JPMorgan Funds Audited Annual Report - JP Morgan Asset ...

JPMorgan Funds Audited Annual Report - JP Morgan Asset ...

JPMorgan Funds Audited Annual Report - JP Morgan Asset ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

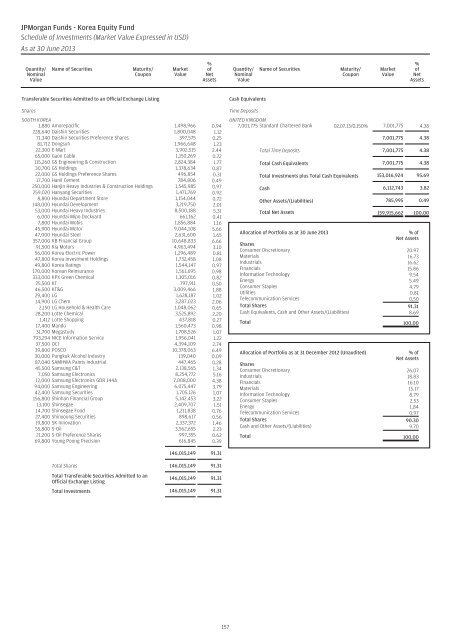

<strong><strong>JP</strong><strong>Morgan</strong></strong> <strong>Funds</strong> - Korea Equity Fund<br />

Schedule of Investments (Market Value Expressed in USD)<br />

As at 30 June 2013<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

%<br />

of<br />

Net<br />

<strong>Asset</strong>s<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

%<br />

of<br />

Net<br />

<strong>Asset</strong>s<br />

Transferable Securities Admitted to an Official Exchange Listing<br />

Shares<br />

SOUTH KOREA<br />

1,880 Amorepacific 1,498,966 0.94<br />

228,640 Daishin Securities 1,800,048 1.12<br />

71,340 Daishin Securities Preference Shares 397,575 0.25<br />

81,712 Dongsuh 1,966,648 1.23<br />

22,300 E-Mart 3,902,515 2.44<br />

65,000 Gaon Cable 1,150,269 0.72<br />

115,260 GS Engineering & Construction 2,824,384 1.77<br />

30,700 GS Holdings 1,378,634 0.87<br />

22,000 GS Holdings Preference Shares 496,854 0.31<br />

17,700 Hanil Cement 784,806 0.49<br />

250,000 Hanjin Heavy Industries & Construction Holdings 1,545,985 0.97<br />

259,020 Hanyang Securities 1,471,769 0.92<br />

8,800 Hyundai Department Store 1,154,044 0.72<br />

148,000 Hyundai Development 3,219,750 2.01<br />

53,000 Hyundai Heavy Industries 8,500,188 5.31<br />

6,000 Hyundai Mipo Dockyard 661,162 0.41<br />

7,800 Hyundai Mobis 1,856,884 1.16<br />

45,900 Hyundai Motor 9,044,108 5.66<br />

47,000 Hyundai Steel 2,631,600 1.65<br />

357,000 KB Financial Group 10,648,833 6.66<br />

91,500 Kia Motors 4,963,494 3.10<br />

56,000 Korea Electric Power 1,296,489 0.81<br />

47,800 Korea Investment Holdings 1,732,458 1.08<br />

49,800 Korea Ratings 1,544,147 0.97<br />

170,000 Korean Reinsurance 1,561,695 0.98<br />

333,000 KPX Green Chemical 1,305,016 0.82<br />

25,500 KT 797,911 0.50<br />

46,500 KT&G 3,009,466 1.88<br />

29,400 LG 1,628,187 1.02<br />

14,900 LG Chem 3,287,023 2.06<br />

2,150 LG Household & Health Care 1,048,062 0.65<br />

28,200 Lotte Chemical 3,525,892 2.20<br />

1,412 Lotte Shopping 437,818 0.27<br />

17,400 Mando 1,560,473 0.98<br />

31,700 Megastudy 1,708,526 1.07<br />

793,294 NICE Information Service 1,956,041 1.22<br />

37,500 OCI 4,394,109 2.74<br />

39,800 POSCO 10,378,063 6.49<br />

30,000 Pungkuk Alcohol Industry 139,040 0.09<br />

87,040 SAMHWA Paints Industrial 447,465 0.28<br />

45,500 Samsung C&T 2,138,565 1.34<br />

7,050 Samsung Electronics 8,254,772 5.16<br />

12,000 Samsung Electronics GDR 144A 7,008,000 4.38<br />

94,000 Samsung Engineering 6,075,447 3.79<br />

42,400 Samsung Securities 1,705,126 1.07<br />

156,800 Shinhan Financial Group 5,142,453 3.22<br />

13,100 Shinsegae 2,409,707 1.51<br />

14,700 Shinsegae Food 1,211,838 0.76<br />

27,400 Shinyoung Securities 898,617 0.56<br />

19,800 SK Innovation 2,337,372 1.46<br />

55,800 S-Oil 3,562,655 2.23<br />

21,200 S-Oil Preference Shares 997,355 0.62<br />

69,800 Young Poong Precision 616,845 0.39<br />

Cash Equivalents<br />

Time Deposits<br />

UNITED KINGDOM<br />

7,001,775 Standard Chartered Bank 02.07.13/0.150% 7,001,775 4.38<br />

7,001,775 4.38<br />

Total Time Deposits 7,001,775 4.38<br />

Total Cash Equivalents 7,001,775 4.38<br />

Total Investments plus Total Cash Equivalents 153,016,924 95.69<br />

Cash 6,112,743 3.82<br />

Other <strong>Asset</strong>s/(Liabilities) 785,995 0.49<br />

Total Net <strong>Asset</strong>s 159,915,662 100.00<br />

Allocation of Portfolio as at 30 June 2013<br />

% of<br />

Net <strong>Asset</strong>s<br />

Shares<br />

Consumer Discretionary 20.97<br />

Materials 16.73<br />

Industrials 16.62<br />

Financials 15.86<br />

Information Technology 9.54<br />

Energy 5.49<br />

Consumer Staples 4.79<br />

Utilities 0.81<br />

Telecommunication Services 0.50<br />

Total Shares 91.31<br />

Cash Equivalents, Cash and Other <strong>Asset</strong>s/(Liabilities) 8.69<br />

Total 100.00<br />

Allocation of Portfolio as at 31 December 2012 (Unaudited)<br />

% of<br />

Net <strong>Asset</strong>s<br />

Shares<br />

Consumer Discretionary 26.07<br />

Industrials 18.83<br />

Financials 16.10<br />

Materials 15.17<br />

Information Technology 8.79<br />

Consumer Staples 2.53<br />

Energy 1.84<br />

Telecommunication Services 0.97<br />

Total Shares 90.30<br />

Cash and Other <strong>Asset</strong>s/(Liabilities) 9.70<br />

Total 100.00<br />

146,015,149 91.31<br />

Total Shares 146,015,149 91.31<br />

Total Transferable Securities Admitted to an<br />

Official Exchange Listing<br />

146,015,149 91.31<br />

Total Investments 146,015,149 91.31<br />

157