Annual Report 2005 - Bank am Bellevue

Annual Report 2005 - Bank am Bellevue

Annual Report 2005 - Bank am Bellevue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

35<br />

Consolidated financial statements<br />

Notes<br />

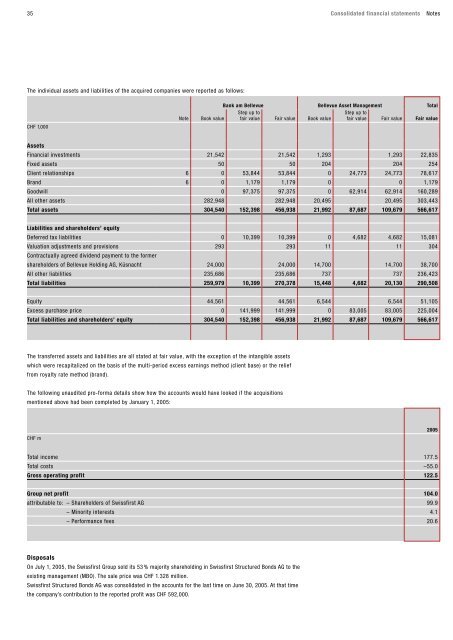

The individual assets and liabilities of the acquired companies were reported as follows:<br />

CHF 1,000<br />

Note<br />

<strong>Bank</strong> <strong>am</strong> <strong>Bellevue</strong> <strong>Bellevue</strong> Asset Management Total<br />

Step up to<br />

Step up to<br />

Book value fair value Fair value Book value fair value Fair value Fair value<br />

Assets<br />

Financial investments 21,542 21,542 1,293 1,293 22,835<br />

Fixed assets 50 50 204 204 254<br />

Client relationships 6 0 53,844 53,844 0 24,773 24,773 78,617<br />

Brand 6 0 1,179 1,179 0 0 1,179<br />

Goodwill 0 97,375 97,375 0 62,914 62,914 160,289<br />

All other assets 282,948 282,948 20,495 20,495 303,443<br />

Total assets 304,540 152,398 456,938 21,992 87,687 109,679 566,617<br />

Liabilities and shareholders’ equity<br />

Deferred tax liabilities 0 10,399 10,399 0 4,682 4,682 15,081<br />

Valuation adjustments and provisions 293 293 11 11 304<br />

Contractually agreed dividend payment to the former<br />

shareholders of <strong>Bellevue</strong> Holding AG, Küsnacht 24,000 24,000 14,700 14,700 38,700<br />

All other liabilities 235,686 235,686 737 737 236,423<br />

Total liabilities 259,979 10,399 270,378 15,448 4,682 20,130 290,508<br />

Equity 44,561 44,561 6,544 6,544 51,105<br />

Excess purchase price 0 141,999 141,999 0 83,005 83,005 225,004<br />

Total liabilities and shareholders’ equity 304,540 152,398 456,938 21,992 87,687 109,679 566,617<br />

The transferred assets and liabilities are all stated at fair value, with the exception of the intangible assets<br />

which were recapitalized on the basis of the multi-period excess earnings method (client base) or the relief<br />

from royalty rate method (brand).<br />

The following unaudited pro-forma details show how the accounts would have looked if the acquisitions<br />

mentioned above had been completed by January 1, <strong>2005</strong>:<br />

CHF m<br />

<strong>2005</strong><br />

Total income 177.5<br />

Total costs –55.0<br />

Gross operating profit 122.5<br />

Group net profit 104.0<br />

attributable to: – Shareholders of Swissfirst AG 99.9<br />

– Minority interests 4.1<br />

– Performance fees 20.6<br />

Disposals<br />

On July 1, <strong>2005</strong>, the Swissfirst Group sold its 53 % majority shareholding in Swissfirst Structured Bonds AG to the<br />

existing management (MBO). The sale price was CHF 1.328 million.<br />

Swissfirst Structured Bonds AG was consolidated in the accounts for the last time on June 30, <strong>2005</strong>. At that time<br />

the company’s contribution to the reported profit was CHF 592,000.