Published by the Credit Union Association of New York

Published by the Credit Union Association of New York

Published by the Credit Union Association of New York

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

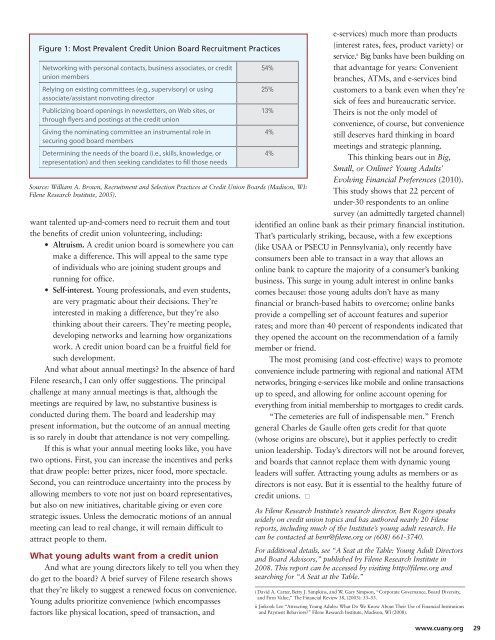

Source: William A. Brown, Recruitment and Selection Practices at <strong>Credit</strong> <strong>Union</strong> Boards (Madison, WI:<br />

Filene Research Institute, 2005).<br />

want talented up-and-comers need to recruit <strong>the</strong>m and tout<br />

<strong>the</strong> benefits <strong>of</strong> credit union volunteering, including:<br />

• Altruism. A credit union board is somewhere you can<br />

make a difference. This will appeal to <strong>the</strong> same type<br />

<strong>of</strong> individuals who are joining student groups and<br />

running for <strong>of</strong>fice.<br />

• Self-interest. Young pr<strong>of</strong>essionals, and even students,<br />

are very pragmatic about <strong>the</strong>ir decisions. They’re<br />

interested in making a difference, but <strong>the</strong>y’re also<br />

thinking about <strong>the</strong>ir careers. They’re meeting people,<br />

developing networks and learning how organizations<br />

work. A credit union board can be a fruitful field for<br />

such development.<br />

And what about annual meetings? In <strong>the</strong> absence <strong>of</strong> hard<br />

Filene research, I can only <strong>of</strong>fer suggestions. The principal<br />

challenge at many annual meetings is that, although <strong>the</strong><br />

meetings are required <strong>by</strong> law, no substantive business is<br />

conducted during <strong>the</strong>m. The board and leadership may<br />

present information, but <strong>the</strong> outcome <strong>of</strong> an annual meeting<br />

is so rarely in doubt that attendance is not very compelling.<br />

If this is what your annual meeting looks like, you have<br />

two options. First, you can increase <strong>the</strong> incentives and perks<br />

that draw people: better prizes, nicer food, more spectacle.<br />

Second, you can reintroduce uncertainty into <strong>the</strong> process <strong>by</strong><br />

allowing members to vote not just on board representatives,<br />

but also on new initiatives, charitable giving or even core<br />

strategic issues. Unless <strong>the</strong> democratic motions <strong>of</strong> an annual<br />

meeting can lead to real change, it will remain difficult to<br />

attract people to <strong>the</strong>m.<br />

What young adults want from a credit union<br />

And what are young directors likely to tell you when <strong>the</strong>y<br />

do get to <strong>the</strong> board? A brief survey <strong>of</strong> Filene research shows<br />

that <strong>the</strong>y’re likely to suggest a renewed focus on convenience.<br />

Young adults prioritize convenience (which encompasses<br />

factors like physical location, speed <strong>of</strong> transaction, and<br />

e-services) much more than products<br />

(interest rates, fees, product variety) or<br />

service. ii Big banks have been building on<br />

that advantage for years: Convenient<br />

branches, ATMs, and e-services bind<br />

customers to a bank even when <strong>the</strong>y’re<br />

sick <strong>of</strong> fees and bureaucratic service.<br />

Theirs is not <strong>the</strong> only model <strong>of</strong><br />

convenience, <strong>of</strong> course, but convenience<br />

still deserves hard thinking in board<br />

meetings and strategic planning.<br />

This thinking bears out in Big,<br />

Small, or Online? Young Adults’<br />

Evolving Financial Preferences (2010).<br />

This study shows that 22 percent <strong>of</strong><br />

under-30 respondents to an online<br />

survey (an admittedly targeted channel)<br />

identified an online bank as <strong>the</strong>ir primary financial institution.<br />

That’s particularly striking, because, with a few exceptions<br />

(like USAA or PSECU in Pennsylvania), only recently have<br />

consumers been able to transact in a way that allows an<br />

online bank to capture <strong>the</strong> majority <strong>of</strong> a consumer’s banking<br />

business. This surge in young adult interest in online banks<br />

comes because: those young adults don’t have as many<br />

financial or branch-based habits to overcome; online banks<br />

provide a compelling set <strong>of</strong> account features and superior<br />

rates; and more than 40 percent <strong>of</strong> respondents indicated that<br />

<strong>the</strong>y opened <strong>the</strong> account on <strong>the</strong> recommendation <strong>of</strong> a family<br />

member or friend.<br />

The most promising (and cost-effective) ways to promote<br />

convenience include partnering with regional and national ATM<br />

networks, bringing e-services like mobile and online transactions<br />

up to speed, and allowing for online account opening for<br />

everything from initial membership to mortgages to credit cards.<br />

“The cemeteries are full <strong>of</strong> indispensable men.” French<br />

general Charles de Gaulle <strong>of</strong>ten gets credit for that quote<br />

(whose origins are obscure), but it applies perfectly to credit<br />

union leadership. Today’s directors will not be around forever,<br />

and boards that cannot replace <strong>the</strong>m with dynamic young<br />

leaders will suffer. Attracting young adults as members or as<br />

directors is not easy. But it is essential to <strong>the</strong> healthy future <strong>of</strong><br />

credit unions. ■<br />

As Filene Research Institute’s research director, Ben Rogers speaks<br />

widely on credit union topics and has authored nearly 20 Filene<br />

reports, including much <strong>of</strong> <strong>the</strong> Institute’s young adult research. He<br />

can be contacted at benr@filene.org or (608) 661-3740.<br />

For additional details, see “A Seat at <strong>the</strong> Table: Young Adult Directors<br />

and Board Advisors,” published <strong>by</strong> Filene Research Institute in<br />

2008. This report can be accessed <strong>by</strong> visiting http://filene.org and<br />

searching for “A Seat at <strong>the</strong> Table.”<br />

i David A. Carter, Betty J. Simpkins, and W. Gary Simpson, “Corporate Governance, Board Diversity,<br />

and Firm Value,” The Financial Review 38, (2003): 33–53.<br />

ii Jinkook Lee “Attracting Young Adults: What Do We Know About Their Use <strong>of</strong> Financial Institutions<br />

and Payment Behaviors?” Filene Research Institute, Madison, WI (2008).<br />

www.cuany.org 29