ANNUAL REPORT

ANNUAL REPORT

ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANSALDO ENERGIA FINANCIAL STATEMENTS 2009<br />

87<br />

Industrial buildings 3-5%<br />

Plant and machinery 5-20%<br />

Minor equipment 12.5-40%<br />

Furniture 12-20%<br />

Vehicles 20-25%<br />

• decreases of Euro 52 thousand deriving from disposals net of depreciation;<br />

• an increase of Euro 2,334 thousand as a result of the merger of Ansaldo Ricerche S.p.A.;<br />

• decreases of Euro 2,863 thousand for transfers to the income statement and the recovery of advances;<br />

• a decrease of Euro 6,500 thousand as a result of the transfer of the Legnano property in Piazza<br />

Monumento to assets held for sale following the completion of the preliminary contract.<br />

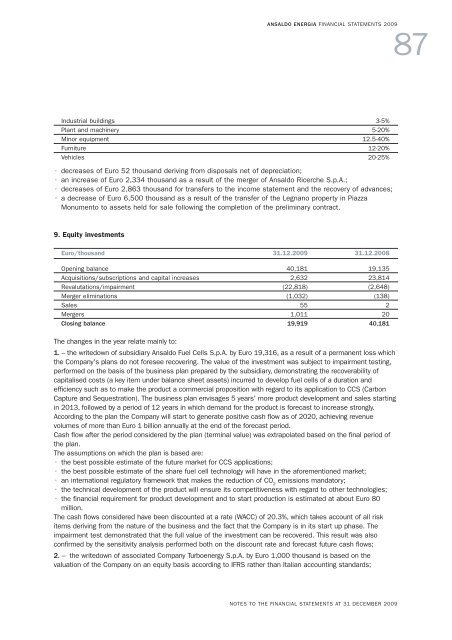

9. Equity investments<br />

Euro/thousand 31.12.2009 31.12.2008<br />

Opening balance 40,181 19,135<br />

Acquisitions/subscriptions and capital increases 2,632 23,814<br />

Revalutations/impairment (22,818) (2,648)<br />

Merger eliminations (1,032) (138)<br />

Sales 55 2<br />

Mergers 1,011 20<br />

Closing balance 19,919 40,181<br />

The changes in the year relate mainly to:<br />

1. – the writedown of subsidiary Ansaldo Fuel Cells S.p.A. by Euro 19,316, as a result of a permanent loss which<br />

the Company's plans do not foresee recovering. The value of the investment was subject to impairment testing,<br />

performed on the basis of the business plan prepared by the subsidiary, demonstrating the recoverability of<br />

capitalised costs (a key item under balance sheet assets) incurred to develop fuel cells of a duration and<br />

efficiency such as to make the product a commercial proposition with regard to its application to CCS (Carbon<br />

Capture and Sequestration). The business plan envisages 5 years' more product development and sales starting<br />

in 2013, followed by a period of 12 years in which demand for the product is forecast to increase strongly.<br />

According to the plan the Company will start to generate positive cash flow as of 2020, achieving revenue<br />

volumes of more than Euro 1 billion annually at the end of the forecast period.<br />

Cash flow after the period considered by the plan (terminal value) was extrapolated based on the final period of<br />

the plan.<br />

The assumptions on which the plan is based are:<br />

• the best possible estimate of the future market for CCS applications;<br />

• the best possible estimate of the share fuel cell technology will have in the aforementioned market;<br />

• an international regulatory framework that makes the reduction of CO 2<br />

emissions mandatory;<br />

• the technical development of the product will ensure its competitiveness with regard to other technologies;<br />

• the financial requirement for product development and to start production is estimated at about Euro 80<br />

million.<br />

The cash flows considered have been discounted at a rate (WACC) of 20.3%, which takes account of all risk<br />

items deriving from the nature of the business and the fact that the Company is in its start up phase. The<br />

impairment test demonstrated that the full value of the investment can be recovered. This result was also<br />

confirmed by the sensitivity analysis performed both on the discount rate and forecast future cash flows;<br />

2. – the writedown of associated Company Turboenergy S.p.A. by Euro 1,000 thousand is based on the<br />

valuation of the Company on an equity basis according to IFRS rather than Italian accounting standards;<br />

NOTES TO THE FINANCIAL STATEMENTS AT 31 DECEMBER 2009