JPMorgan Funds Audited Annual Report - JP Morgan Asset ...

JPMorgan Funds Audited Annual Report - JP Morgan Asset ...

JPMorgan Funds Audited Annual Report - JP Morgan Asset ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

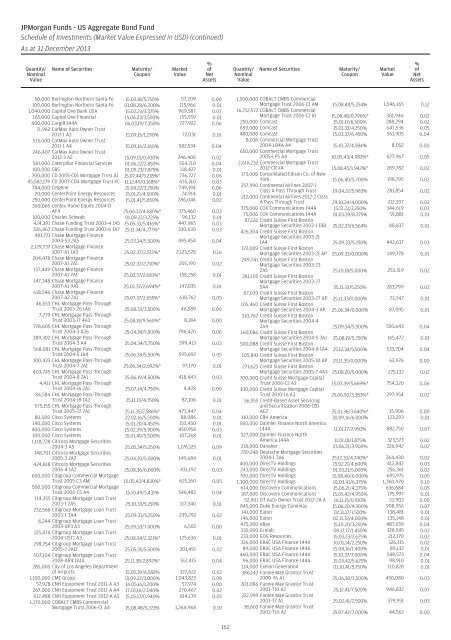

<strong><strong>JP</strong><strong>Morgan</strong></strong> <strong>Funds</strong> - US Aggregate Bond Fund<br />

