ANNUAL REPORT

ANNUAL REPORT

ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

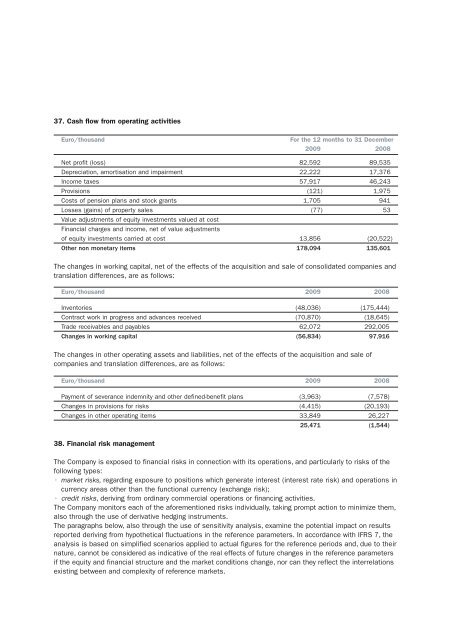

37. Cash flow from operating activities<br />

Euro/thousand<br />

For the 12 months to 31 December<br />

2009 2008<br />

Net profit (loss) 82,592 89,535<br />

Depreciation, amortisation and impairment 22,222 17,376<br />

Income taxes 57,917 46,243<br />

Provisions (121) 1,975<br />

Costs of pension plans and stock grants 1,705 941<br />

Losses (gains) of property sales (77) 53<br />

Value adjustments of equity investments valued at cost<br />

Financial charges and income, net of value adjustments<br />

of equity investments carried at cost 13,856 (20,522)<br />

Other non monetary items 178,094 135,601<br />

The changes in working capital, net of the effects of the acquisition and sale of consolidated companies and<br />

translation differences, are as follows:<br />

Euro/thousand 2009 2008<br />

Inventories (48,036) (175,444)<br />

Contract work in progress and advances received (70,870) (18,645)<br />

Trade receivables and payables 62,072 292,005<br />

Changes in working capital (56,834) 97,916<br />

The changes in other operating assets and liabilities, net of the effects of the acquisition and sale of<br />

companies and translation differences, are as follows:<br />

Euro/thousand 2009 2008<br />

Payment of severance indemnity and other defined-benefit plans (3,963) (7,578)<br />

Changes in provisions for risks (4,415) (20,193)<br />

Changes in other operating items 33,849 26,227<br />

25,471 (1,544)<br />

38. Financial risk management<br />

The Company is exposed to financial risks in connection with its operations, and particularly to risks of the<br />

following types:<br />

• market risks, regarding exposure to positions which generate interest (interest rate risk) and operations in<br />

currency areas other than the functional currency (exchange risk);<br />

• credit risks, deriving from ordinary commercial operations or financing activities.<br />

The Company monitors each of the aforementioned risks individually, taking prompt action to minimize them,<br />

also through the use of derivative hedging instruments.<br />

The paragraphs below, also through the use of sensitivity analysis, examine the potential impact on results<br />

reported deriving from hypothetical fluctuations in the reference parameters. In accordance with IFRS 7, the<br />

analysis is based on simplified scenarios applied to actual figures for the reference periods and, due to their<br />

nature, cannot be considered as indicative of the real effects of future changes in the reference parameters<br />

if the equity and financial structure and the market conditions change, nor can they reflect the interrelations<br />

existing between and complexity of reference markets.