Quarterly report - LLB Quotes - Liechtensteinische Landesbank

Quarterly report - LLB Quotes - Liechtensteinische Landesbank

Quarterly report - LLB Quotes - Liechtensteinische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

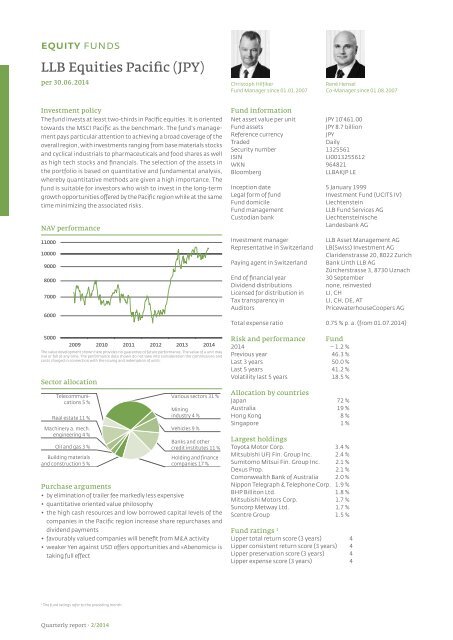

equity funds<br />

<strong>LLB</strong> Equities Pacific (JPY)<br />

per 30.06.2014<br />

Christoph Hilfiker<br />

Fund Manager since 01.01.2007<br />

René Hensel<br />

Co-Manager since 01.08.2007<br />

Investment policy<br />

The fund invests at least two-thirds in Pacific equities. It is oriented<br />

towards the MSCI Pacific as the benchmark. The fund's management<br />

pays particular attention to achieving a broad coverage of the<br />

overall region, with investments ranging from base materials stocks<br />

and cyclical industrials to pharmaceuticals and food shares as well<br />

as high tech stocks and financials. The selection of the assets in<br />

the portfolio is based on quantitative and fundamental analysis,<br />

whereby quantitative methods are given a high importance. The<br />

fund is suitable for investors who wish to invest in the long-term<br />

growth opportunities offered by the Pacific region while at the same<br />

time minimizing the associated risks.<br />

NAV performance<br />

11000<br />

10000<br />

9000<br />

8000<br />

7000<br />

6000<br />

5000<br />

2009 2010 2011 2012 2013 2014<br />

The value development shown here provides no guarantee of future performance. The value of a unit may<br />

rise or fall at any time. The performance data shown do not take into consideration the commissions and<br />

costs charged in connection with the issuing and redemption of units.<br />

Sector allocation<br />

Telecommunications<br />

5 %<br />

Real estate 11 %<br />

Machinery a. mech.<br />

engineering 4 %<br />

Oil and gas 3 %<br />

Building materials<br />

and construction 5 %<br />

Various sectors 31 %<br />

Mining<br />

industry 4 %<br />

Vehicles 9 %<br />

Banks and other<br />

credit institutes 11 %<br />

Holding and finance<br />

companies 17 %<br />

Purchase arguments<br />

◆ by elimination of trailer fee markedly less expensive<br />

◆ quantitative oriented value philosophy<br />

◆ the high cash resources and low borrowed capital levels of the<br />

companies in the Pacific region increase share repurchases and<br />

dividend payments<br />

◆ favourably valued companies will benefit from M&A activity<br />

◆ weaker Yen against USD offers opportunities and «Abenomics» is<br />

taking full effect<br />

Fund information<br />

Net asset value per unit<br />

JPY 10'461.00<br />

Fund assets<br />

JPY 8.7 billion<br />

Reference currency<br />

JPY<br />

Traded<br />

Daily<br />

Security number 1325561<br />

ISIN<br />

LI0013255612<br />

WKN 964821<br />

Bloomberg<br />

<strong>LLB</strong>AKJP LE<br />

Inception date 5 January 1999<br />

Legal form of fund<br />

Investment Fund (UCITS IV)<br />

Fund domicile<br />

Liechtenstein<br />

Fund management<br />

<strong>LLB</strong> Fund Services AG<br />

Custodian bank<br />

<strong>Liechtensteinische</strong><br />

<strong>Landesbank</strong> AG<br />

Investment manager<br />

Representative in Switzerland<br />

Paying agent in Switzerland<br />

End of financial year<br />

Dividend distributions<br />

Licensed for distribution in<br />

Tax transparency in<br />

Auditors<br />

<strong>LLB</strong> Asset Management AG<br />

LB(Swiss) Investment AG<br />

Claridenstrasse 20, 8022 Zurich<br />

Bank Linth <strong>LLB</strong> AG<br />

Zürcherstrasse 3, 8730 Uznach<br />

30 September<br />

none, reinvested<br />

LI, CH<br />

LI, CH, DE, AT<br />

PricewaterhouseCoopers AG<br />

Total expense ratio 0.75 % p. a. (from 01.07.2014)<br />

Risk and performance Fund<br />

2014 – 1.2 %<br />

Previous year 46.3 %<br />

Last 3 years 50.0 %<br />

Last 5 years 41.2 %<br />

Volatility last 5 years 18.5 %<br />

Allocation by countries<br />

Japan 72 %<br />

Australia 19 %<br />

Hong Kong 8 %<br />

Singapore 1 %<br />

Largest holdings<br />

Toyota Motor Corp. 3.4 %<br />

Mitsubishi UFJ Fin. Group Inc. 2.4 %<br />

Sumitomo Mitsui Fin. Group Inc. 2.1 %<br />

Dexus Prop. 2.1 %<br />

Comonwealth Bank of Australia 2.0 %<br />

Nippon Telegraph & Telephone Corp. 1.9 %<br />

BHP Billiton Ltd. 1.8 %<br />

Mitsubishi Motors Corp. 1.7 %<br />

Suncorp Metway Ltd. 1.7 %<br />

Scentre Group 1.5 %<br />

Fund ratings 1<br />

Lipper total return score (3 years) 4<br />

Lipper consistent return score (3 years) 4<br />

Lipper preservation score (3 years) 4<br />

Lipper expense score (3 years) 4<br />

1<br />

The fund ratings refer to the preceding month.<br />

<strong>Quarterly</strong> <strong>report</strong> · 2/2014

![Invest Express [PDF, 1.6 MB] - Liechtensteinische Landesbank](https://img.yumpu.com/49799662/1/184x260/invest-express-pdf-16-mb-liechtensteinische-landesbank.jpg?quality=85)