Employers' Digest March 2012 - Crowe Horwath International

Employers' Digest March 2012 - Crowe Horwath International

Employers' Digest March 2012 - Crowe Horwath International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Employers’ <strong>Digest</strong> <strong>March</strong> <strong>2012</strong><br />

Official rate of<br />

interest<br />

HMRC has announced that its official<br />

rate of interest will remain unchanged<br />

at 4% for the <strong>2012</strong>/13 tax year. This rate<br />

is used to calculate the taxable benefit<br />

arising from interest-free or low-interest<br />

loans to employees. It is also used to<br />

calculate the additional tax charge on<br />

employee living accommodation costing<br />

more than £75,000. The interest rate<br />

may be subject to review in the event<br />

of significant changes to the Bank of<br />

England’s base lending rate.<br />

Home working<br />

allowance updated<br />

HMRC has announced an increase<br />

in the home working allowance. This<br />

is a fixed weekly amount that can be<br />

paid to employees who work at home<br />

under arrangements agreed with their<br />

employer. It is intended to compensate<br />

for the additional heating and lighting<br />

costs that the employee will incur. With<br />

effect from 6 April <strong>2012</strong>, the weekly<br />

allowance will go up from £3 to £4.<br />

Employees who incur greater costs than<br />

these may be able to claim tax relief<br />

for more than £4, but to do so they will<br />

first have to satisfy HMRC that they are<br />

necessarily working from home (the<br />

allowance can be paid to employees who<br />

voluntarily work at home). They will then<br />

have to produce detailed calculations as<br />

evidence of the actual costs.<br />

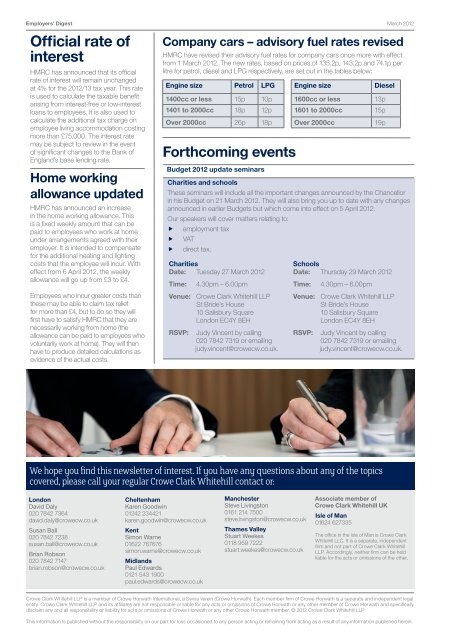

Company cars – advisory fuel rates revised<br />

HMRC have revised their advisory fuel rates for company cars once more with effect<br />

from 1 <strong>March</strong> <strong>2012</strong>. The new rates, based on prices of 135.2p, 143.2p and 74.1p per<br />

litre for petrol, diesel and LPG respectively, are set out in the tables below:<br />

Engine size Petrol LPG<br />

1400cc or less 15p 10p<br />

1401 to 2000cc 18p 12p<br />

Over 2000cc 26p 18p<br />

Forthcoming events<br />

Budget <strong>2012</strong> update seminars<br />

Engine size<br />

Diesel<br />

1600cc or less 13p<br />

1601 to 2000cc 15p<br />

Over 2000cc<br />

Charities and schools<br />

These seminars will include all the important changes announced by the Chancellor<br />

in his Budget on 21 <strong>March</strong> <strong>2012</strong>. They will also bring you up to date with any changes<br />

announced in earlier Budgets but which come into effect on 5 April <strong>2012</strong>.<br />

Our speakers will cover matters relating to:<br />

employment tax<br />

VAT<br />

direct tax.<br />

Charities<br />

Date: Tuesday 27 <strong>March</strong> <strong>2012</strong><br />

Time:<br />

4.30pm – 6.00pm<br />

Venue: <strong>Crowe</strong> Clark Whitehill LLP<br />

St Bride’s House<br />

10 Salisbury Square<br />

London EC4Y 8EH<br />

RSVP:<br />

Judy Vincent by calling<br />

020 7842 7319 or emailing<br />

judy.vincent@crowecw.co.uk.<br />

19p<br />

Schools<br />

Date: Thursday 29 <strong>March</strong> <strong>2012</strong><br />

Time:<br />

4.30pm – 6.00pm<br />

Venue: <strong>Crowe</strong> Clark Whitehill LLP<br />

St Bride’s House<br />

10 Salisbury Square<br />

London EC4Y 8EH<br />

RSVP:<br />

Judy Vincent by calling<br />

020 7842 7319 or emailing<br />

judy.vincent@crowecw.co.uk.<br />

We hope you find this newsletter of interest. If you have any questions about any of the topics<br />

covered, please call your regular <strong>Crowe</strong> Clark Whitehill contact or:<br />

London<br />

David Daly<br />

020 Office 7842 locations<br />

7364<br />

david.daly@crowecw.co.uk<br />

Susan Ball<br />

020 7842 7238<br />

susan.ball@crowecw.co.uk<br />

Brian Robson<br />

020 7842 7147<br />

brian.robson@crowecw.co.uk<br />

Cheltenham<br />

Karen Goodwin<br />

01242 234421<br />

karen.goodwin@crowecw.co.uk<br />

Kent<br />

Simon Warne<br />

01622 767676<br />

simon.warne@crowecw.co.uk<br />

Midlands<br />

Paul Edwards<br />

0121 543 1900<br />

paul.edwards@crowecw.co.uk<br />

Manchester<br />

Steve Livingston<br />

0161 214 7500<br />

steve.livingston@crowecw.co.uk<br />

Thames Valley<br />

Stuart Weekes<br />

0118 959 7222<br />

stuart.weekes@crowecw.co.uk<br />

Associate member of<br />

<strong>Crowe</strong> Clark Whitehill UK<br />

Isle of Man<br />

01624 627335<br />

The office in the Isle of Man is <strong>Crowe</strong> Clark<br />

Whitehill LLC. It is a separate, independent<br />

firm and not part of <strong>Crowe</strong> Clark Whitehill<br />

LLP. Accordingly, neither firm can be held<br />

liable for the acts or omissions of the other.<br />

<strong>Crowe</strong> Clark Whitehill LLP is a member of <strong>Crowe</strong> <strong>Horwath</strong> <strong>International</strong>, a Swiss verein (<strong>Crowe</strong> <strong>Horwath</strong>). Each member firm of <strong>Crowe</strong> <strong>Horwath</strong> is a separate and independent legal<br />

entity. <strong>Crowe</strong> Clark Whitehill LLP and its affiliates are not responsible or liable for any acts or omissions of <strong>Crowe</strong> <strong>Horwath</strong> or any other member of <strong>Crowe</strong> <strong>Horwath</strong> and specifically<br />

disclaim any and all responsibility or liability for acts or omissions of <strong>Crowe</strong> <strong>Horwath</strong> or any other <strong>Crowe</strong> <strong>Horwath</strong> member. © <strong>2012</strong> <strong>Crowe</strong> Clark Whitehill LLP<br />

This information is published without the responsibility on our part for loss occasioned to any person acting or refraining from acting as a result of any information published herein.