Schedule of Investments (Market Value Expressed in USD) (continued)<br />

As at 31 December 2013<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

%<br />

of<br />

Net<br />

<strong>Asset</strong>s<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

%<br />

of<br />

Net<br />

<strong>Asset</strong>s<br />

50,000 Burlington Northern Santa Fe 15.03.18/5.750% 57,209 0.00<br />

100,000 Burlington Northern Santa Fe 01.08.28/6.700% 115,966 0.01<br />

1,040,000 Capital One Bank USA 15.02.23/3.375% 969,587 0.07<br />

165,000 Capital One Financial 15.06.23/3.500% 155,559 0.01<br />

600,000 Cargill 144A 06.03.19/7.350% 727,922 0.06<br />

71,962 CarMax Auto Owner Trust<br />

2011-1 A3 15.09.15/1.290% 72,031 0.01<br />

575,000 CarMax Auto Owner Trust<br />

2011-1 A4 15.09.16/2.160% 582,534 0.04<br />

246,407 CarMax Auto Owner Trust<br />

2012-3 A2 15.09.15/0.430% 246,406 0.02<br />

581,000 Caterpillar Financial Services 01.06.22/2.850% 554,710 0.04<br />

100,000 CBS 01.09.23/7.875% 118,427 0.01<br />

700,000 CD 2005-CD1 Mortgage Trust AJ 15.07.44/5.218%* 736,727 0.06<br />

45,582,179 CD 2007-CD4 Mortgage Trust XC 11.12.49/0.168%* 435,310 0.03<br />

784,000 Celgene 15.08.22/3.250% 749,194 0.06<br />

70,000 CenterPoint Energy Resources 15.01.21/4.500% 74,914 0.01<br />

250,000 CenterPoint Energy Resources 15.01.41/5.850% 286,046 0.02<br />

360,066 Centex Home Equity 2004-D<br />

AF4 25.06.32/4.680%* 375,460 0.03<br />

100,000 Charles Schwab 01.09.22/3.225% 96,132 0.01<br />

424,391 Chase Funding Trust 2003-4 1A5 25.05.33/5.416%* 447,965 0.03<br />

326,467 Chase Funding Trust 2003-6 1A7 25.11.34/4.277%* 330,630 0.03<br />

481,771 Chase Mortgage Finance<br />

2004-S3 2A5 25.03.34/5.500% 495,454 0.04<br />

2,129,737 Chase Mortgage Finance<br />

2007-A1 1A3 25.02.37/2.722%* 2,123,578 0.16<br />

204,478 Chase Mortgage Finance<br />

2007-A1 2A1 25.02.37/2.710%* 205,190 0.02<br />

157,449 Chase Mortgage Finance<br />

2007-A1 7A1 25.02.37/2.683%* 158,258 0.01<br />

147,348 Chase Mortgage Finance<br />

2007-A1 9A1 25.02.37/2.694%* 147,835 0.01<br />

618,546 Chase Mortgage Finance<br />

2007-A2 2A1 25.07.37/2.655%* 618,762 0.05<br />

46,553 CHL Mortgage Pass-Through<br />

Trust 2003-26 1A6 25.08.33/3.500% 46,589 0.00<br />

7,779 CHL Mortgage Pass-Through<br />

Trust 2003-J7 4A3 25.08.18/9.560%* 8,184 0.00<br />

778,605 CHL Mortgage Pass-Through<br />

Trust 2004-3 A26 25.04.34/5.500% 796,420 0.06<br />

389,302 CHL Mortgage Pass-Through<br />

Trust 2004-3 A4 25.04.34/5.750% 399,413 0.03<br />

568,081 CHL Mortgage Pass-Through<br />

Trust 2004-5 1A4 25.06.34/5.500% 595,692 0.05<br />

100,433 CHL Mortgage Pass-Through<br />

Trust 2004-7 2A1 25.06.34/2.692%* 97,170 0.01<br />

403,745 CHL Mortgage Pass-Through<br />

Trust 2004-8 2A1 25.06.19/4.500% 418,443 0.03<br />

4,411 CHL Mortgage Pass-Through<br />

Trust 2004-J6 2A1 25.07.14/4.750% 4,428 0.00<br />

84,584 CHL Mortgage Pass-Through<br />

Trust 2004-J8 1A2 25.11.19/4.750% 87,106 0.01<br />

575,155 CHL Mortgage Pass-Through<br />

Trust 2005-22 2A1 25.11.35/2.586%* 473,447 0.04<br />

80,000 Cisco Systems 22.02.16/5.500% 88,086 0.01<br />

140,000 Cisco Systems 15.01.20/4.450% 153,450 0.01<br />

400,000 Cisco Systems 15.02.39/5.900% 450,958 0.03<br />

100,000 Cisco Systems 15.01.40/5.500% 107,268 0.01<br />

1,118,728 Citicorp Mortgage Securities<br />

2004-3 A5 25.05.34/5.250% 1,176,125 0.09<br />

148,701 Citicorp Mortgage Securities<br />

2005-3 2A2 25.04.20/5.000% 149,684 0.01<br />

424,818 Citicorp Mortgage Securities<br />

2006-4 1A2 25.08.36/6.000% 431,192 0.03<br />

600,000 Citigroup Commercial Mortgage<br />

Trust 2005-C3 AM 15.05.43/4.830%* 625,160 0.05<br />

500,000 Citigroup Commercial Mortgage<br />

Trust 2006-C5 A4 15.10.49/5.431% 546,482 0.04<br />

114,355 Citigroup Mortgage Loan Trust<br />

2003-1 2A5 25.10.33/5.250% 117,340 0.01<br />

232,568 Citigroup Mortgage Loan Trust<br />

2003-1 3A4 25.09.33/5.250% 239,292 0.02<br />

6,244 Citigroup Mortgage Loan Trust<br />

2003-UP3 A3 25.09.33/7.000% 6,502 0.00<br />

125,474 Citigroup Mortgage Loan Trust<br />

2004-UST1 A3 25.08.34/2.321%* 125,636 0.01<br />

298,754 Citigroup Mortgage Loan Trust<br />

2005-2 2A11 25.05.35/5.500% 301,491 0.02<br />

507,104 Citigroup Mortgage Loan Trust<br />

2008-AR4 1A1A 25.11.38/2.892%* 512,415 0.04<br />

285,000 City of Los Angeles Department<br />

of Airports 15.05.39/6.582% 327,622 0.02<br />

1,100,000 CME Group 15.09.22/3.000% 1,043,823 0.08<br />

57,928 CNH Equipment Trust 2011-A A3 16.05.16/1.200% 57,974 0.00<br />

267,000 CNH Equipment Trust 2011-A A4 17.10.16/2.040% 270,467 0.02<br />

