 79,558 535<br />

At 31.12.<strong>2005</strong>/31.12.2004<br />

Cost 78,617 1,179 4,354 84,150 2,245<br />

Accumulated depreciations –1,517 –59 –3,016 –4,592 –1,710<br />

Balance sheet value at 31.12.<strong>2005</strong>/31.12.2004 77,100 1,120 1,338 79,558 535<br />

7. Goodwill Note 31.12.<strong>2005</strong> 31.12.2004<br />

CHF 1,000<br />

Opening balance 0 0<br />

Additions 28 160,289 0<br />

of which – Investment <strong>Bank</strong>ing (<strong>Bank</strong> <strong>am</strong> <strong>Bellevue</strong> AG) 97,375 0<br />

– Asset Management (Swissfirst Asset Management AG, formerly <strong>Bellevue</strong> Asset Management AG) 62,914 0<br />

Amortization 0 0<br />

Total goodwill 160,289 0<br />

Costs relating to the acquisition of the <strong>Bellevue</strong> Group 276,110<br />

– less fair value of net assets excl. intangibles –51,106<br />

– less fair value of customer base/brand (after deferred taxes) –64,715<br />

Book value of the goodwill at the time of acquisition 160,289<br />

<strong>Annual</strong> impairment testing is performed on the existing goodwill positions for each cash generating unit (CGU),<br />

with the useful value determined for each CGU based on future discounted cash flows.<br />

The budgets serve as a basis here. Subsequent years are taken into account with a perpetual yield. Projections<br />

are based partly on empirical values and partly on the management’s view of how the markets in question are<br />

likely to develop. It is assumed that no major organizational change will occur in any of the business groups.<br />

A perpetual growth rate (inflation) of 1.0 % is assumed. The capital asset pricing model produces an average<br />

capital cost of 9.7 %.