612,488 CNH Equipment Trust 2012-A A3 15.05.17/0.940% 614,139 0.05<br />

1,170,000 COBALT CMBS Commercial<br />

Mortgage Trust 2006-C1 A4 15.08.48/5.223% 1,264,968 0.10<br />

1,500,000 COBALT CMBS Commercial<br />

Mortgage Trust 2006-C1 AM 15.08.48/5.254% 1,546,165 0.12<br />

16,712,572 COBALT CMBS Commercial<br />

Mortgage Trust 2006-C1 IO 15.08.48/0.796%* 301,946 0.02<br />

250,000 Comcast 15.01.17/6.500% 288,294 0.02<br />

693,000 Comcast 15.01.33/4.250% 647,536 0.05<br />

480,000 Comcast 15.03.37/6.450% 561,905 0.04<br />

8,036 Commercial Mortgage Trust<br />

2004-LB4A A4 15.10.37/4.584% 8,052 0.00<br />

650,000 Commercial Mortgage Trust<br />

2005-LP5 A4 10.05.43/4.982%* 677,967 0.05<br />

2,616,232 Commercial Mortgage Trust<br />

2012-CR XA 15.08.45/1.942%* 289,782 0.02<br />

173,000 Consolidated Edison Co. of New<br />

York 15.06.40/5.700% 198,795 0.02<br />

257,990 Continental Airlines 2007-1<br />

Class A Pass Through Trust 19.04.22/5.983% 281,854 0.02<br />

212,000 Continental Airlines 2012-2 Class<br />

A Pass Through Trust 29.10.24/4.000% 212,397 0.02<br />

375,000 COX Communications 144A 15.12.22/3.250% 344,619 0.03<br />

75,000 COX Communications 144A 01.03.39/8.375% 91,881 0.01<br />

87,126 Credit Suisse First Boston<br />

Mortgage Securities 2003-1 DB1 25.02.33/6.564% 88,837 0.01<br />

426,304 Credit Suisse First Boston<br />

Mortgage Securities 2003-21<br />

1A4 25.09.33/5.250% 442,637 0.03<br />

172,009 Credit Suisse First Boston<br />

Mortgage Securities 2003-21 AP 25.09.33/0.000% 149,778 0.01<br />

249,741 Credit Suisse First Boston<br />

Mortgage Securities 2003-23<br />

2A5 25.10.18/5.000% 253,319 0.02<br />

281,105 Credit Suisse First Boston<br />

Mortgage Securities 2003-27<br />

5A4 25.11.33/5.250% 283,799 0.02<br />

87,039 Credit Suisse First Boston<br />

Mortgage Securities 2003-27 AP 25.11.33/0.000% 73,747 0.01<br />

105,460 Credit Suisse First Boston<br />

Mortgage Securities 2004-3 AP 25.06.34/0.000% 87,095 0.01<br />

510,762 Credit Suisse First Boston<br />

Mortgage Securities 2004-4<br />

2A4 25.09.34/5.500% 550,643 0.04<br />

160,086 Credit Suisse First Boston<br />

Mortgage Securities 2004-5 3A1 25.08.19/5.250% 165,472 0.01<br />

500,088 Credit Suisse First Boston<br />

Mortgage Securities 2004-8 1A4 25.12.34/5.500% 533,704 0.04<br />

105,841 Credit Suisse First Boston<br />

Mortgage Securities 2005-10 AP 25.11.35/0.000% 62,976 0.00<br />

271,623 Credit Suisse First Boston<br />

Mortgage Securities 2005-7 4A3 25.08.20/5.000% 275,132 0.02<br />

700,000 Credit Suisse Mortgage Capital<br />

Trust 2006-C2 A3 15.03.39/5.669%* 754,320 0.06<br />

300,000 Credit Suisse Mortgage Capital<br />

Trust 2010-16 A3 25.06.50/3.383%* 297,954 0.02<br />

56,555 Credit-Based <strong>Asset</strong> Servicing<br />

and Securitization 2006-CB1<br />

AF2 25.01.36/3.640%* 35,906 0.00<br />

110,000 CRH America 30.09.16/6.000% 123,293 0.01<br />

850,000 Daimler Finance North America<br />

144A 11.01.17/2.950% 882,750 0.07<br />

327,000 Daimler Finance North<br />

America 144A 11.01.18/1.875% 323,573 0.02<br />

218,000 Danaher 23.06.21/3.900% 226,942 0.02<br />

259,246 Deutsche Mortgage Securities<br />

2004-1 3A6 25.12.33/4.740%* 264,430 0.02<br />

400,000 DirecTV Holdings 15.02.21/4.600% 412,842 0.03<br />

243,000 DirecTV Holdings 01.03.21/5.000% 256,361 0.02<br />

700,000 DirecTV Holdings 15.08.40/6.000% 695,975 0.05<br />

1,300,000 DirecTV Holdings 01.03.41/6.375% 1,360,970 0.10<br />

614,000 Discovery Communications 15.06.21/4.375% 636,684 0.05<br />

187,000 Discovery Communications 15.05.42/4.950% 175,997 0.01<br />

52,901 DT Auto Owner Trust 2012-2A A 16.11.15/0.910% 52,902 0.00<br />

845,000 Duke Energy Carolinas 15.06.20/4.300% 908,956 0.07<br />

141,000 Eaton 02.11.17/1.500% 138,481 0.01<br />

146,000 Eaton 02.11.32/4.000% 135,148 0.01<br />

475,000 eBay 15.10.20/3.250% 487,659 0.04<br />

335,000 Ecolab 08.12.17/1.450% 328,545 0.02<br />

233,000 EOG Resources 15.03.23/2.625% 212,170 0.02<br />

326,000 ERAC USA Finance 144A 10.01.14/2.250% 326,115 0.02<br />

89,000 ERAC USA Finance 144A 15.04.16/1.400% 89,132 0.01<br />

460,000 ERAC USA Finance 144A 15.10.37/7.000% 548,573 0.04<br />

96,000 ERAC USA Finance 144A 15.03.42/5.625% 98,910 0.01<br />

114,000 Exelon Generation 01.10.41/5.750% 110,828 0.01<br />

386,143 Fannie Mae Grantor Trust<br />

2000-T6 A1 25.06.30/7.500% 450,080 0.03<br />

821,086 Fannie Mae Grantor Trust<br />

2001-T10 A2 25.12.41/7.500% 946,832 0.07<br />

322,999 Fannie Mae Grantor Trust<br />

2001-T7 A1 25.02.41/7.500% 379,951 0.03<br />

38,603 Fannie Mae Grantor Trust<br />

2002-T16 A2 25.07.42/7.000% 44,562 0.00<br />

162